I. VIETNAMESE STOCK MARKET WEEK 03-05/09/2025

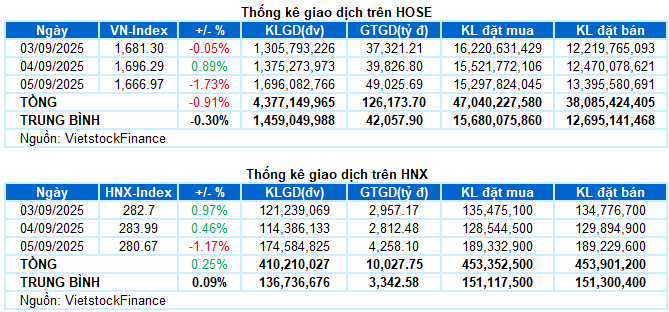

Trading: The main indices fell sharply during the 05/09 session. The VN-Index ended the week at 1,666.97 points, a significant drop of 1.73% from the previous session. The HNX-Index also plummeted by 1.17%, settling at 280.67 points. For the week, the VN-Index lost a total of 15.24 points (-0.91%), while the HNX-Index gained slightly by 0.69 points (+0.25%).

The Vietnamese stock market concluded the first trading week of September swiftly due to the two-day holiday at the beginning of the week. Despite a modest improvement in liquidity, the VN-Index steadily advanced to establish a new peak amid multiple shaking pressures. However, the last session witnessed an unexpected reversal as the index plunged towards the end of the day after breaking through the 1,700-point mark in the morning. Widespread selling pressure made the recovery effort fragile. At the week’s close, the VN-Index stood at 1,666.97 points, a 0.91% decline compared to the previous week.

In terms of impact, the top 10 negative contributors caused the VN-Index to lose more than 16 points, with the most significant pressure coming from the trio of banks: VCB, VPB, and BID. On the other hand, no notable positive contributors emerged to curb the downward trend. While SJS, GVR, and VJC led the supportive group, they only helped the index recoup less than 1 point.

The heightened profit-taking pressure caused most sectors to end the week in negative territory. The financial group bore the brunt, plunging 2.58% as numerous bank and securities stocks corrected over 2%, including VCB, BID, MBB, LPB, VPB, HDB, VIB, SHB, SSB, VIX, TPB, VND, and SSI.

The information technology, materials, and real estate sectors also exerted considerable pressure on the overall market, with large-cap stocks witnessing sharp declines: FPT (-1.52%), CMG (-2.27%); HPG (-3.52%), MSR (-5.17%), NTP (-2.47%), HSG (-3.34%); VHM (-2.25%), KDH (-3.54%), PDR (-3.46%), DXG (-5.71%), and SSH (-11.57%).

On the flip side, healthcare was the sole sector that managed to cling to a fragile green tint thanks to the positive contributions of DHG (+0.49%), DCL (+6.19%), VDP (+1%), MKP (+1.08%), NDC (+1.63%), and JVC (+3.89%).

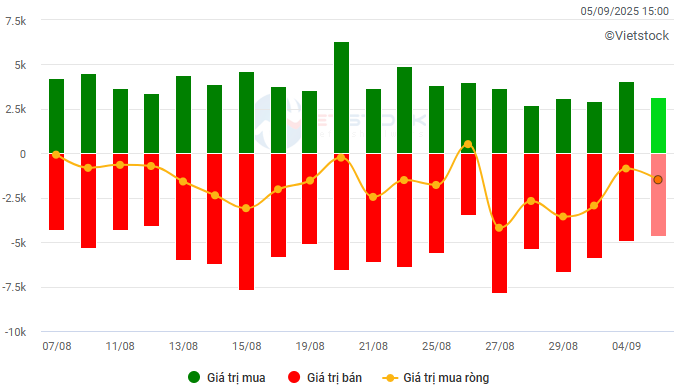

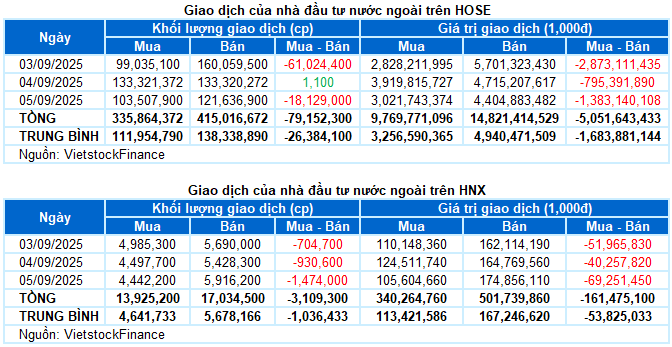

Foreign investors continued to offload their holdings aggressively, with net sell values exceeding VND 5.2 trillion on both exchanges during the week. Specifically, foreign investors sold a net amount of over VND 5 trillion on the HOSE and VND 161 billion on the HNX.

Trading value of foreign investors on HOSE, HNX, and UPCOM by day. Unit: VND billion

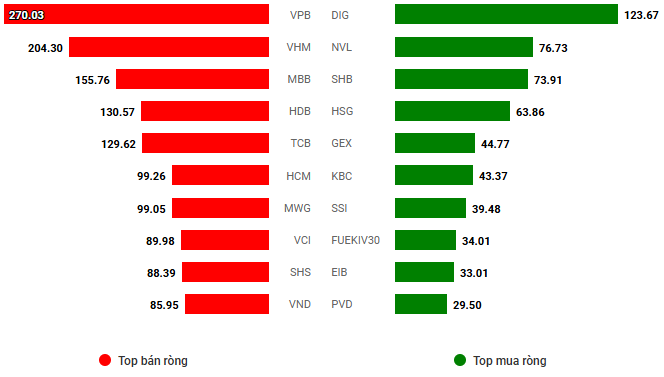

Net trading value by stock code. Unit: VND billion

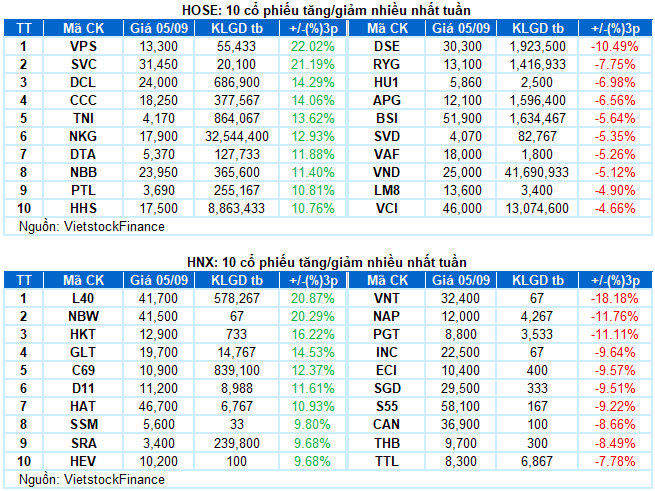

Stocks with notable gains this week include NKG

NKG rose by 12.93%: NKG witnessed positive price action after surpassing the Middle line of the Bollinger Bands. However, the corrective movement in the last session indicates the presence of profit-taking pressure. The 16,500-17,500 region (equivalent to the previous peak in August 2025) will act as short-term support. Additionally, the Stochastic Oscillator and MACD indicators continue to trend upward after generating buy signals, suggesting that the upward potential remains intact.

Stocks with significant losses this week include DSE

DSE declined by 10.49%: DSE reversed course this week after two consecutive weeks of strong gains. The emergence of a Big Black Candle pattern, coupled with surging trading volume in the final session, paints a pessimistic picture.

Currently, the Stochastic Oscillator has provided a sell signal within the overbought zone, while the MACD is gradually narrowing the gap with the Signal line. Risks will escalate if the MACD generates a similar signal in the near future.

II. STOCK MARKET STATISTICS FOR THE PAST WEEK

Economic and Market Strategy Division, Vietstock Research Team

The Bank Stock Surprise: A Proprietary Trading Boost

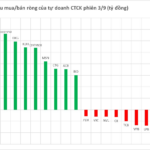

The proprietary trading arms of securities companies returned to net buying with a value of VND435 billion on the HoSE.