On the occasion of the 80th National Day anniversary on September 2, 2025, Vice Governor of the State Bank of Vietnam Dao Minh Tu looks back on the journey of the banking industry over the past 74 years. Established in 1951, the State Bank of Vietnam has navigated through the ups and downs of the nation’s history, solidifying its role as a pillar of the economy.

The banking sector is the primary provider of capital for the economy

According to Mr. Dao Minh Tu, at every stage, the banking industry has been proactive and flexible in monetary policy management, protecting the national currency, contributing to inflation control, macroeconomic stability, and promoting sustainable growth.

Vice Governor of the State Bank Dao Minh Tu |

The State Bank has gradually improved and innovated its monetary policy tools, moving closer to modern central banking operations, in line with international practices and the country’s economic development trends.

In a developing economy, where the banking system is the primary source of capital, monetary policy has played a crucial role as one of the government’s most important macroeconomic policies in promoting economic growth and aiming for rapid and sustainable development.

Governor of the State Bank Nguyen Thi Hong with leaders of commercial banks at the Exhibition of National Achievements “80 Years of Independence – Freedom – Happiness” in Hanoi on the occasion of the 2-9 holiday

|

“Throughout its historical journey, the State Bank has consistently prioritized inflation control and macroeconomic stability as its primary goals in monetary policy management,” said Mr. Dao Minh Tu. “A stable macroeconomic environment and controlled inflation lay the foundation for the country’s economic development, strengthen the foundation, and maintain the confidence of investors, businesses, and the people in the business environment. This, in turn, helps attract foreign investment, mobilize, and optimally allocate resources.”

Ensuring the stability of the currency

Especially in the past decade and before, the State Bank has successfully contributed to controlling inflation in line with the targets set by the National Assembly and the Government, maintaining stable inflation expectations, with a target of below 4.5%. This is one of the most significant and important political goals, providing a foundation for economic stability, ensuring the stability of the currency’s value, and building trust in the economy among domestic and foreign investors.

The “Vietnamese Bank – 74 Years of Pride and Confidence” section at the Exhibition of National Achievements, showcasing the journey of the banking industry’s formation, development, innovation, and international integration. |

The money market has been stable, with a tendency for lending interest rates to decrease to support businesses, borrowers, and economic growth. The exchange rate has remained fundamentally stable, with a smooth foreign exchange market and all legitimate foreign currency demands being met.

“The banking industry not only ensured financial support for the resistance war but also contributed to establishing monetary independence and economic and financial sovereignty, leading to the great spring victory of 1975, reuniting the country, unifying the currency, and uniting the people,” affirmed the Vice Governor of the State Bank.

|

Looking ahead to the vision for the year 2045 – a significant milestone marking the 100th anniversary of national independence, the State Bank sets its strategic goal to continue adhering to the leadership of the Party while promoting proactiveness, creativity, and a high sense of responsibility. The Bank also aims to coordinate closely with ministries, sectors, and localities to best achieve the country’s common development goals. |

Thai Phuong

– 13:41 09/03/2025

The Vietnamese Economy Over 80 Years: The 1986 ‘Major Surgery’ and the Historic Decision for a ‘Second Renovation’

According to economic expert Nguyen Bich Lam, if the 1986 renovation was considered a vital choice to rescue the economy, then the “second renovation” in 2025 and beyond is a prerequisite for Vietnam to fulfill its aspiration of rapid and sustainable development.

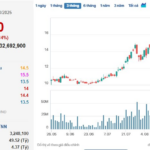

The Stock Market Embraces a New Growth Cycle

The Vietnamese stock market is at a pivotal crossroads, where macro policy drivers, upgrade expectations, and international capital converge to shape a new era of quantitative and qualitative growth. While short-term challenges persist, the long-term outlook is clearer than ever, promising a transformative phase in the country’s economic landscape.

A Creative Makeover: Unveiling EVNFinance’s Transformation with a New Name and Logo Post-Inspection

“EVNFinance (EVF) has announced a name and logo change following an inspection that revealed a number of irregularities in its lending practices. The inspection found that EVF had granted credit to organizations and individuals who did not meet the legal requirements, misclassified assets, and improperly provided domestic credit in foreign currency.”

“FPT Retail Ranks Among Vietnam’s Top 50 Listed Companies in 2025, According to Forbes”

On August 21, 2025, in Ho Chi Minh City, FPT Digital Retail Joint Stock Company (FPT Retail, HOSE: FRT) was honored as one of the “Top 50 Best Listed Companies in 2025” by Forbes Vietnam. This is the second time FPT Retail has been featured in this prestigious ranking, recognizing its relentless efforts in the journey towards sustainable growth.