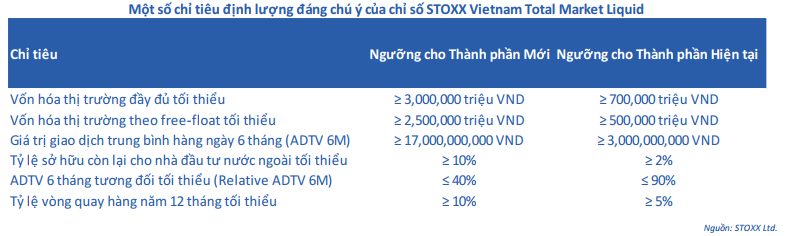

According to asset management company DWS, the FTSE ETF will be renamed from “Xtrackers FTSE Vietnam Swap UCITS ETF” to “Xtrackers Vietnam Swap UCITS ETF” and will switch its benchmark from the FTSE Vietnam Index to the STOXX Vietnam Total Market Liquid. The STOXX Vietnam Total Market Liquid index will undergo periodic reviews in March and September each year. According to DWS, this change aims to improve liquidity compared to the previous index.

The transition period lasted from July 17 to October 16, during which the portfolio could be gradually restructured through swap transactions on both indexes.

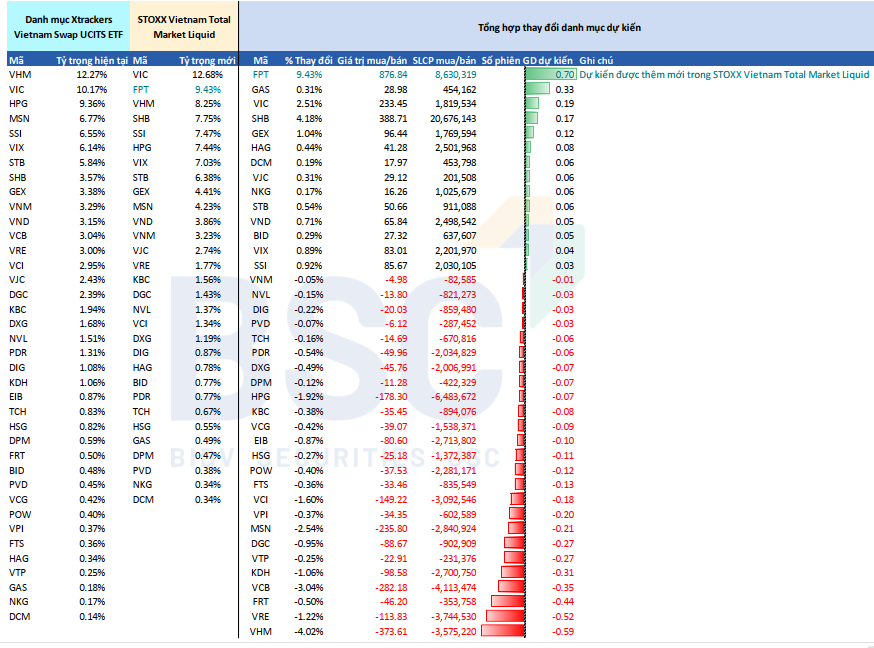

According to BSC Research’s predictions based on late August data, FPT is expected to be the most purchased stock, with an estimated volume of up to 8.6 million shares, accounting for 0.7% of the portfolio.

In addition to FPT, SHB will also be bought in large volumes of 20.7 million shares. Stocks such as HAG, SSI, VIX, and VND will be added with volumes below 2 million shares each.

On the other hand, the ETF will sell HPG with the largest volume of 6.5 million shares. This is followed by VCB with 4.1 million shares, VRE with 3.7 million shares, VHM with 3.6 million shares, and KDH with 2.7 million shares.

|

Forecast of the New FTSE ETF Portfolio

Source: BSC Research

|

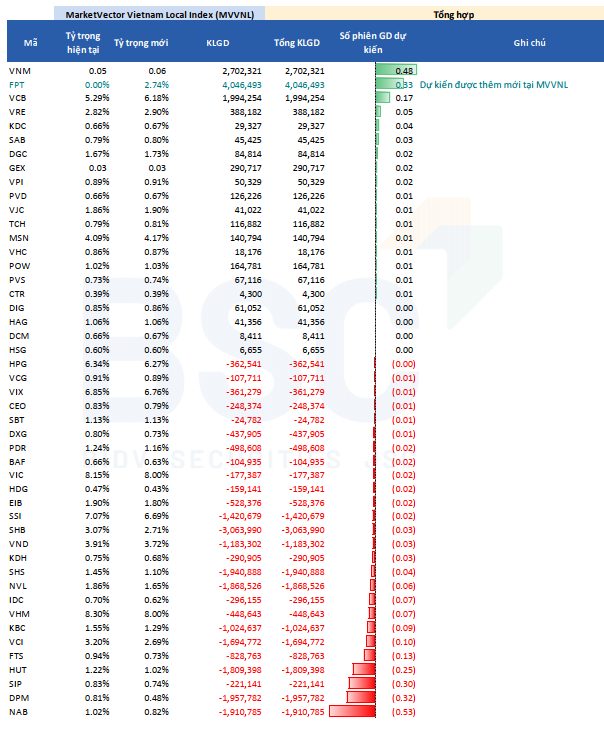

Meanwhile, the VanEck Vector Vietnam ETF (VNM ETF) is expected to announce its restructuring results in the early hours of September 13. BSC Research forecasts that this fund will also add FPT with a volume of 4 million shares. At the same time, VNM ETF will purchase additional VNM shares of 2.7 million and VCB shares of 2 million. Conversely, the fund will sell SHB with 3.1 million shares, DPM with 2 million shares, and NAB with 1.9 million shares.

|

VNM ETF Portfolio Forecast

Source: BSC Research

|

– 09:57 04/09/2025

“Market Winds of Change: Anticipating the Big Shift”

The VN-Index recovered towards the end of the trading session, forming a long lower shadow candle. This indicates that buyers stepped in during a period of correction, suggesting underlying strength in the index. However, to surpass the previous peak of 1,680-1,693 points achieved in August 2025, an improvement in trading volume is necessary in the upcoming sessions.