National Securities JSC (NS9) was fined a total of VND 897.5 million for various violations in securities activities.

The company was fined VND 125 million for violating regulations on receiving and executing customer trading orders. On May 28, 2024, and January 23, 2025, the company failed to record the time of receiving customer trading orders at the time of order receipt. On December 18, 2023, June 19, 2024, December 31, 2024, April 9, 2025, and April 22, 2025, the company allowed some customers to place buy orders without sufficient funds in their accounts.

NSI was also fined VND 112.5 million for allowing customers to trade on margin beyond their buying power. Additionally, the company was fined VND 175 million for transferring money between customer accounts and the company’s account without the investor’s request.

Specifically, on May 31, 2024, September 25, 2024, and March 26, 2025, the company made transactions to transfer money between the dedicated account for managing customer securities trading funds and the company’s payment account without the investor’s request.

NSI was fined for allowing customers to trade on margin beyond their account buying power. Illustrative image.

Another violation by NSI was lending money to customers in violation of regulations through deposit contracts for the purchase of securities, forward contracts for the sale of shares, etc. The company was fined VND 175 million for this violation. The company was also fined VND 85 million for failing to disclose the resolution of the Board of Directors (BOD) on borrowing and purchasing corporate bonds.

Notably, the company was fined VND 225 million because the dossier and private offering plan of Encapital Financial Technology Joint Stock Company (code ECFCH2425001) advised by the company did not fully meet the prescribed content.

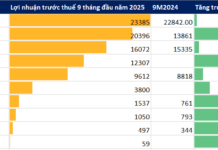

Established in 2006, NSI increased its charter capital to VND 1,000 billion in 2021. In 2024, NSI recorded operating revenue of nearly VND 321 billion and after-tax profit of over VND 80 billion. Compared to other enterprises in the industry, NSI’s revenue and profit are still modest.

Another enterprise recently fined by the SSC is Thai Nguyen Refractory Materials Group Joint Stock Company, with a total fine of VND 100 million, for violating information disclosure regulations.

Specifically, the company was fined VND 85 million for failing to disclose on the SSC’s information system a series of mandatory reports and documents, including: reports on the corporate governance situation from 2022 to the first half of 2025, audited financial statements for the years 2022-2024, annual reports for the years 2022-2024, and minutes and resolutions of the annual general meeting of shareholders (AGM) for the years 2023-2025.

In addition, the company was fined VND 15 million for not having a website, violating the regulations on means and forms of information disclosure.

Vietnam Boiler Joint Stock Company was also fined VND 100 million for violating information disclosure regulations.

According to the decision, the company was fined VND 85 million for failing to disclose on the SSC’s system many mandatory documents, including: minutes and resolutions of the AGM for the years 2023-2025, semi-annual and annual corporate governance reports for the years 2023-2025, and annual reports for the years 2023-2024. In addition, the company also disclosed late many documents such as invitations and materials of the AGM for the years 2023-2025, resolutions of the AGM in 2023 and 2024, and audited financial statements for the years 2023-2024. The company was also fined VND 15 million because the website did not meet the requirements, as it did not fully publish periodic and unscheduled information and did not display the time of posting.

Besides enterprises, there are also individuals who were fined for violations in the securities market. Accordingly, Mr. Le Huu Toan, Deputy General Director of Tin Viet Joint Stock Finance Company (code TIN), was fined VND 87.5 million. The reason is that Mr. Toan bought 609,237 TIN shares (corresponding to more than VND 6 billion in par value) on April 16, 2025, but did not report on the expected transaction as prescribed.

The SEC Penalizes Company for Turning Losses into Profits

The State Securities Commission (SSC) has taken a tough stance on companies that fail to disclose information accurately. In a recent announcement, the regulator revealed penalties for several businesses, including one that reported a loss as profit and another with significant profit discrepancies post-audit.

The Stock Market Violators: Businesses Face the Music

The State Securities Commission has announced a series of fines for various corporate violations, including failure to register securities transactions, misleading disclosures, and providing unauthorized services. The penalties for these infractions amount to hundreds of millions of dong.