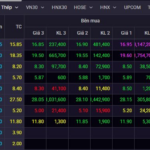

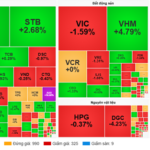

The stock market opened the first session of March 9 with relatively subdued and polarized trading. The VN-Index faced adjustment pressure from large-cap stocks and edged down 0.91 points (-0.05%) to close at 1,681.30. Foreign trading continued to be a downside, with a strong net sell-off of VND 2,939 billion across the market.

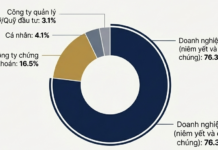

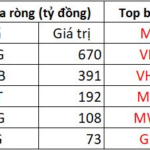

Securities companies’ proprietary trading returned to net buying with a value of VND 435 billion on the HoSE exchange.

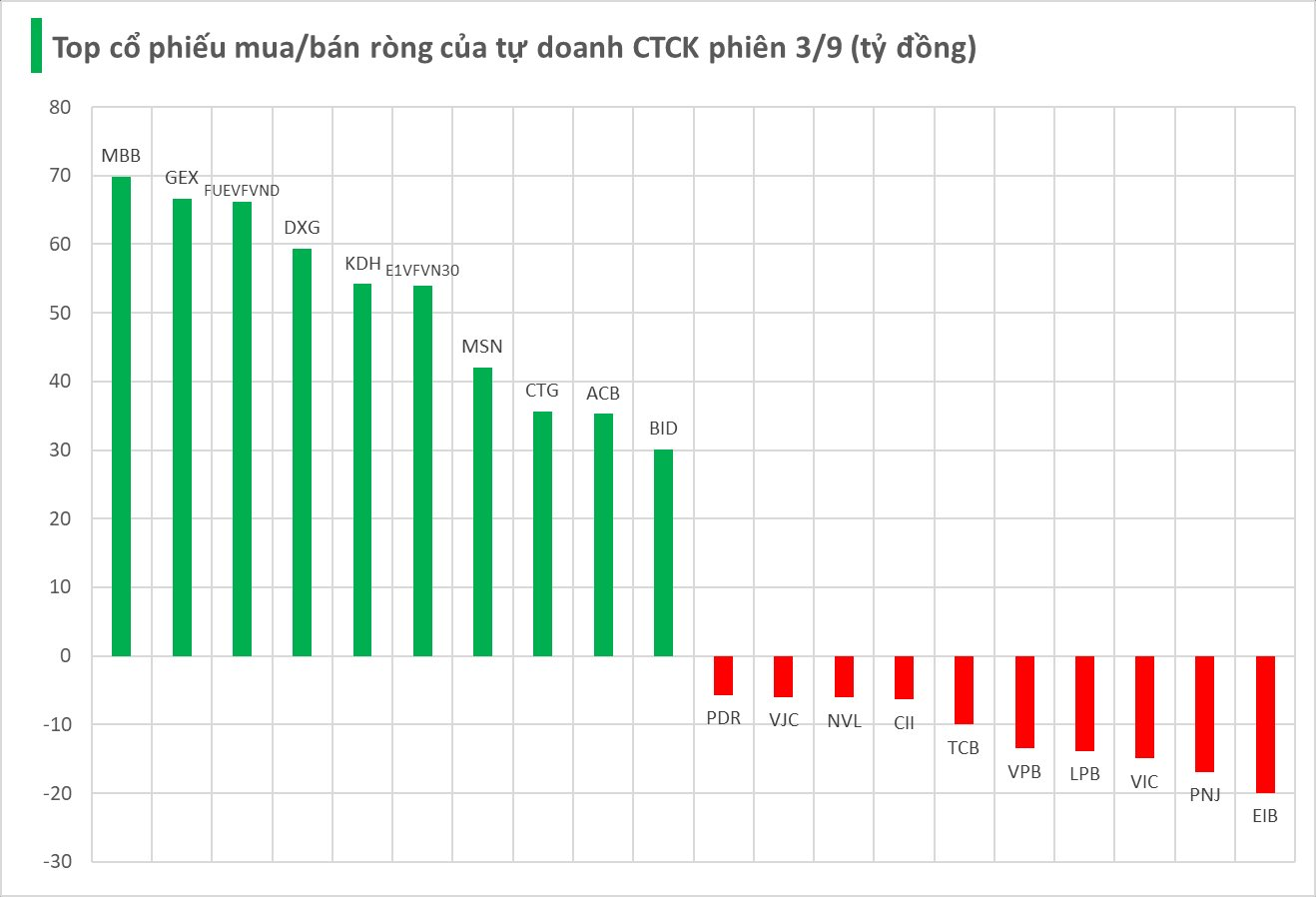

Specifically, MBB and GEX were net bought with respective values of VND 70 billion and VND 67 billion. This was followed by FUEVFVND (VND 66 billion), DXG (VND 59 billion), KDH (VND 54 billion), E1VFVN30 (VND 54 billion), MSN (VND 42 billion), CTG (VND 36 billion), ACB (VND 35 billion), and BID (VND 30 billion). These stocks witnessed strong buying from securities companies’ proprietary trading desks.

On the other hand, the group of securities companies net sold the most in EIB with a value of VND 20 billion, followed by PNJ (VND 17 billion), VIC (VND 15 billion), LPB (VND 14 billion), and VPB (VND 13 billion). Several other stocks also experienced notable net selling, including TCB (VND 10 billion), CII (VND 6 billion), NVL (VND 6 billion), VJC (VND 6 billion), and PDR (VND 6 billion).

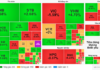

Steel Stocks are Turning “Green and Purple”: What’s the Deal?

From the depths of April 2025, stocks such as HPG, TVN, NKG, HSG, and TLH have surged by double-digit percentages.