“Echoing Silicon Valley of 60 years ago”

Vietnamese engineers, who have worked at major semiconductor companies abroad, are now bringing their expertise home.

A group of experts with experience at global firms, including Soitec, a French semiconductor materials manufacturer; Synopsys; TSMC; and Samsung, are joining a tech company called VSAP Lab. The company is investing in a $72 million advanced semiconductor packaging laboratory in the coastal city of Da Nang. The lab is designed to produce 10 million units annually. It will also offer advanced semiconductor packaging and testing services.

“This will be the first laboratory in Vietnam where Vietnamese own the technology,” said Le Hoang Phuc, director of the Danang Center for Semiconductors and Artificial Intelligence.

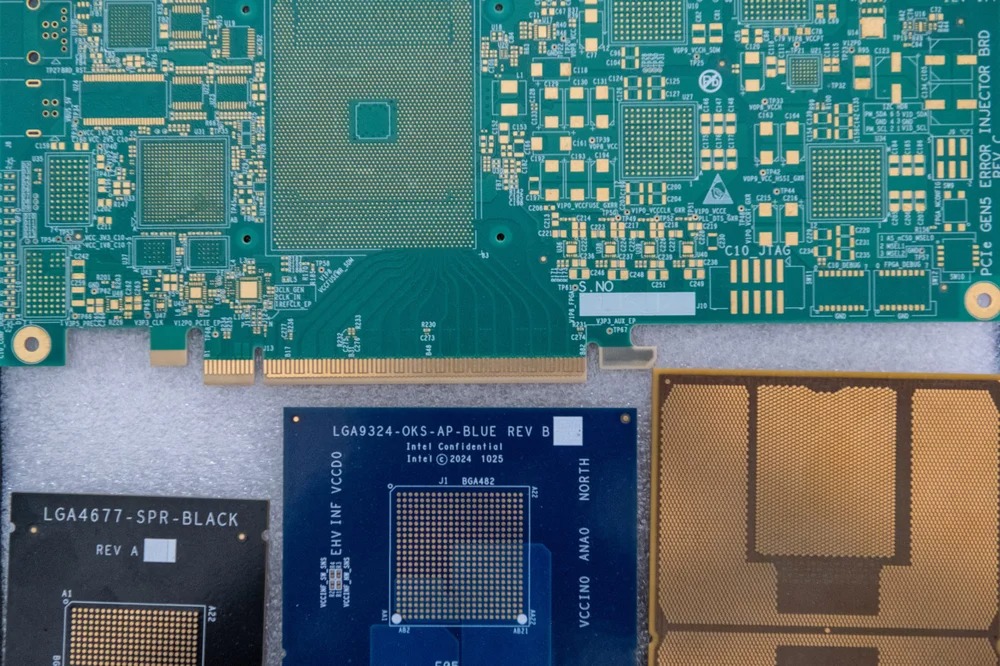

Photo: Rest of World

Vietnam is undergoing significant administrative reforms, placing technology, research and development, and the private sector at the heart of its new growth strategy.

In June, Vietnam announced its first free trade zone in the coastal city of Da Nang, which has become an attractive tech hub with 23 chip design companies. In 2023, this number was only nine. This free trade zone aims to attract foreign investment to build high-tech manufacturing and logistics industries.

Outside the Fab-9 factory, Vietnam’s ambition to become a high-tech manufacturing hub is growing stronger with government and foreign support.

Other provinces are also emerging as critical nodes for the country’s chip manufacturing aspirations. Vietnam Wafer is expanding and repurposing a sand processing plant in Quang Tri province to produce ultra-pure quartz for wafers.

Hanoi-based FPT – Vietnam’s largest private tech company – and CT Semiconductor in Ho Chi Minh City are simultaneously building the first Vietnamese-owned assembly, testing, and packaging facilities.

Viettel Group is pursuing a similar goal as part of a broader state-led effort to reposition Vietnam as a high-tech manufacturing hub rather than a low-cost assembly and testing site.

This news excites Bert Arucan, chairman of Fab-9, a circuit board manufacturer for chips at a facility in Ho Chi Minh City. “It’s like the Silicon Valley of about 55 to 60 years ago,” he said.

A significant opportunity to enter the semiconductor supply chain

Vietnamese companies manufacturing chip components, such as circuit boards and wafers, have seen a surge in demand as customers placed orders ahead of Trump’s tariffs and Washington increased pressure to reduce reliance on Chinese products.

Bert Arucan, Chairman of Fab-9, a circuit board manufacturer for chips at a facility in Ho Chi Minh City. Photo: Rest of World

Fab-9, a circuit board manufacturer for chips based in Ho Chi Minh City, witnessed a 20% increase in orders after Trump threatened to impose 145% tariffs on China in April, according to its chairman, Bert Arucan.

“We’ve been very busy,” Arucan said in a May meeting. Fab-9 is now expanding into a second building to install new equipment and scale up production to meet the growing demand.

“This is a significant opportunity for us to enter the [semiconductor] supply chain,” said Le Hoang Phuc, director of the Danang Center for Semiconductors and Artificial Intelligence, a state-managed organization promoting Vietnam’s chip and AI manufacturing capabilities.

“In the long run, this is necessary because we need to own the supply chain. We can’t just import components for assembly,” he added.

Vietnam is already home to factories of several major chipmakers, including Intel, Amkor, Onsemi, and Hana Micron. Last September, Vietnam unveiled its National Semiconductor Strategy, aiming to establish a domestic manufacturing base, 100 chip design firms, and ten packaging plants by 2030.

The World Sells 1 Trillion Chips a Year: What’s in It for Vietnam?

The global semiconductor industry took 66 years to reach the $500 billion mark, but it needed just nine more to sprint to the $1 trillion milestone. Meanwhile, foreign-invested enterprises dominate the chip design and packaging industry in Vietnam, leaving us with near-zero ownership of chip products.

Spending More Than the US and South Korea Combined: China’s Buying Spree of a ‘Game-Changing’ Commodity in the Semiconductor Industry

In a bid to bolster its domestic chip supply chain, China is estimated to have spent a whopping $25 billion in the first half of 2024. This substantial investment underscores the country’s commitment to fostering self-reliance in the semiconductor industry and reducing its dependence on foreign suppliers.

The “Triple Threat” That’s Transforming West-North Danang

The northwestern region of Da Nang city is undergoing a spectacular transformation in terms of infrastructure development. This area, designated as the new growth hub, is attracting major projects that are having a significant impact on the economy of not just Da Nang but the entire Central region of Vietnam.