The Rise and Fall of the Social Housing Tycoon

Established in 2000 as Hoang Quan Consulting – Trading – Service Real Estate Company with an initial charter capital of only VND 500 billion, the company transformed into a joint-stock company in 2007.

In 2010, Hoang Quan officially listed on HoSE under the stock code HQC, becoming one of the notable real estate companies in the market as it recorded a sudden spike in profits, exceeding VND 411 billion.

However, this success was short-lived. In 2011, the company’s profits plummeted to a mere VND 16.4 billion, and in 2012, it only managed a slight increase to VND 19 billion.

Faced with these challenges, Hoang Quan decided to venture into the social housing segment, an area that was not particularly attractive to real estate businesses. In 2013, the company converted the high-end commercial project, Sovrano Plaza in Binh Chanh, Ho Chi Minh City, into social housing named HQC Plaza, marking the beginning of a series of HQC Plaza projects.

Within a few years, Hoang Quan rapidly expanded its scale and continuously increased its charter capital. By 2015, the charter capital had reached VND 4,266 billion. In the same year, the company owned 15 projects with a total investment of VND 10,000 billion. This number further increased to 22 projects with a scale of VND 20,000 billion just a year later.

Troubles loomed again for Hoang Quan when the VND 30,000 billion credit package for social housing projects expired. As a result, many of the company’s customers lost access to cheap capital to continue payments to the investor or dared not approach the product. Additionally, legal entanglements with several projects further hindered progress.

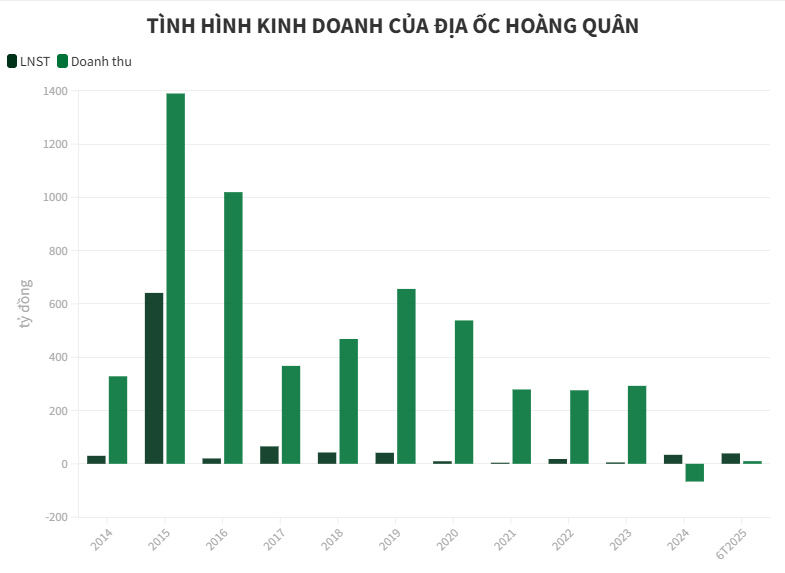

The company’s business performance continued to deteriorate, with revenues and profits shrinking. Except for the year 2015, when the company recorded a record profit of over VND 641 billion due to the transfer and cheap purchase of a subsidiary, in the past decade, Hoang Quan has only reported an average profit of about VND 20 billion per year. In 2021 and 2023, profits stood at a meager VND 4-5 billion.

Not only did the business performance suffer, but the market price of HQC shares also traded below the par value of VND 10,000 for many years, even dropping to VND 2,000-3,000 per share during certain periods—less than the price of an iced tea. Although the stock occasionally experienced rare ceiling sessions, HQC largely lingered at the bottom.

At the 2025 Annual General Meeting of Shareholders, Chairman of the Board of Directors, Truong Anh Tuan, attributed the share price of around VND 3,000 to various factors, including internal difficulties such as some projects being unable to commence due to legal entanglements or completed projects not meeting profit expectations.

According to him, if calculated based on book value, HQC should be valued at VND 15,000 per share. He explained that the HQC share price was influenced by the overall downward trend in the market. Additionally, an objective reason was that HQC’s surplus capital account was negative VND 300 billion. Therefore, the company needed to achieve a minimum profit of VND 300 billion to raise the share price.

Ambition for 40,000 Social Housing Units: Can the Challenges of Capital and Land Break this Dream?

In 2025, Hoang Quan and its member companies plan to supply the market with 5,000 social housing units from key projects: Golden City (Tay Ninh), HQC Tan Huong (Tien Giang), New Urban Area Tra Vinh, Nam Phan Thiet Urban Area (Binh Thuan), and Social Housing Area in Binh Minh (Vinh Long).

However, Mr. Truong Anh Tuan also pointed out the significant challenges Hoang Quan faces. Firstly, the company currently has low revenue and profit. HQC has a capital source of nearly VND 5,800 billion. The business plan for the past nine years has consistently fallen short of targets, with profits reaching only about VND 100 billion, far below expectations.

Typically, the minimum revenue in the real estate sector should be 50% of the charter capital. Currently, HQC has VND 5,800 billion in capital, but last year’s (2024) revenue was only nearly VND 346 billion. The management considers this a significant challenge.

Chairman of the Board of Directors, Truong Anh Tuan, highlights the significant challenges faced by Hoang Quan.

HQC’s next challenge lies in the land fund and the ambitious goal of constructing a large number of social housing units. The company still needs to build 40,000 social housing units by 2030 and requires 200 hectares of land, while currently having only 50 hectares. The management also noted that land conversion procedures and building permits pose additional obstacles.

The target of 40,000 social housing units requires an investment of about VND 40,000 billion, of which a minimum of VND 10,000 billion in medium and long-term loans must be mobilized from banks. However, banks will only disburse funds when the project is feasible and has a potential for repayment. HQC’s challenge is to demonstrate the project’s feasibility (land fund, approach, efficiency, and capital flow) to access capital from banks for themselves and support customers with loans.

Is Hoang Quan Tightening its Belt to Revive?

To overcome these difficulties, Hoang Quan has chosen a robust financial restructuring solution. In May 2025, the company approved a plan to issue 50 million private placement shares at a price of VND 10,000 per share to convert VND 500 billion of debt, including a VND 212 billion debt to Hai Phat, which will be converted into 21.2 million shares. Simultaneously, the company also ceased the operations of five branches simultaneously due to their inefficiency.

This year, the company will focus on recovering capital from projects that have received investment in recent years, especially in provinces such as Dak Lak, Can Tho, and Tay Ninh. According to Hoang Quan’s leader, this will be a pivotal phase for the company to “bounce back” and create momentum for stronger revenue and profit growth.

In addition to social housing, this year, Hoang Quan is also developing three industrial parks: Ham Kiem I (Binh Thuan), Tuy Phong (Binh Thuan), and Binh Minh (Vinh Long). Simultaneously, the company plans to implement commercial housing projects in Dak Lak, Long An, Vung Tau, Can Tho, and Vinh Long to utilize available land funds, increase investment efficiency, and enhance profits.

Regarding business prospects, the company sets a target of VND 1,000 billion in revenue and VND 70 billion in after-tax profit for this year. In the revenue structure, VND 800 billion will come from the social housing project Golden City (Tay Ninh), VND 100 billion from the New Urban Area Tra Vinh project (Tra Vinh), and VND 100 billion from the HQC Tan Huong project (Tien Giang).

In the first half of the year, the company recorded revenue of less than VND 39 billion and an after-tax profit of only VND 10 billion, achieving 8% and 13% of the yearly plan, respectively. Thus, the goal of achieving VND 1,000 billion in revenue and VND 70 billion in profit is not without challenges for Hoang Quan.

Looking back, from 2016 to the present, Hoang Quan Real Estate has failed to achieve the profit plan set by the General Meeting of Shareholders for the Board of Directors for nine consecutive years.

The consortium of Hanoi-Vid Real Estate Joint Stock Company and AAC Vietnam Joint Stock Company is the investor of Project No. 1B Urban Area in Thai Nguyen province.

“National Housing Fund Suggestion: Renting Homes, Not Trading or Selling”

The National Housing Fund is a revolutionary initiative, stemming from Resolution No. 201/2025/QH15, which pilots special mechanisms and policies for social housing development. This fund is unique in its nature, operating as a rental-only model, where units are ‘entered but never leave’. Instead of buying and selling, the fund solely focuses on providing a stable and accessible rental service, funded by the government and legal contributions from various sources. This innovative approach aims to create a sustainable and inclusive housing solution for those in need.

“A Modest Proposal: Raising Income Limits for Social Housing Applicants”

The Ministry of Construction is drafting a decree to amend and supplement several articles of Decree No. 100/2024/ND-CP, dated July 26, 2024. This decree provides detailed regulations on the Law on Social Housing, encompassing its development and management.

“Financial and Guarantor Issues for Off-Plan Property Investment.”

Within the context of the dynamic real estate market and evolving legal landscape, Attorney Vu Thi Que, a esteemed member of the Hanoi Bar Association, shed light on crucial updates and considerations regarding guarantees in future real estate transactions as outlined in the 2023 Real Estate Business Law.

Unleashing a New Strategic Move: From Suburban Conquest to the Core of Metropolitan Dominance

“After a period of robust restructuring and a focused approach on projects in satellite cities surrounding Ho Chi Minh City, Phat Dat Real Estate Development Corporation (HOSE: PDR) is entering a new phase of growth with an intensified vision: to direct its strategic efforts towards the heart of metropolitan areas and develop iconic projects. This bold yet calculated move by the company underscores its determination to solidify its standing in the gradually flourishing market.”