Phú Nhuận Jewelry Joint Stock Company (PNJ: HoSE) has announced its plans to issue shares under an employee stock ownership plan (ESOP).

PNJ aims to issue over 3.2 million ESOP shares, representing 0.96% of the total outstanding shares. With a sale price of 20,000 VND per share, the company expects to raise nearly VND 65 billion from this ESOP issuance.

The subscription period for the shares will be from September 9, 2025, to September 23, 2025. The purpose of this share issuance is to recognize the contributions of employees and key personnel in the company and its subsidiaries during the year 2024.

Illustrative image

If the issuance is successful as planned, PNJ’s charter capital is expected to increase from over VND 3,380.7 billion to nearly VND 3,413.2 billion.

According to the previously published list, 110 PNJ employees are eligible to purchase ESOP shares in this offering. Mr. Le Tri Thong, the CEO, will be able to purchase the most shares with 308,000 PNJ shares, followed by Ms. Tran Phuong Ngoc Thao, a member of the Board of Directors, who is allocated 136,800 shares.

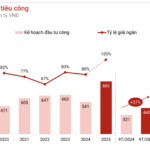

In terms of business performance, according to the reviewed consolidated financial statements for the first half of 2025, PNJ reported a revenue of over VND 17,217.5 billion, a 22.1% decrease compared to the same period in 2024. The company’s net profit after tax reached over VND 1,114.7 billion, a 4.4% decline.

For the full year 2025, PNJ has set a business plan with an estimated net profit of nearly VND 1,959.7 billion, a 7.3% decrease compared to the results achieved in 2024.

As of the end of the second quarter of 2025, PNJ has achieved 56.9% of its net profit target for the year.

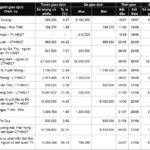

As of June 30, 2025, PNJ’s total assets decreased slightly by nearly VND 54 billion compared to the beginning of the year, standing at nearly VND 17,153.8 billion. Inventories accounted for 79.9% of total assets, amounting to over VND 13,708.7 billion.

On the liabilities side of the balance sheet, total liabilities were nearly VND 5,184.4 billion, a 12.9% decrease from the beginning of the year. Short-term loans accounted for VND 3,096.3 billion, or 59.7% of total debt.

What were the Top-Performing Stocks on HOSE in August?

The Vietnamese stock market has witnessed a bustling month, with the VN-Index surging over 180 points to a record high of more than 1,680 points. As the market soars, one can’t help but wonder, which stocks have been the top performers during this exhilarating rally?

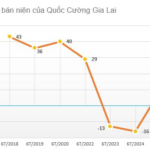

“A Surprising Turnaround: Stock Surges with a 63% Post-Tax Profit Jump Post-Audit”

With the release of its 2025 half-year audited financial report, TV2 has achieved a remarkable feat, surpassing 60% of its annual net profit plan for the year.