Amidst overwhelming selling pressure for almost the entire trading session, the VN-Index unexpectedly narrowed its loss to just 1 point by the end of the September 3rd session.

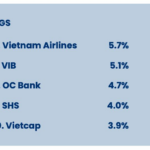

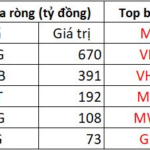

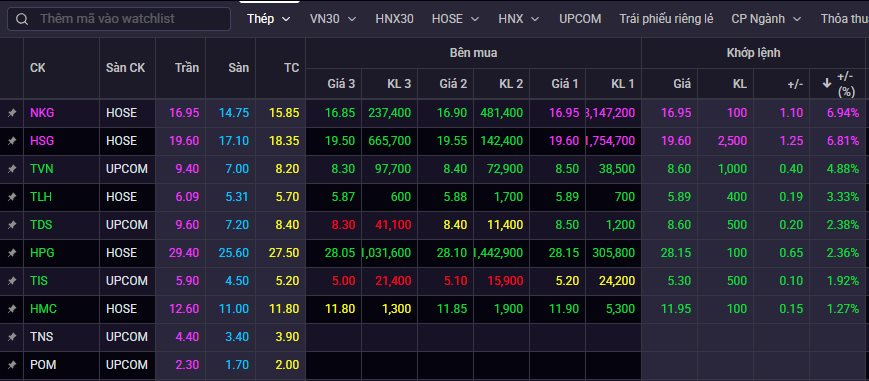

In this context, steel stocks became the focal point as they competed to turn “green and purple.” Nam Kim Steel (code: NKG) and Hoa Sen (code: HSG) joined forces to hit the ceiling price, helping to mitigate the index’s decline. Liquidity for these two stocks also surged, with trading volume for NKG and HSG reaching 32 million and 23.5 million units, respectively.

Additionally, other codes such as TVN, TLH, TDS, and HPG witnessed positive gains ranging from nearly 3% to 5% in value.

Since the April 2025 lows, stocks like HPG, TVN, NKG, HSG, and TLH have surged by tens of percent in value.

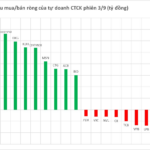

Steel stocks’ performance on September 3rd, 2025.

The steel group’s uptrend was bolstered by several positive developments. Regionally, downward pressure on steel prices from China eased thanks to the Chinese government’s resolute implementation of production cut measures. In July, production in the country decreased by 4% year-on-year, and since the beginning of the year, production has dropped by 3%.

The cooling of Chinese steel prices has become a significant catalyst for the domestic steel industry. Coupled with the fact that the second half of the year is typically the peak consumption season, as real estate supply improves and public investment disbursement is accelerated, further bolsters expectations for the sector’s recovery.

According to updated figures for the first seven months, domestic steel consumption grew by 16% year-on-year. Specifically, construction steel and HRC consumption increased by 14% and 26%, respectively, thanks to market share gains from Chinese steel. Steel and HRC prices have shown signs of recovery since July, rising by approximately 3% and 4% from the previous month to $560/530 per ton.

Falling raw material prices positively impact gross profit margins

In its latest steel report, Military Bank Securities (MBS) anticipates a decline in raw material prices for coal and ore amid excess supply in Australia and Brazil as these countries ramp up production thanks to favorable weather conditions. Specifically, during 2025–2026, coal supply is projected to increase by 1.5%/2% year-on-year, while ore supply is expected to remain high, with growth estimates of 2%/3%. Additionally, there is a decrease in the demand for raw materials due to China’s move to cut steel production.

“With positive steel prices and declining raw material prices, the gross profit margins of manufacturing enterprises such as HPG are expected to continue expanding by 1.1 and 0.2 percentage points in 2025–2026,” the report states.

For galvanizing companies like HSG, NKG, and GDA, HRC prices are expected to recover from the end of Q3/25, so the selling prices of galvanized products will benefit from following HRC prices. Additionally, stockpiling inexpensive HRC will enable these galvanizing companies to increase their gross profit margins by approximately 0.7–1 percentage points in 2025–2026. Overall, the industry’s gross profit margin is projected to increase by 1 and 0.5 percentage points during 2025–2026.

Steel companies are valued higher in the industry’s upcycle

Thanks to the momentum from growing domestic consumption and recovering gross profit margins, MBS forecasts that the steel industry’s profits in 2025 and 2026 could increase by 47% and 32%, respectively, compared to the previous year.

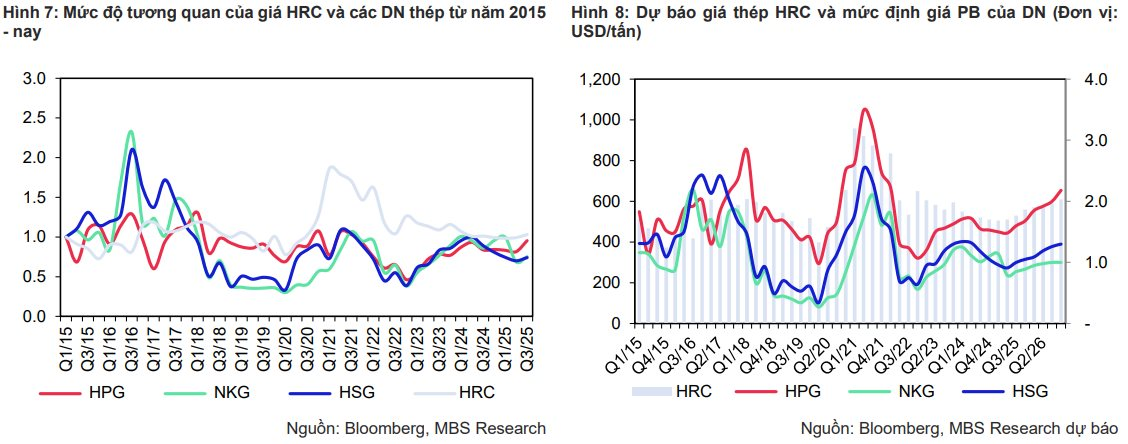

MBS states that the P/B ratios of steel companies are highly correlated with the steel price cycle. During 2020–2021, as construction steel and HRC prices surged by 120% and 118%, respectively, the P/B valuations of companies in the industry rose from 0.4–1.0 to 1.1–3.2 due to the positive impact of steel prices on gross margins and profit growth. Therefore, during the steel price upcycle, the P/B ratios of steel companies are expected to improve significantly compared to the stagnant steel price phase.

” Steel prices in 2025–26 have passed their lows and marked the beginning of a new upcycle in steel prices amid strong domestic demand ,” MBS analysts assessed.

Consequently, MBS anticipates that the P/B valuations of companies in the industry could rise to 1.4–2.8 (about 30% higher than current levels). Companies such as Hoa Phat (HPG), Hoa Sen (HSG), and VG Pipe (VGS) are viewed positively.

“Shares Soar as Chairman Announces Company Stake Sale”

Today, September 3rd, the stock market resumed trading after the holiday break, with the VN-Index fluctuating in the red. Meanwhile, the real estate sector grabbed attention as a slew of stocks soared to the ceiling.