Sovico Group’s member companies have experienced robust business growth in the first half of 2025, according to reports. HDBank, for instance, achieved remarkable financial performance, with pre-tax profits surpassing VND 10,000 billion, a 23.3% increase compared to the previous year. This semi-annual profit marks a record high for the bank, and its ROE reached 26.5%, outperforming previous years.

As of June 30, 2025, HDBank’s total assets exceeded VND 784,000 billion, reflecting a 12.4% growth since the beginning of the year.

Vietjet Air has also demonstrated an impressive recovery, witnessing exponential growth in both revenue and profit. The airline’s revenue reached VND 35,800 billion, a 52.3% surge compared to the same period last year, while profit exceeded VND 1,600 billion, a 65% increase year-on-year. During the second quarter of 2025, Vietjet Air operated a total of 154 routes (including 109 international and 45 domestic routes). The airline operated nearly 41,000 flights, carrying 7.5 million passengers. Additionally, the cargo freight volume for the quarter neared 29,000 tons.

Investments in other businesses, including urban development projects, have also yielded favorable financial results.

Consequently, the Group posted a pre-tax profit of VND 657 billion in the first half of 2025, a 20.3% increase year-on-year. Its equity reached nearly VND 70,000 billion, while total assets approximated VND 230,000 billion. As of June 30, 2025, cash and cash equivalents (including marketable securities) stood at VND 28,754 billion.

The debt-to-equity ratio, including bonds, decreased to a healthy 0.33 as of June 30, 2025. The Group’s other liabilities primarily consist of debts owed to shareholders and partners, offset by accounts receivable.

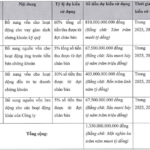

Spring Goodwill Securities to Inject Over VND 2,700 Billion into Margin and Proprietary Trading

The XTSC Board of Directors has approved a resolution to utilize proceeds from a recent rights issue, amounting to VND 1,350 billion. Together with plans for a private placement to raise an additional VND 1,515 billion, XTSC is set to invest over VND 2,700 billion into margin and proprietary trading activities.

“Masan’s Mineral Segment to Witness Significant Growth: Vietcap Predicts Surge in Tungsten Prices”

As of Q2 2025, Masan High-tech Materials has turned a corner, reporting positive profits after consecutive quarters of losses.

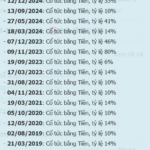

“LPBank Securities Offers 878 Million Shares to Boost Chartered Capital.”

LPBank is set to offer its existing shareholders a lucrative opportunity to invest in its growth journey. The company is offering a rights issue of 878 million shares at an attractive price of VND 10,000 per share, with a subscription ratio of 1000:2258.23. Mark your calendars, as the record date for this offering is September 8, 2025.