The VN-Index unexpectedly narrowed its loss to just 1 point at the close of the September 3rd trading session, despite overwhelming selling pressure throughout most of the day.

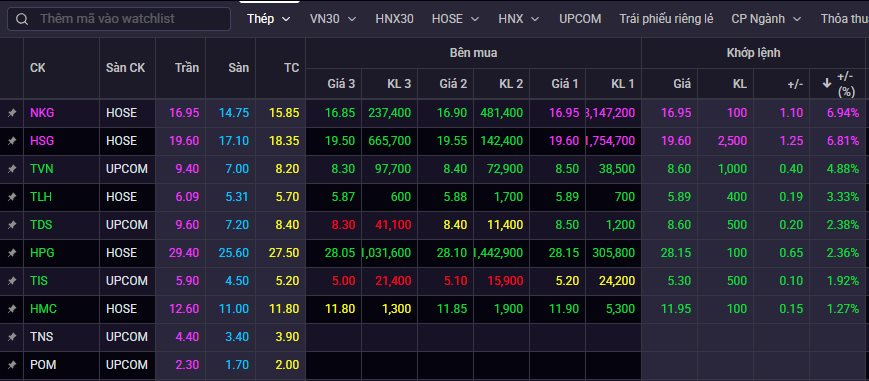

In this context, steel stocks became the focal point as they competed to outperform the market. Nam Kim Steel (NKG) and Hoa Sen Group (HSG) joined forces to reach the maximum daily limit, helping to mitigate the decline in the main index. Trading volume in these two stocks also surged, with NKG and HSG recording 32 million and 23.5 million units traded, respectively.

Additionally, other steel-related stocks such as TVN, TLH, TDS, and HPG witnessed positive momentum, with gains ranging from nearly 3% to 5%.

Since their April 2025 lows, stocks like HPG, TVN, NKG, HSG, and TLH have surged by double-digit percentages.

Steel stocks’ performance on September 3rd, 2025.

The upward momentum in the steel sector is bolstered by several positive factors. Regionally, price pressure from Chinese steel has eased thanks to the Chinese government’s determined implementation of production cuts. In July, steel production in China decreased by 4% year-on-year, and since the beginning of the year, production has dropped by 3%.

The cooling of Chinese steel prices has become a significant catalyst for the domestic steel industry. Coupled with the fact that the second half of the year is typically a peak consumption period, with improved real estate supply and accelerated public investment disbursements, further boosts expectations for a sector-wide recovery.

According to updated data for the first seven months of the year, domestic steel consumption grew by 16% year-on-year. Specifically, construction steel and HRC consumption increased by 14% and 26%, respectively, as they gained market share from Chinese steel. Steel and HRC prices have shown signs of recovery since July, with increases of about 3% and 4% from the previous month to $560/530 per ton.

Falling raw material prices positively impact gross profit margins

In their latest steel report, MBS Securities expects raw material prices for coal and iron ore to ease due to surplus supply in Australia and Brazil as these countries ramp up production thanks to favorable weather conditions. Specifically, during 2025-2026, coal supply is projected to increase by 1.5%/2% year-on-year, while iron ore supply is expected to remain high, with anticipated growth of 2%/3%. Additionally, the demand for raw materials will decrease due to China’s decision to cut steel production.

“With positive steel prices and decreasing raw material prices, the gross profit margins of manufacturing enterprises such as HPG are forecasted to continue improving by 1.1 and 0.2 percentage points in 2025-2026,” the report states.

For galvanized steel companies like HSG, NKG, and GDA, HRC prices are expected to recover from the end of Q3/25, positively impacting the selling prices of galvanized steel, which are linked to HRC prices. Moreover, the stockpiling of low-cost HRC will boost these companies’ gross profit margins by approximately 0.7-1 percentage points in 2025-2026. Overall, the industry’s gross profit margin is projected to increase by 1 and 0.5 percentage points during 2025-2026.

Steel companies are expected to receive higher valuations during the industry’s upcycle

Thanks to the positive dynamics of growing domestic consumption and recovering profit margins, MBS forecasts that the steel industry’s profits in 2025 and 2026 could increase by 47% and 32%, respectively, compared to the previous year.

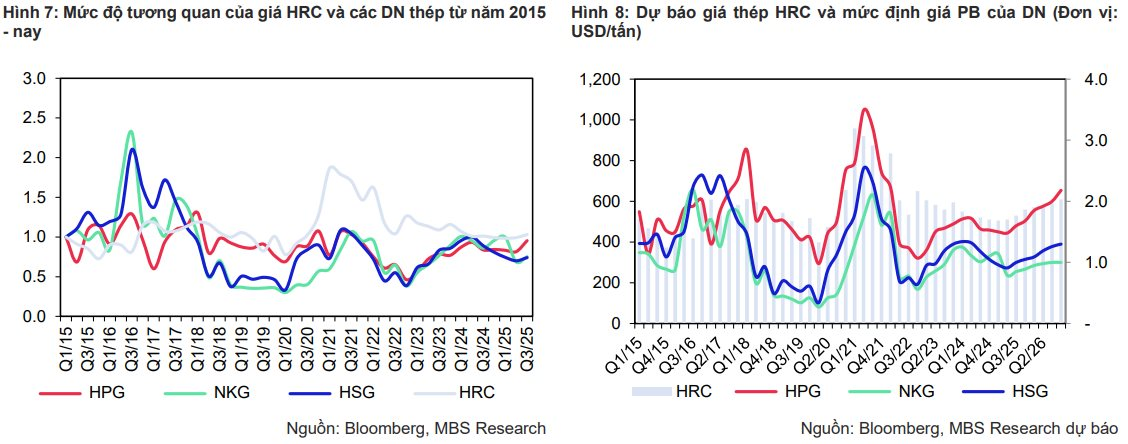

MBS notes that the P/B ratios of steel companies are highly correlated with the industry’s price cycle. During 2020-2021, as construction steel and HRC prices surged by 120% and 118%, the P/B valuations of companies in the sector rose from 0.4-1.0 to 1.1-3.2, driven by the positive impact of steel prices on profit margins and earnings growth. Therefore, during the steel price upcycle, the P/B valuations of steel companies are expected to significantly improve compared to the period of stagnant steel prices.

” Steel prices in 2025-2026 have started to move past their lows and mark the beginning of a new upcycle, driven by robust domestic demand ,” MBS analysts assess.

Consequently, MBS anticipates that the P/B valuations of companies in the sector could rise to 1.4-2.8 (approximately 30% higher than current levels). Companies such as Hoa Phat (HPG), Hoa Sen Group (HSG), and VG Pipe (VGS) are viewed positively in this context.