In a recent post on social media platform X, Ethereum co-founder Joseph Lubin argued that Wall Street is currently paying for a fragmented infrastructure system, and Ethereum will eliminate much of this fragmentation. “Large financial corporations like JPMorgan will soon have to join the decentralized infrastructure,” emphasized Lubin.

According to Lubin, this means that financial “giants” will participate in staking, operate validators, manage Layer 2 and Layer 3 networks, develop smart contracts, and engage in DeFi. He also dismissed concerns that Layer 2 networks would weaken the Ethereum mainnet.

Notably, the Ethereum co-founder predicted that the price of ETH could increase by 100 times its current value, or even more. “Ethereum/ETH will surpass the monetary base of Bitcoin/BTC,” Lubin stressed. This raises the prospect of Ethereum becoming not only the leading blockchain platform in terms of technology but also potentially the strongest digital asset in terms of market capitalization.

In fact, ETH has been the focus of crypto investors recently. Since the beginning of April, the digital currency has tripled in value, surpassing its historical peak from 2021 before adjusting. In this context, some whales are tending to switch from holding BTC to ETH.

On-chain analytics company Lookonchain, which tracks whale wallet addresses, reported that this wallet sold 2,000 BTC (equivalent to $215 million) to acquire 48,942 ETH on Monday. Earlier on Sunday, Lookonchain also announced that another whale had sold 4,000 BTC to buy 96,859 ETH within a 12-hour period. In total, this Bitcoin whale has invested in 886,317 ETH, equivalent to nearly $4 billion at the current market price.

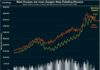

It can be seen that, in the last few years, while BTC has maintained its long-term uptrend and continuously set new peaks, ETH has fluctuated quite erratically and without a clear trend. However, the situation is expected to change as Ethereum’s applications are increasingly gaining recognition.

In a recent interview on Fox Business, Jan van Eck, CEO of VanEck, affirmed that Ethereum (ETH) is Wall Street finance’s top choice, capturing the interest of major banks and financial institutions. According to Jan van Eck, Ethereum has become an integral part of the modern financial system.

Ethereum’s strength lies in its smart contracts and staking mechanism, providing practical applications for financial institutions. As a result, Ethereum is being used for stablecoin payments, DeFi projects, and asset tokenization. Additionally, companies holding ETH are not only reserving it but also staking it to generate stable income.

The Digital Asset Investment Frontier: Unlocking the Potential

Bitcoin has come a long way since its mysterious inception on October 31, 2008. In just 16 short years, it has evolved from a niche digital currency to a global financial powerhouse, with a market capitalization in the billions. But is Bitcoin’s remarkable growth simply a fluke, or does it signal a new era in the world of finance?

“CEO of VanEck Shares Insights on Developing the Digital Asset Market, Proposes a Bitcoin Fund with SSI”

On March 17, 2025, VanEck Asset Management’s CEO, Jan van Eck, engaged in a fruitful discussion with Permanent Vice Minister, Nguyen Minh Vu, at the Ministry of Foreign Affairs. This landmark meeting paved the way for the transfer of invaluable international expertise and strategic insights into the development of Vietnam’s burgeoning digital asset market.

“The Crypto Report for August 2025 (Part 1): The Long-Term Uptrend Remains Intact”

The world of cryptocurrency is ever-evolving, and keeping abreast of market trends is crucial for investors. This analysis delves into the trends and behaviors of prominent cryptocurrencies that are on the radar of discerning investors. The insights provided herein offer a valuable reference point for both short-term trades and long-term investment strategies.