44% of Vingroup’s Total Liabilities are Future Revenue in Nature

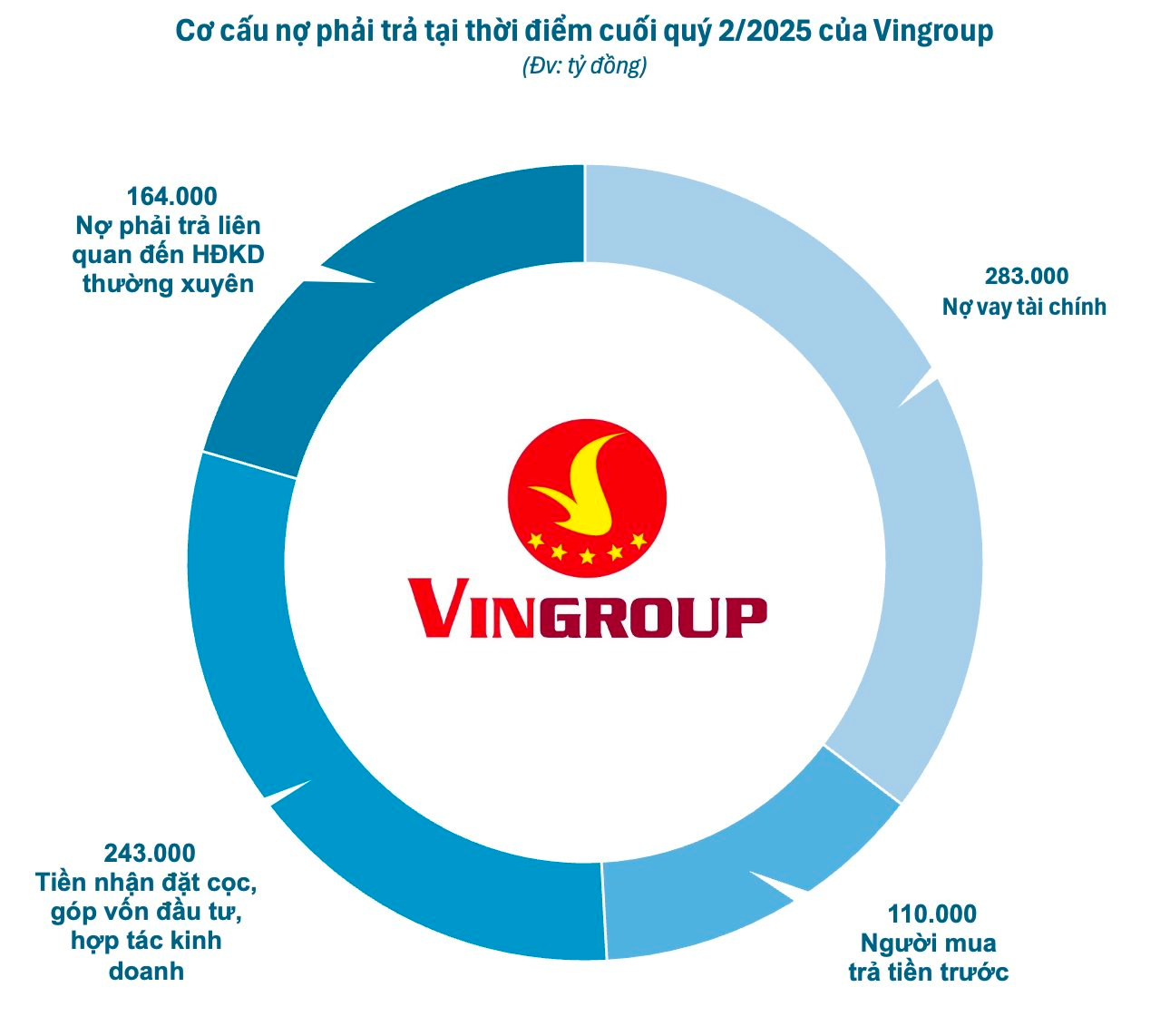

As per the financial report dated June 30, 2025, Vingroup’s reported payables stood at approximately VND 800 trillion. However, a closer analysis reveals that this figure does not accurately reflect the company’s actual debt position.

Specifically, of the VND 800 trillion, short-term and long-term borrowings as of June 30, 2025, accounted for only about VND 283 trillion, equivalent to 29% of total assets. These are financial borrowings that incur interest expenses. This ratio, by international standards, is considered safe, given Vingroup’s nearly VND 1 quadrillion in total assets.

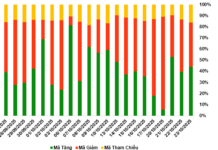

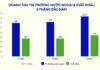

So, what is the nature of the remaining payables? According to the report, 44% of total payables, equivalent to VND 353 trillion, are not borrowings but rather advances and deposits from customers and partners. Of this, nearly VND 110 trillion is from customers who have made advance payments for houses, vehicles, or other products within the Vingroup ecosystem.

Per accounting regulations, amounts received from customers in advance for goods or services to be provided in the future, but not yet meeting the conditions for revenue recognition in the period, are recognized as “Advances from Customers” in the company’s liabilities. In essence, this is not debt but Vingroup’s future revenue.

Similarly, nearly VND 243 trillion is money deposited by partners for the transfer of real estate or cooperation in project development. This, too, represents future revenue that has been confirmed by the market.

The remaining portion of the payables relates to regular business operations, such as payables to suppliers, taxes, construction costs, warranties, etc. These are essentially balanced by the VND 288 trillion in receivables that Vingroup currently holds.

Thus, “86% debt” does not imply “86% bank debt burden.” Instead, it comprises a mix of obligations, most of which arise from regular business operations, with some even indicating positive future revenue streams. Moreover, an important factor to consider is market confidence. Customers and partners have advanced more than VND 353 trillion for Vingroup’s products and projects, demonstrating strong demand and faith in the brand and the company’s offerings.

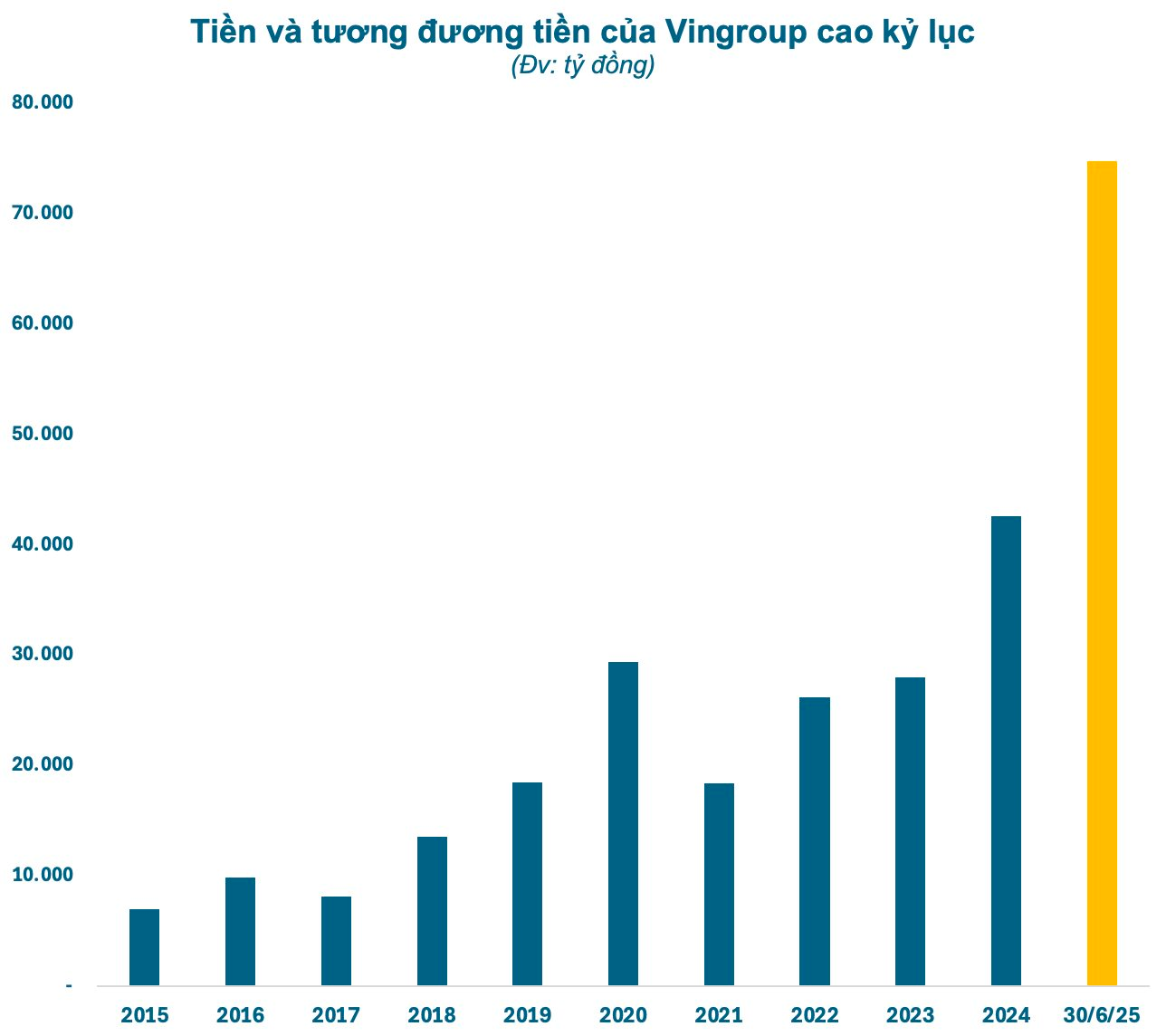

Record High Cash Position, Interest Expense is Manageable

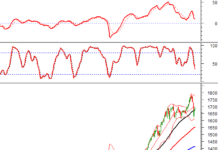

Delving into Vingroup’s repayment capacity, the Q2 2025 figures show interest and bond issuance expenses of VND 7.7 trillion. Some have raised concerns about Vingroup’s interest payment pressure. However, considering that only about one-third of the payables are financial borrowings that incur interest, and given Vingroup’s strong cash position of VND 74,760 billion, with VND 47 trillion in cash – a record high, there are no significant concerns. Additionally, Vingroup’s debt service capacity remains stable across periods.

Regarding the exit of some large investors, notably SK Group, it’s important to understand the context. This move is part of SK’s global investment restructuring strategy in recent years. In Vietnam, SK has also divested from Masan and other investments. SK has expressed its desire to continue exploring collaboration opportunities with Vingroup, aligning with SK’s new investment orientation.

From an investment perspective, a 5-7 year investment cycle is quite typical (SK invested in Vingroup in 2019). For Vingroup, the exit of a few large shareholders does not imply a loss of confidence but rather creates room for the group to diversify its investor base and tap into new capital from international financial institutions keen on Vietnam. With Vietnam’s rapidly growing economy and the expected upgrade of its stock market from frontier to emerging status, international capital inflows are poised to increase. This presents an opportunity for leading enterprises like Vingroup to not only retain but also expand their network of strategic foreign shareholders.

In conclusion, the speculations surrounding Vingroup result from a fundamental misunderstanding of its financial position. The overall picture reveals a stable, safe, and well-founded financial state, poised for continued growth.