There’s still room to grow, but the context has changed

According to Mr. Trung, corrective phases always occur within an uptrend, but it won’t happen in September. The market has risen significantly in terms of points, but not in duration since the bottom.

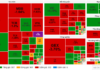

In fact, during the 2016-2018 period, the VN-Index doubled before seeing a correction of over 10%. Currently, since the April low, the market has risen by less than 50%. If the pattern resembles that of 2016-2018, there’s still room for upside.

However, a sharp rise is unlikely at this point, and instead, we can expect a gradual climb with interspersed minor corrections before a stronger upward phase.

To answer the question of how long the uptrend will last, Mr. Trung suggests considering both macroeconomic policies and market valuation. Specifically, the M2 money supply currently stands at over VND 20 million billion and is projected to reach VND 26 million billion by the end of the year, double that of 2020-2021. Theoretically, when the money supply doubles, goods should also double.

In terms of valuation, a market P/E of 20-22 times earnings typically indicates a peak, while the current P/E is just over 15 times. With expectations of a 20-25% increase in corporate profits by the end of 2026 and a rise in P/E to 20-22 times, there’s considerable potential for the market.

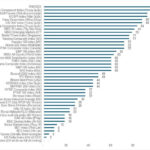

Mr. Trung emphasizes that corrections are normal within an uptrend, and while everyone wants to sell before a correction and buy back at the bottom, historical data shows a very low success rate. For instance, during the 2020-2021 period, the VN-Index rose nearly 140% from its low to its high, with three corrections of over 10%, while in 2016-2018, it also increased by nearly 140% but only corrected once by more than 10%.

Moreover, in 2020-2021, out of 448 sessions from the low to the high, there were only 54 sessions (about 12%) where investors could have sold correctly before the correction and bought back at lower prices. In 2016-2018, there were only 9 out of 551 such sessions (1.63%), indicating a very low probability. This suggests that the strategy of selling before a correction to buy back at lower prices is not feasible for the majority.

Mr. La Giang Trung, CEO of Passion Investment, shared his insights at the “Vietnam and the Indices” program on September 4, 2025.

|

According to the CEO of Passion Investment, the current macroeconomic policies focus on boosting infrastructure development through the private sector, supported by both fiscal and monetary policies. As a result, the direct beneficiaries will be the infrastructure and public investment sectors.

At the same time, the banking sector will benefit from strong credit growth, and the real estate sector will gain from infrastructure development and credit expansion. The stock market also looks promising due to improved market liquidity.

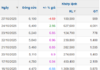

Investors should compare the valuations of these sectors with historical levels, and sectors with valuations equal to or slightly above average remain attractive. Using this approach, real estate and banking currently appear undervalued, while the stock market is slightly overvalued.

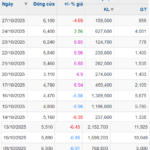

Regarding the banking sector, when credit expansion occurs, all banks benefit, especially private banks. Additionally, in terms of valuation, banks with a P/B ratio of around 1.5 times or lower are numerous in the market and offer attractive investment opportunities.

Foreigners’ continuous net selling is understandable

Mr. Trung attributes the recent net selling by foreign investors to their investment philosophy, which is based on enterprise valuation. Currently, the market has covered about half of the uptrend, and valuations are around 60%, which is above the “fair value” of 50%. For value investors, selling at this point is reasonable.

However, during an uptrend, when money flow and macroeconomic policies are supportive, the market tends to be valued at “overvalue” levels. Consequently, value investors continue to sell while momentum investors buy. Only when the money flow weakens and can no longer support the valuation does the market reverse.

By Huy Khai

– 5:02 PM, September 4, 2025

Why Are Securities Companies Rushing to Increase Their Charter Capital?

The race to raise charter capital is on, with numerous securities companies planning to issue shares to boost their capital. But why this rush to raise funds? What are the driving forces behind this strategic move?

What’s in Store for the Stock Market Post the 2nd of September Holidays?

The stock market closed off an impressive August rally, with the VN-Index soaring past 1,680 points and consecutive record-breaking liquidity. Experts believe that several variables, such as expectations of a Federal Reserve rate cut in September, exchange rate dynamics, and the potential for an FTSE upgrade for the Vietnamese stock market, will keep investor sentiment buoyant post the September 2nd holiday.