PV Power, Vietnam’s second-largest independent power producer, boasts an installed capacity of 4,230 MW. It operates a diverse portfolio of power plants, including gas-fired facilities in Ca Mau and Nhon Trach, the Vung Ang 1 coal-fired power plant, and the Hua Na and Dakdrinh hydroelectric plants, alongside a growing pipeline of renewable energy projects.

Amidst a volatile energy market, PV Power stands out for its impressive financial performance, particularly in terms of profit growth.

For Q2 2025, PV Power reported flat revenue of VND 9,415 billion compared to the previous year. However, its after-tax profit surged by 66% to VND 733 billion, representing a 16% and 18% increase, respectively, over Q1.

For the first half of 2025, the company’s revenue reached VND 17,565 billion, a 12% year-on-year increase, while its after-tax profit soared to VND 1,205 billion, almost twice as much as the same period last year. With these results, the company has already surpassed its annual profit target by 274%.

In July alone, PV Power generated 1.28 billion kWh of electricity, bringing its seven-month cumulative revenue to VND 20,625 billion. The Ca Mau 1 and 2 clusters contributed VND 6,361 billion, while Vung Ang 1 led the way with VND 7,503 billion.

Notably, the Nhon Trach 3 and 4 complexes have started grid connection, delivering over 42 million kWh, even though revenue recognition is pending until the commencement of commercial operations later this year.

Nhon Trach 2 Power Company also delivered standout results for Q2 2025, with a slight revenue dip to VND 2,081 billion but a remarkable 167% surge in after-tax profit to VND 326 billion. For the first six months, its revenue reached VND 3,508 billion, and profit stood at VND 363 billion, marking a significant turnaround from the VND 36 billion loss incurred in the first half of 2024.

By effectively managing costs, the company witnessed a threefold increase in its gross profit margin to 17.6%, as the reduction in expenses outpaced the revenue decline. As a result, Nhon Trach 2 has already exceeded its annual profit target by 130% just halfway through the year, significantly contributing to PV Power’s overall success.

With the imminent commercial operation of Nhon Trach 3 in Q3 2025 and Nhon Trach 4 by the year’s end, PV Power will add 1,624 MW of capacity, translating to approximately 9 billion kWh of annual output. This expansion will significantly boost the company’s electricity production, setting the stage for long-term growth.

Even as the market electricity price (FMP) for July 2025 dropped to VND 637/kWh, the lowest in three years, challenging coal and gas-fired power plants, PV Power maintained its revenue and profit trajectory thanks to its diverse energy portfolio and cost optimization strategies.

Looking ahead, PV Power aims for double-digit growth in installed capacity, electricity output, and revenue while remaining a cornerstone of Vietnam’s energy security. By the end of the 2025-2030 period, the company aspires to reach an installed capacity of 6,000 MW, with a commercial electricity output of 116 billion kWh. It targets a total revenue of VND 260,000 billion, a pre-tax profit of VND 6,000 billion, and contributions to the state budget amounting to VND 5,000 billion.

Spring Goodwill Securities to Inject Over VND 2,700 Billion into Margin and Proprietary Trading

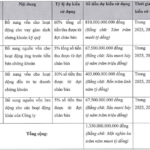

The XTSC Board of Directors has approved a resolution to utilize proceeds from a recent rights issue, amounting to VND 1,350 billion. Together with plans for a private placement to raise an additional VND 1,515 billion, XTSC is set to invest over VND 2,700 billion into margin and proprietary trading activities.

“LPBank Securities Offers 878 Million Shares to Boost Chartered Capital.”

LPBank is set to offer its existing shareholders a lucrative opportunity to invest in its growth journey. The company is offering a rights issue of 878 million shares at an attractive price of VND 10,000 per share, with a subscription ratio of 1000:2258.23. Mark your calendars, as the record date for this offering is September 8, 2025.

“An Cuong Wood Elects New Board Member, Expanding Business Operations”

The Ho Chi Minh City Stock Exchange-listed An Cuong Wood JSC (HOSE: ACG) has announced the appointment of Ms. Vu Hau Giang to its Board of Directors, replacing Mr. Phan Quoc Cong, who has stepped down. The Company has also approved an expansion of its business operations into the industrial machinery and equipment sector.