With this merger, Hasfarm is set to become a leading company in Asia and one of the largest fresh flower companies in the world, with production operations in Vietnam, China, and Indonesia, while also expanding access to significant markets such as China, Japan, and Australia.

As per the agreement, Lynch shareholders will receive AUD 2,245 per share in cash, excluding previously permitted dividend payments. The total transaction value is estimated at approximately AUD 270 million (equivalent to about VND 4,660 billion). The agreement is subject to shareholder approval and an independent report confirming that it is in the best interests of shareholders.

The deal will support Lynch’s strategy in production, distribution, and logistics, especially in the Chinese market. For Hasfarm, CEO Aad Gordijn stated that their production operations will ensure a stable supply for Lynch’s customers, particularly retailers in Australia, and expand their reach into the Chinese and Japanese markets.

Hasfarm is the largest highland tropical flower producer in Asia, with a presence in Vietnam, China, and Indonesia. Their crop portfolio includes chrysanthemums, roses, carnations, lilies, hydrangeas, gerberas, irises, and tulips.

In Vietnam, Hasfarm established Dalat Hasfarm in 1994, headquartered in Da Lat, Lam Dong. Their business encompasses the production, distribution, and export of flower cuttings, potted flowers, and seedlings. The company has a chartered capital of nearly VND 144 billion, is 100% foreign-owned, and is directed by Mr. Adrianus Anthonius Maria, a Dutch national. With 4,000 employees, Dalat Hasfarm is Vietnam’s largest fresh flower grower and trader, exporting across the Asia-Pacific region.

In 2010, Hasfarm expanded into flower distribution in Japan through Greenwings Japan, a leading flower importer. In 2014, the company entered the Chinese market by acquiring Kunming Hasfarm. Also, in the same year, they purchased Flying Fresh International, a long-standing exporter of premium flowers from New Zealand. In 2017, Hasfarm ventured into Indonesia by acquiring HasfarmLabs and subsequently into the cut flower cultivation sector under the brand Toba Hasfarm.

The Lynch Group is an integrated flower and ornamental plant grower and wholesaler in Australia since 1979 and China since 2002. Prior to its acquisition by Hasfarm, Lynch had shareholders such as Mitsubishi UFJ Financial, Morgan Stanley, Regal, and MA Financial.

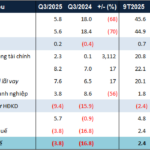

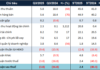

For the first half of the 2025 fiscal year (ending December 29, 2024), the company reported revenue growth despite consumer spending tightening in Australia and China. Revenue reached AUD 196.5 million (approximately USD 128.7 million), a 5.3% increase compared to the same period last year. EBITDA (earnings before interest, taxes, depreciation, and amortization) amounted to AUD 16.5 million (approximately USD 10.8 million), a slight decrease of nearly 1% due to low rose prices in the Chinese market, while the Australian market remained stable. Despite the challenges, the Group’s leaders remain optimistic about China, especially in the medium and long term. With various holidays, Lynch forecasts a 6% increase in revenue for the full 2025 fiscal year.

Thu Minh

– 10:14 09/04/2025

The Premier Unveils the Merger Plan for the Ministry of Agriculture and the Ministry of Natural Resources

Prime Minister Pham Minh Chinh has announced that the proposed merger of the Ministry of Agriculture and Rural Development with the Ministry of Natural Resources and Environment will be discussed at the Central Committee meeting in January 2025. If approved, the merger will then be put forward to the National Assembly for ratification in February 2025, with the official merger taking place thereafter.