In a recent development, the People’s Committee of Khanh Hoa province has granted approval for the KN Cam Ranh Passenger Wharf Project (Cam Ranh International Marina) to KN Cam Ranh JSC.

Spanning an area of 148 hectares, including land and water surfaces, the project features a 420-meter-long main pier connected to a spacious 22,000 sq. m passenger terminal. This facility is designed to accommodate tens of thousands of passengers annually.

The Cam Ranh International Marina is projected to serve between 300,000 and 500,000 cruise passengers each year, generating hundreds of millions of dollars in revenue and creating over 7,000 local jobs.

Cam Ranh International Marina Project Illustration.

KN Cam Ranh, established in 2015 with an initial chartered capital of VND 540 billion, is a subsidiary of Long Thanh Golf Investment and Trading JSC – a key player in the KN Investment Group ecosystem founded by entrepreneur Le Van Kiem.

The company is the owner of the mega-project KN Paradise Complex of Resorts and Entertainment in Cam Ranh, Khanh Hoa (covering 794.5 hectares with a total investment of VND 46,266 billion).

On April 27, 2023, KN Cam Ranh increased its chartered capital from VND 6,746 billion to VND 7,900 billion, with Long Thanh Golf holding 90% of the shares and Mr. Le Van Kiem owning the remaining 10%. In June 2025, the company further raised its capital to VND 9,000 billion, maintaining the same shareholder structure.

In the first half of 2025, the company reported a post-tax profit of VND 94.2 billion, a 17% increase compared to the previous year. Currently, the company’s equity capital stands at VND 9,106 billion, translating to a post-tax profit/equity ratio of just 1%.

Meanwhile, the debt-to-equity ratio is 3.6 times, indicating KN Cam Ranh’s total liabilities have reached VND 32,902.9 billion, an increase of VND 7,139 billion compared to the previous year. This includes bank loans exceeding VND 6,003 billion, bond issuance debt of VND 751 billion, and other liabilities totaling over VND 26,048 billion.

KN Cam Ranh’s liability scale has been steadily increasing, from VND 18,900 billion in 2021 to VND 20,600 billion in 2022, VND 23,926 billion in 2023, and VND 25,409 billion in 2024.

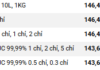

According to the Hanoi Stock Exchange (HNX), KN Cam Ranh currently has two bond batches in circulation.

The first batch, KNCCH2126001, was issued on August 31, 2021, with a five-year term and was fully purchased by a credit institution arranged by MBS and MBBank. The proceeds from this bond issuance were used to fund infrastructure construction and land leveling for Zone 3.3 of the KN Paradise Complex of Resorts and Entertainment project.

In 2021, the company also issued the second batch, KNCCH2126002, with a value of VND 1,000 billion and a five-year term, scheduled to mature on December 29, 2026.

On May 14, 2025, KN Cam Ranh repurchased VND 189 billion worth of the KNCCH2126002 bond batch before the due date, reducing the circulating value to VND 181 billion. On May 30, 2025, the company also bought back VND 10 billion worth of KNCCH2126001 bonds, bringing the circulating value down to VND 570 billion.

From Billion-Dong Profits to Modest Earnings: A Real Estate Giant’s Journey and Ambitious Plans

Despite modest profits of just a few billion dong and a stock price lower than the cost of a glass of iced tea, this real estate giant aims high with a target of 40,000 social housing units.

Over the years, Hoang Quan Real Estate JSC has faced declining business performance. For the past nine years, the company has consistently fallen short of its business plans, earning only over VND 20 billion per year, with profits dipping as low as VND 4-5 billion in 2021 and 2023.