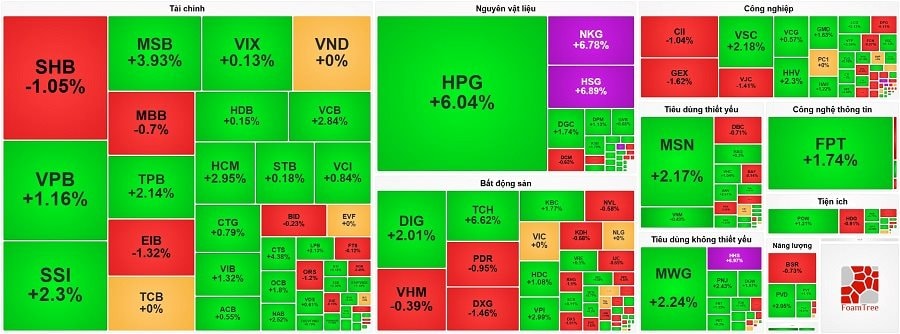

The trading session on September 4th witnessed a robust performance from steel stocks, becoming the focal point for capital inflows as numerous tickers surged to the maximum daily limit allowed, with trading volume and liquidity experiencing a sudden spike.

Leading the pack was HPG, the ticker of steel giant Hoa Phat Group, which climbed 6.04% to VND 29,850 per share. The trading volume of HPG continued its upward trajectory, surpassing 141.4 million shares.

HSG, the ticker of Hoa Sen Group, extended its rally with a 6.89% gain, closing at VND 20,950 per share. The trading volume for HSG reached over 28.8 million shares.

Similarly, NKG, the ticker of Nam Kim Steel Joint Stock Company, maintained its upward momentum, surging 6.78% to VND 18,100 per share. The trading volume for NKG witnessed a substantial increase, nearing 38.2 million shares.

TLH, the ticker of Tien Len Steel Group, experienced a sharp rise of 6.96%, ending the day at VND 6,300 per share. The trading volume for TLH witnessed a sudden surge, surpassing 1.6 million shares.

Additionally, other steel stocks such as SMC (+3.19%), VCA (+3.61%), HMC (+0.42%), and a few others also posted gains.

Steel stocks surge in the September 4th session.

The upward momentum in the steel sector was bolstered by several positive developments in the regional market. The downward pressure on prices from Chinese steel abated thanks to the Chinese government’s resolute implementation of production cuts. In July, steel production in China decreased by 4% year-on-year, and since the beginning of the year, production has dropped by 3%.

The cooling of Chinese steel prices has become a significant catalyst for the domestic steel industry. Coupled with this, the second half of the year is typically a peak consumption period as real estate supply improves and public investment disbursement accelerates, further boosting expectations for a sector-wide recovery.

VN-Index inches closer to the 1,700 mark

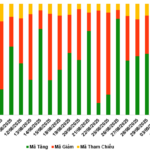

Following a mild correction, the stock market surged on September 4th as buying pressure from investors overwhelmed selling, with the benchmark VN-Index adding nearly 15 points and approaching the 1,700 threshold.

At the close of the September 4th session, the VN-Index climbed 14.99 points to 1,696.29. The HNX-Index gained 1.19 points to reach 283, while the UPCoM-Index rose 0.8 points to 111.85.

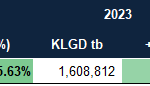

Liquidity in the market remained elevated, with total trading value across all three exchanges nearing VND 43,800 billion. On the HoSE alone, liquidity reached nearly VND 39,600 billion, an increase of over VND 2,200 billion compared to the previous session.

The stock market surges on September 4th, with the VN-Index nearing the 1,700 mark.

In addition to the strong performance of steel stocks, several other sectors witnessed robust gains, including banking, securities, retail, and others, which collectively propelled the market higher.

Within the banking sector, numerous tickers rallied, including: VCB (+2.84%), TPB (+2.14%), NAB (+2.52%), LPB (+2.13%), MSB (+3.93%), VPB (+1.16%), VIB (+1.32%), OCB (+1.8%), and a few others.

Similarly, securities stocks also posted strong gains, with SSI (+2.3%), HCM (+2.95%), CTS (+4.38%), and others leading the charge.

Retail stocks joined the rally, with notable gains from MWG (+2.24%), PNJ (+2.43%), DGW (+1.97%), FRT (+1.33%), and others.

Moreover, large-cap stocks across various sectors advanced, including: DGC (+1.74%), DPM (+1.13%), MSN (+2.17%), FPT (+1.74%), POW (+1.21%), VSC (+2.18%), GMD (+1.63%), TCH (+6.62%), DIG (+2.01%), KBc (+1.77%), VPI (+2.99%), and several others.

Swimming against the market tide, some large-cap stocks experienced profit-taking by investors, including: SHB (-1.05%), EIB (+1.32%), DXG (-1.46%), GEX (-1.62%), VJC (-1.41%), CII (-1.04%), and a few others.

Market Beat: The Triumphant Trio Revives, VN-Index Rallies in the Afternoon

The Vietnamese stock market indices witnessed a remarkable turnaround on Thursday, September 4th. After a challenging morning session, the VN-Index surged in the afternoon, closing at 1,696.29, a gain of nearly 15 points. The HNX-Index and UPCoM-Index mirrored this positive sentiment, with the former climbing 1.29 points to 283.99 and the latter rising 0.8 points to finish at 111.85. This unexpected rally has injected a dose of optimism into the market, setting the stage for a potential upward trajectory in the coming sessions.