| Vietnamese Stock Market Closes Higher as Blue Chips Rebound |

|

Source: VietstockFinance

|

The market breadth was strongly positive, with 487 gainers, including 23 stocks that hit the daily limit-up, far outpacing 307 decliners, of which 11 touched the limit-down. Meanwhile, 810 stocks closed flat.

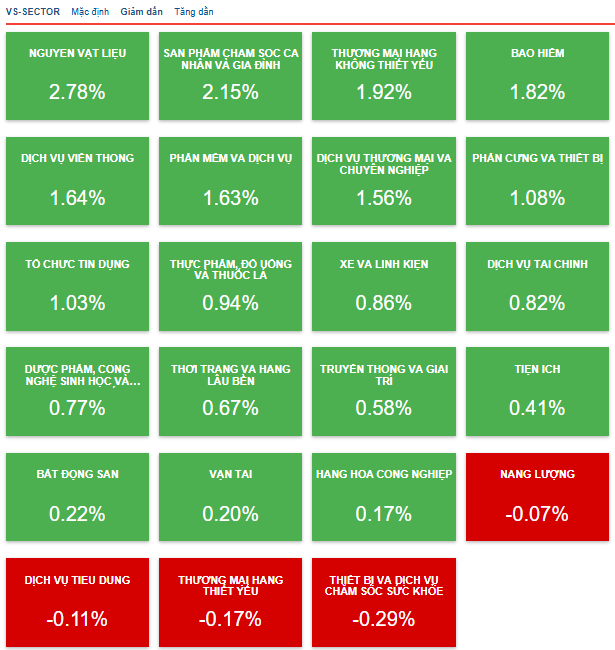

The market rebounded thanks to a more positive performance from large-cap sectors such as real estate, securities, and banking.

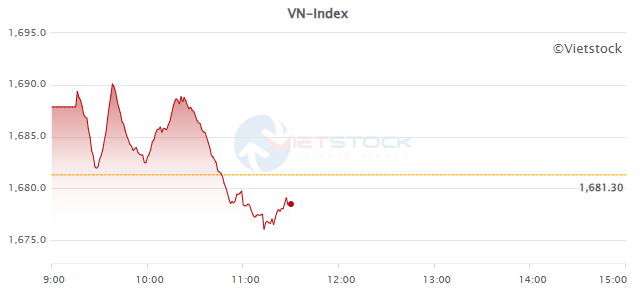

Specifically, the real estate sector, which was the worst-performing sector in the morning session (down 1.07%), managed to climb into positive territory with a 0.22% gain. This was driven by a more positive performance from the Vingroup family of stocks, with VHM narrowing its losses, VIC closing flat, and VRE even ending the session with a slight gain of 0.5%.

Similarly, the banking and securities sectors also turned positive, ending the day with gains of 1.03% and 0.82%, respectively. Overall, green dominated these two large-cap sectors, in contrast to the mixed performance seen in the morning session.

Another notable sector was materials, which led the market with a 2.78% gain, driven by a 6.04% jump in HPG, and even NKG and HSG hitting the daily limit-up. Additionally, some other large-cap stocks, such as FPT and MSN, also posted solid gains.

|

Real Estate, Banking, and Securities Sectors Turn Green in the Afternoon Session

Source: VietstockFinance

|

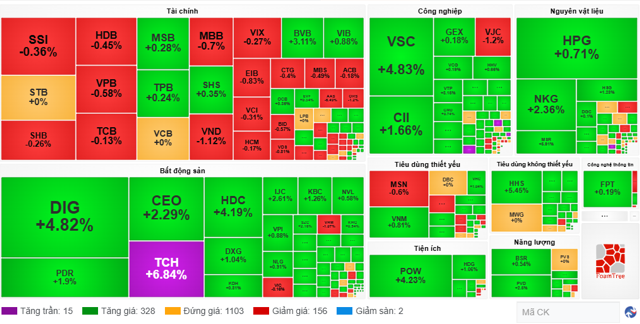

This positive dynamic was also evident when looking at market capitalization, with Large Cap gaining 0.9%, outperforming Mid Cap (up 0.58%) and Small Cap (up 0.39%).

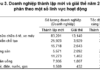

Looking at the top 10 stocks with the most positive impact on the VN-Index, VCB and HPG led the way, contributing nearly 3.8 points and over 3.2 points, respectively, far ahead of the other stocks in the top 10. In total, these top 10 stocks contributed almost 11.8 points to the index.

Source: VietstockFinance

|

Total trading value across the market reached nearly VND 44 trillion, with HOSE accounting for nearly VND 40 trillion, slightly higher than the previous session. In terms of volume, nearly 1.6 billion shares changed hands.

In this context, foreign investors increased their net buying compared to the last few sessions, but the net selling value still stood at over VND 862 billion, marking the fifth consecutive net selling session.

Morning Session: Putting an End to the Tug-of-War with a Sharp Drop

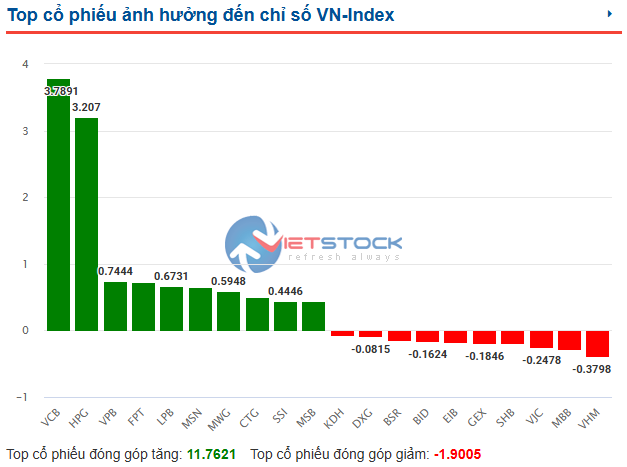

Contrary to the continuous tug-of-war in the first half of the morning session, the VN-Index ended this stalemate with a sharp drop of nearly 13 points.

The VN-Index closed the morning session down 2.83 points, or 0.17%, at 1,678.47. Notably, the index fell sharply from around 1,689 points to 1,676 points, a drop of nearly 13 points.

Source: VietstockFinance

|

Real estate was the worst-performing sector, falling 1.07%, led by the Vingroup trio: VIC fell 1.2%, VHM dropped 2.92%, and VRE declined by 0.5%. The rest of the sector showed mixed performance, with many stocks in the red, including BCM, KDH, NVL, PDR, DXG, NLG, etc. However, some stocks managed to stay in the green, such as KSF, SJS, VPI, DIG, SIP, CEO, SNZ, TCH, and SIP.

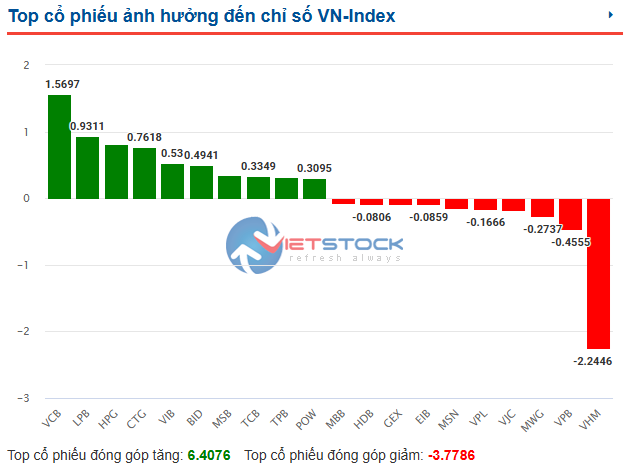

Among the top 10 stocks with the most negative impact on the market, VHM took the lead, dragging down the index by more than 2.2 points.

The second-worst performing sector was consumer services, dragged down by another Vin family member, VPL, which fell 0.62%.

In the other declining sectors, securities and banking recorded relatively modest declines, but their large market capitalization still had a significant impact on the market. Many stocks in these sectors traded lower in the morning session, including VPB, SHB, TCB, MBB, EIB, STB, ACB, BID, HDB in banking, and VIX, VND, MBS, AAS, etc. in securities.

Source: VietstockFinance

|

In terms of foreign trading, net selling value in the morning session was nearly VND 830 billion, pointing to a fifth consecutive net selling session. VPB led the net selling list, with a net sell value of over VND 192 billion, followed by VHM (over VND 153 billion), MWG (over VND 142 billion), and MSN (over VND 125 billion).

10:40 AM: Continuous Tug-of-War within a Narrow Range

VN-Index continued to fluctuate in the morning session, mostly trading within a narrow range of 1,682 – 1,688 points. The performance of large-cap stocks in the banking and securities sectors was mixed, while VHM from the real estate sector exerted the most pressure on the index.

Among the top 10 stocks with the most positive impact on the VN-Index, eight were from the banking sector, with VCB contributing nearly 1.6 points, followed by LPB, CTG, VIB, BID, MSB, TCB, and TPB. However, four banking stocks also appeared in the top 10 stocks with the most negative impact, including VPB, EIB, HDB, and MBB. Additionally, the Vingroup duo of VHM and VPL also took away a certain number of points from the index, with VHM dragging down the index by more than 2.2 points and VPL by nearly 0.2 points.

Source: VietstockFinance

|

Looking at the market map, green and red were clearly divided in the banking and securities sectors. Meanwhile, green dominated most other sectors, although some notable names traded against the overall market trend, including VHM (down 2.63%), DXG (down 0.42%), GEX (down 1.08%), VJC (down 0.77%), MSN (down 0.48%), and MWG (down 1.06%).

Market Open: A Volatile Start

The VN-Index started the day on a positive note, with a strong ATO session, even rising over 8 points at one point. However, selling pressure quickly kicked in, erasing most of the gains. As of 9:30 AM, the VN-Index was up 0.94 points, or 0.06%, at 1,682.24.

Green also dominated the HNX-Index and UPCoM, which were up 1.83 points and 0.28 points, respectively.

Across the market, 328 stocks traded in the green, including 15 stocks that hit the daily limit-up, significantly outnumbering the 158 declining stocks. Looking at the market map, green prevailed in most sectors, including real estate, with notable gainers such as DIG (up 4.82%), CEO (up 2.29%), HDC (up 4.19%), and even TCH, which hit the daily limit-up; the industry sector, with VSC (up 4.83%) and CII (up 1.66%) among the gainers; and the materials sector, led by NKG (up 2.36%) and HPG (up 0.71%).

On the downside, the banking and securities sectors opened on a weak note, with most stocks in the red. In the banking sector, SHB, HDB, VPB, TCB, MBB, EIB, CTG, BID, and ACB all traded lower, while the securities sector also saw declines in many stocks, including SSI, VND, VIX, VCI, HCM, and MBS.

|

Market Map as of 9:30 AM

Source: VPBankS

|

In terms of liquidity, nearly 170.6 million shares were traded, equivalent to a value of over VND 4.4 trillion.

Elsewhere in Asia, markets were mixed, with Australia’s All Ordinaries up 0.79%, Japan’s Nikkei 225 gaining 1.27%, and Singapore’s Straits Times rising 0.22%. In contrast, Hong Kong’s Hang Seng fell 0.44%, while China’s Shanghai Composite dropped 1.23%.

On Wall Street, the S&P 500 closed higher thanks to a rally in tech stocks following a federal court ruling in Alphabet’s antitrust case. This ruling sparked optimism that tech giants could overcome legal challenges.

At the close of the session on September 3, the S&P 500 rose 0.51% to 6,448.26, while the Nasdaq Composite climbed 1.03% to 21,497.73. Meanwhile, the Dow Jones lost 24.58 points, or 0.05%, to 45,271.23.

– 15:50 04/09/2025

Expert Insights: Market Rally Has Further to Run – Smart Stock Picks Needed for Investors to Stay Afloat.

“According to investment guru, Mr. Do Thanh Son, the investment narrative for the latter part of the year revolves around the fundamentals of individual businesses. With pricing no longer being the sole competitive advantage, the focus shifts to growth potential and intrinsic value.”

What’s in Store for the Stock Market Post the 2nd of September Holidays?

The stock market closed off an impressive August rally, with the VN-Index soaring past 1,680 points and consecutive record-breaking liquidity. Experts believe that several variables, such as expectations of a Federal Reserve rate cut in September, exchange rate dynamics, and the potential for an FTSE upgrade for the Vietnamese stock market, will keep investor sentiment buoyant post the September 2nd holiday.