| Trading of VCR stocks has recently surged to its highest price since April 2022. |

In early July, the Board of Directors of Vinaconex, listed on the Ho Chi Minh City Stock Exchange (HOSE) under the ticker VCG, approved the transfer of all 107.1 million shares (51%) held by VCG in VCR at a minimum price of 48,000 VND per share.

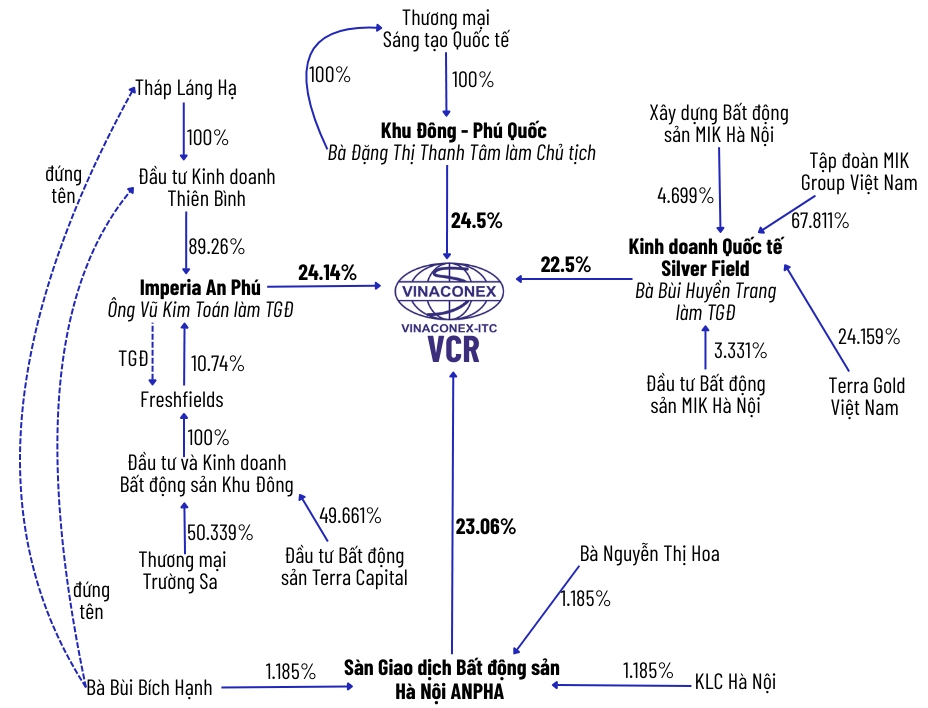

On July 3, Hanoi ANPHA Real Estate Exchange Company purchased 48.4 million shares, thereby holding 23.06% of VCR’s capital. By July 9, Imperia An Phu Company had also purchased more than 50.2 million VCR shares to hold a 24.14% stake.

On July 17, there was a negotiated transaction of more than 47.7 million VCR shares, almost equal to the number reported by Silver Field International Business Company, which acquired 47.25 million shares, or 22.5%, for nearly VND 2,344 billion.

The session on August 1 witnessed a negotiated transaction of nearly 51.6 million VCR shares, with a total value of more than VND 2,558 billion, equivalent to VND 49,600 per share. The volume and timing matched the transaction reported by Phu Quoc East Area Company, which acquired a 24.5% stake in VCR. Prior to this, the company did not hold any shares in VCR.

On August 6, VCG announced that it had sold all 107.1 million VCR shares in three transactions between July 14 and August 1.

Thus, within a few weeks, four new enterprises purchased nearly 197 million VCR shares, equivalent to 94.2% of its capital.

Profile of the four new shareholders

The two organizations, which had never held VCR shares before and have just spent thousands of billions of dong to become major shareholders, are famous names related to large real estate companies from Hanoi.

Phu Quoc East Area Company, established in 2015, is chaired by Ms. Le Thi Hai Chau. Mr. Phong is also known as the Chairman of Dong Area Real Estate Investment and Trading Company (abbreviated as Dong Area Company). This enterprise currently has a charter capital of VND 2,950 billion, in which Truong Sa Trading Company holds 50.339% and Terra Capital Real Estate Investment Company holds 49.661%. He is also the Chairman of Hai An Huy Company and Phuoc Long Real Estate Investment and Trading Company.

At the end of 2020, the Company changed its Chairman to Mr. Dang Nam Phong. The latest update in July of this year shows that the Company changed its owner from Dong Area Company to International Creative Trading Company. At the same time, Ms. Dang Thi Thanh Tam took over as Chairwoman.

Silver Field International Business Company, established in 2014, had a charter capital of VND 1,147 billion at the end of July; the contributing members included: MIK Hanoi Real Estate Construction Company owning 4.699%, MIK Group Vietnam Joint Stock Company 67.811%, MIK Hanoi Real Estate Investment Company 3.331%, and Terra Gold Vietnam Joint Stock Company 24.159%. The company authorized three individuals, Mr. Nguyen Truong Son, Mr. Vu Tien Duc, and Mrs. Tran Thu Huong, to represent the capital contributors.

Imperia An Phu Company, headquartered in Ho Chi Minh City and established in 2007, recently increased its charter capital from VND 416.7 billion to VND 3,880 billion. In this structure, Thien Binh Investment and Trading Company holds 89.26%, and Freshfields Company holds 10.74%. Mr. Vu Kim Toan is the General Director and legal representative.

| Thien Binh, with a capital of VND 341.5 billion, is owned by Lang Ha Tower Company. Entrepreneur Vu Kim Toan, born in 1955, is also present in many enterprises such as Thang Long Invest Company, Phu Quoc House Development Joint Stock Company, Vietnam Prosperous Phu Quoc Joint Stock Company, and Freshfields Company, a legal entity owned by Dong Area Real Estate Investment and Trading Company. |

Hanoi ANPHA Real Estate Exchange Company, established in 2015, had a charter capital of nearly VND 4,251 billion at the end of July. The updated list of contributing members includes: KLC Hanoi Joint Stock Company holding 97.63%, Mrs. Bui Bich Hanh 1.185%, and Mrs. Nguyen Thi Hoa 1.185%. Ms. Hanh is also present at Thien Binh Company and Lang Ha Company.

|

The four new shareholders of VCR and their relationships

Compiled by the author

|

After the four new shareholders completed the acquisition of 94.2% of VCR’s capital, VCR announced the resignation of five members of the Board of Directors (Chairman Duong Van Mau, members Nguyen Tuan Hai, Le Van Huy, and Vu Duc Thinh) and three members of the Supervisory Board (Chairman Vu Van Manh, and members Vu Manh Hung and Vu Thai Duong) for the 2021-2026 term.

Mr. Mau (currently a member of the Board of Directors and Deputy General Director of VCG), Mr. Huy, Mr. Thinh, and Mr. Manh (currently Chairman of the Supervisory Board of VCG) resigned because VCG had divested its entire stake. The other members resigned for personal reasons.

In addition, VCR also changed its legal representative from Mr. Le Van Huy, who stepped down as General Director, to Mr. Vu Nguyen Vu, who took over the position on June 4, 2025.

On September 26, VCR will hold an extraordinary General Meeting of Shareholders to dismiss the members of the Board of Directors and the Supervisory Board and elect new members.

Panorama of Cai Gia – Cat Ba project (Cat Ba Amatina) with a total area of nearly 172.4ha and a total investment of nearly VND 11 trillion

|

The amount of capital injected into Cat Ba Amatina

VCR was established in 2008 based on the Cai Gia – Cat Ba Project Management Board of VCG. As a project enterprise, VCR’s cash flow largely depends on the revenue from this project. Starting to recognize revenue and expenses in 2008, after three profitable years, VCR began to incur cumulative losses from 2012 onwards, with cumulative losses exceeding VND 550 billion.

Since the COVID-19 pandemic, the vacation property market has not fully recovered, and the investment period is much longer than that of commercial real estate. VCG’s General Director, Mr. Nguyen Xuan Dong, once shared that Cat Ba Amatina is a large vacation property project. If VCR cannot sell its products, it will not have cash flow. The issue at VCR, according to Mr. Dong, is how to sell the products and recognize revenue, either through wholesale or partial sales, provided that the selling price ensures profitability.

VCG’s former Chairman, Mr. Dao Ngoc Thanh, said that the project had been suspended for more than a decade and was only restarted in 2020. The legal procedures have been completed, the apartments have been granted red books, and the infrastructure construction is basically finished.

VCR’s revenue and profit from 2008 to the present

As of the end of June 2025, VCG recorded construction in progress at Cat Ba Amatina of nearly VND 5.8 trillion, in addition to more than VND 2.1 trillion in inventory items at the end of 2024.

Meanwhile, VCR recognized more than VND 4.8 trillion in construction in progress for Cat Ba Amatina. The company also mortgaged a number of land use rights and assets attached to the land that have been formed and will be formed in the future, belonging to a part of the project, to secure loans and guarantees from Bank A.

VCR’s short-term payables include more than VND 60 billion in customer contributions for land purchase in areas B2 and B3 of the project and more than VND 39 billion in customer payments for housing purchase in the twin/terraced villa area A3.

VCR also has a loan of nearly VND 400 billion from VCG for the project. In early July this year, the two parties extended the loan for 120 days.

In addition, VCR borrowed from Bank A last year to invest in the project, including a loan to refinance the company’s loan from Bank B. The credit limits of the loans were VND 1.5 trillion and VND 2.8 trillion, respectively.

In 2025, VCR is expected to achieve total revenue of nearly VND 1.8 trillion, while the figure reached last year was only VND 3 billion. The projected pre-tax profit is a record VND 569 billion, expected to end the streak of losses since 2017. The company’s management expects a revival in the vacation property market, especially with the synchronous investment in the infrastructure of Hai Phong city and Cat Ba island.

Project progress at the beginning of this year

|

Thu Minh

– 09:00 04/09/2025

The Greenback Inches Up

“During the week of August 25-29, 2025, the US dollar staged a mild recovery in the international market following the release of US Commerce Department data. The data revealed a 2.9% year-over-year increase in the core Personal Consumption Expenditures (PCE) price index for July, the highest since February 2025.”

“A Soaring Stock: Surging Over 70%, Nears All-Time High as Leadership Assures, “Not Selling Means Not Losing””

“At the 2025 Annual General Meeting held in late May, the CEO addressed the stock price fluctuations, offering insights into the company’s performance and future prospects.”

“Technical Analysis for the Session Ahead: On the Cusp of History”

The VN-Index has been on a remarkable growth trajectory, inching closer to its historical peak. With a high probability of breaching the old peak zone of 1,680-1,693 points, the index is poised for a potential breakthrough. Meanwhile, the HNX-Index has also been on an upward trend, forming a Big White Candle pattern, indicating strong buying pressure and potential for further gains.