The USD Index (DXY) – a measure of the greenback’s strength against a basket of six major currencies – rose 0.13 points to 97.86 on August 29, ending a three-week losing streak.

An inflation report exceeding the Federal Reserve’s 2% target led investors to believe that the US central bank will need to maintain high-interest rates for longer. US bond yields rose in response, attracting capital inflows into the USD, strengthening the currency.

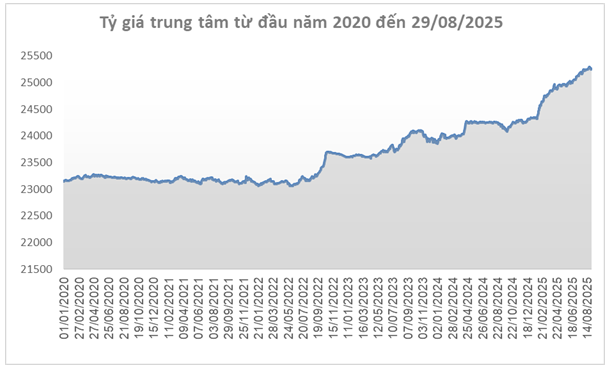

Source: SBV

|

Domestically, the State Bank of Vietnam set the daily reference exchange rate on August 29 at 23,240 VND per USD, a decrease of 58 VND from the previous week. With a +/- 5% fluctuation band, the exchange rates at commercial banks are allowed to trade within the range of 23,978 – 26,502 VND/USD.

The buying and selling rates at the State Bank of Vietnam’s Foreign Exchange Management Department decreased to 24,028 – 26,452 VND/USD (buying – selling), a reduction of 56 and 60 VND compared to the previous week, respectively.

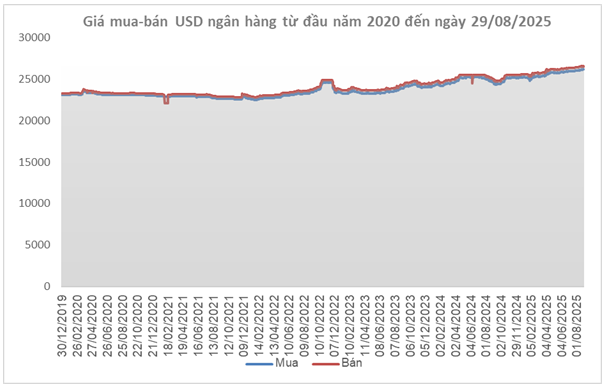

Source: VCB

|

At Vietcombank, the USD buying and selling rates were listed at 26,132 – 26,502 VND/USD, a slight increase of 2 VND on the buying side but a decrease of 18 VND on the selling side.

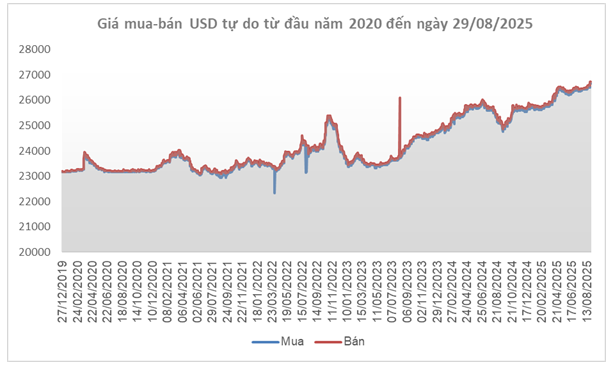

Source: VietstockFinance

|

In the free market, the USD surged by 140 VND on both sides, trading around 26,650 – 26,720 VND/USD.

– 20:41 31/08/2025

Maintaining Exchange Rate Stability

“With the busiest season for trade fast approaching, businesses are yearning for stable exchange rates to ease their financial worries. As the markets gear up for a frenzied few months, a predictable currency environment would be a welcome relief.”

The Power of Compounding: Maximizing Your Savings with Strategic Deposit Rates in September 2025

“Savings accounts are a popular way to grow your money, and with interest rates on the rise, it’s an opportune time to explore your options. As of September 2025, Vietnamese banks are offering attractive rates on VND savings accounts, with interest rates ranging from 3.0%-6.0% p.a. This wide range of rates across different tenure options empowers customers to make informed choices and maximize their savings potential.”