**Urban Development Corporation Announces New Subsidiary: Kinh Bac – Dong Thap**

The Urban Development Corporation of Kinh Bac – JSC (KBC on HoSE) has announced an unusual investment in establishing a new company, Kinh Bac – Dong Thap Urban Development Joint Stock Company.

The newly established company has a charter capital of VND 1,500 billion, of which Kinh Bac contributed VND 1,350 billion, holding 90% of the charter capital. With this majority stake, Kinh Bac – Dong Thap becomes a subsidiary of Kinh Bac.

According to the published registration content, the main business lines of Kinh Bac – Dong Thap include real estate trading and leasing of land use rights. Its head office is located on the 7th floor of the Dong Thap Post Office building, 71A Nam Ky Khoi Nghia Street, Dao Thanh Ward, Dong Thap Province.

Illustrative image

The other two shareholders contributing capital to this enterprise are Kinh Bac Investment Consulting and Investment Joint Stock Company and Kinh Bac Service Joint Stock Company, with a contribution of VND 75 billion each, equivalent to a 5% ownership stake.

Currently, Mr. Phan Minh Toan Thu (DOB: 1977) holds the position of General Director and Legal Representative of Kinh Bac – Dong Thap.

In another development, Kinh Bac recently announced information on the repayment of principal and interest on bonds for the first half of 2025 to the Hanoi Stock Exchange (HNX).

Accordingly, in the first half of 2025, Kinh Bac paid over VND 52.9 billion in interest on time for the KBC12401 bond lot (KBCH2426001). It is known that the total issuance value was VND 1,000 billion, issued on August 18, 2024, with a term of 24 months and expected maturity on August 28, 2026.

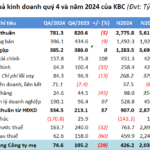

Regarding business performance, according to the reviewed consolidated financial statements for the first half of 2025, Kinh Bac reported net revenue of over VND 3,691.4 billion, up 253.5% compared to the same period in 2024. After deducting taxes and fees, the company reported a net profit of over VND 1,250.6 billion, nearly 6.4 times higher than the previous year.

As of June 30, 2025, Kinh Bac’s total assets stood at over VND 70,363 billion, up 57.3% from the beginning of the year. Of this, inventory was over VND 23,651.7 billion, accounting for 33.6% of total assets, and cash and cash equivalents were over VND 18,138.9 billion, accounting for 25.8% of total assets.

On the liability side of the balance sheet, total liabilities were over VND 44,663.6 billion, up 85.4% from the beginning of the year. Of this, loans and finance leases amounted to over VND 26,074 billion, accounting for 58.4% of total liabilities.

Special Economic Zone Phu Binh: KBC Takes Over the Reins of the $500 Million Thai Nguyen Project

The Urban Development and Investment Corporation (UDIC), a leading Vietnamese infrastructure development company, has announced that its proposal for the construction and business infrastructure investment project in Phu Binh Industrial Park has been approved by the People’s Committee of Thai Nguyen province. This decision, made on June 30, 2025, authorizes UDIC, listed on the Ho Chi Minh Stock Exchange as KBC, to proceed with its plans for developing key industrial infrastructure in the region.

“LIX Appoints New Board Secretary”

The Ho Chi Minh City Stock Exchange (HoSE)-listed Detergent Powder Company Lix [HOSE: LIX] has recently announced the appointment of Mr. Huynh The Hien as the new Secretary of the Board of Directors. Mr. Hien’s term will commence on August 4th, 2023, and continue until the end of the 2022-2027 tenure.

Industrial Land Rental Revenue Plummets, KBC Loses Nearly 80% of 2024 Profits

In 2024, Kinh Bac City Development Holding Corporation (HOSE: KBC) experienced a less impressive performance compared to the previous year, with a 51% and 79% decline in revenue and profit, respectively. This was largely due to a significant 77% drop in land and industrial infrastructure leasing revenue. Consequently, the enterprise achieved only 12% of its profit plan.