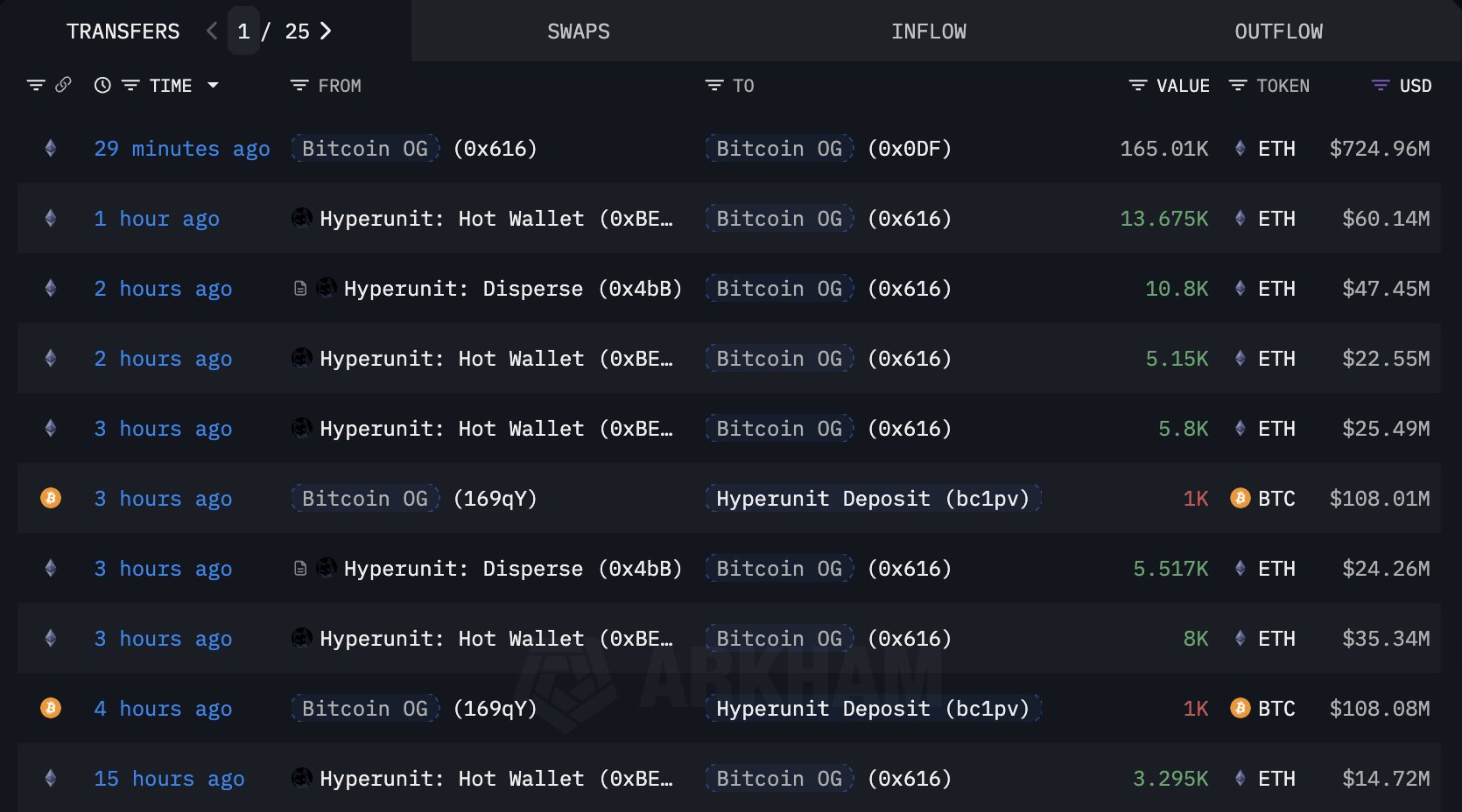

Recent analytics from on-chain analysis firm Lookonchain have spotted a Bitcoin whale making a significant transaction on September 1st, 2025.

Within a four-hour window, this whale wallet performed a ‘capital rotation’ by selling 2,000 Bitcoins (BTC), worth approximately $220 million, and using the proceeds to purchase 48,942 Ethereum (ETH).

The day before, on August 31st, the same whale wallet sold 4,000 BTC to buy 96,859 ETH (around $433 million). In total, this wallet has accumulated 886,371 ETH, valued at roughly $3.9 billion at current market prices.

These two transactions are the latest moves by this whale since August 2025, ending a seven-year hiatus from trading. According to a previous report by Arkham Intelligence, this whale once held over $5 billion in Bitcoin and purchased $2.5 billion worth of Ethereum in just one week.

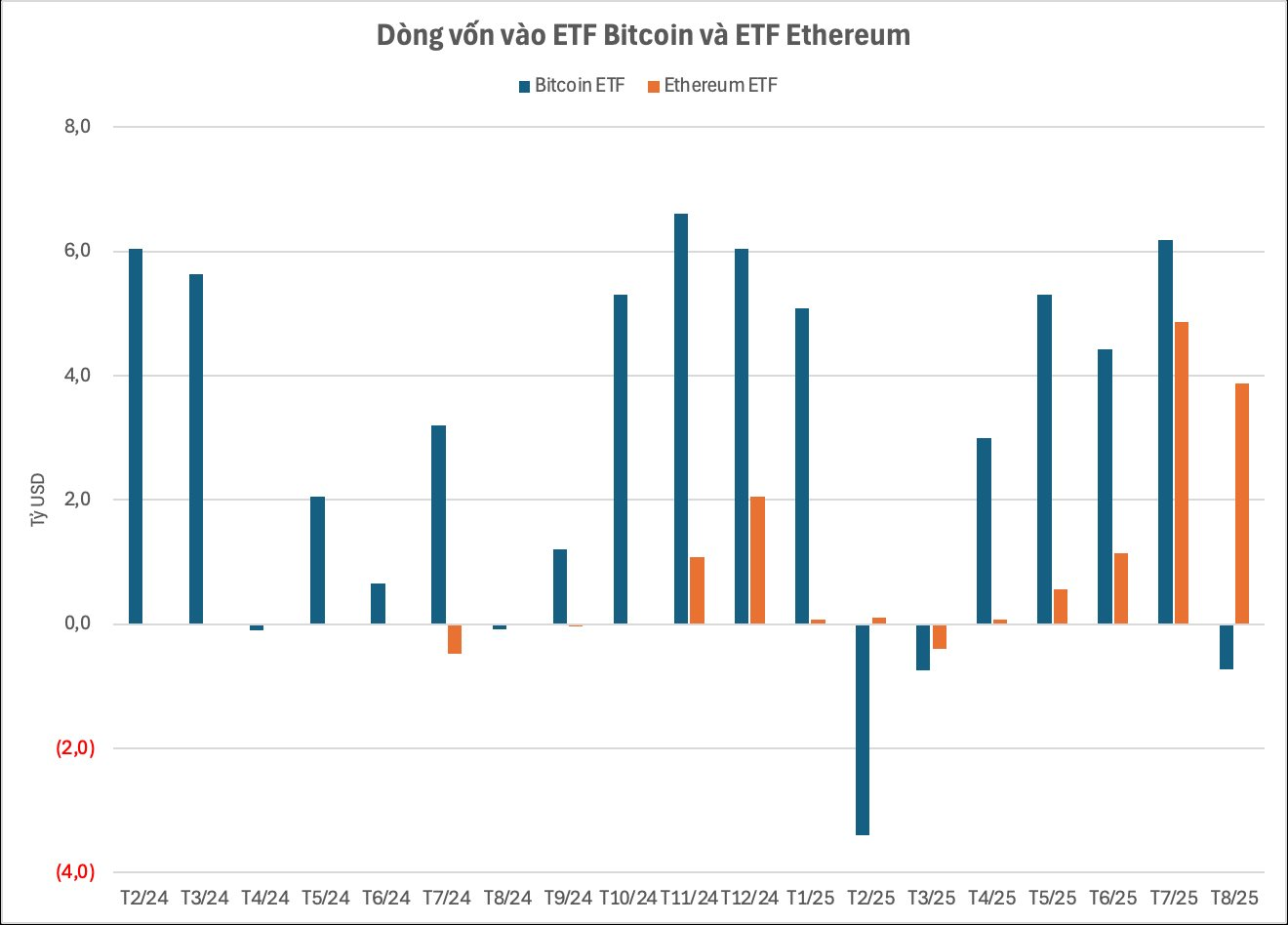

Interestingly, this whale’s capital rotation from BTC to ETH aligns with a similar trend observed in exchange-traded funds (ETFs), where capital is flowing from Bitcoin ETFs to Ethereum ETFs.

Ethereum ETFs have been attracting strong capital inflows. In August alone, these funds saw nearly $3.9 billion in net inflows, while Bitcoin ETFs experienced outflows of over $736 million.

The growing interest in Ethereum is attributed to its potential applications in smart contracts, decentralized finance (DeFi), and NFTs. Additionally, several filings for ETFs tracking altcoins such as Solana, Cardano, and XRP have been submitted to regulatory authorities in the US.

Compared to direct investment, ETFs offer investors cost optimization and significantly lower risks. Instead of managing digital wallets themselves or incurring discrete transaction fees, investors can participate indirectly through fund certificates that are custodied, secured, and operated by large financial institutions with clear regulations.

In Vietnam, a significant step forward was taken with the enactment of the Law on Digital Technology Industry, which introduced the concept of “digital assets” into the legal framework for the first time. This lays the foundation for the potential development of modern investment products, enhancing capital transparency while offering investors a legitimate, low-cost, and better-risk-managed investment channel.

“The Ethereum Foundation Plans to Sell 10,000 ETH in September”

On the flip side, Yunfeng Financial Group, an organization with ties to billionaire Jack Ma, has just announced the purchase of 10,000 ETH on the open market.

Vietnam’s Foundation for High-Income Aspirations: Targeting 2045

The past 80 years of Vietnam’s development is a testament to its visionary, resilient, and progressive nature. The nation’s achievements during this period have laid a robust foundation, propelling Vietnam confidently towards its ambitious goals of high income, green growth, and inclusivity by 2045.

The Rise of Vietnam’s New Industrial Powerhouse: 52 Industrial Parks and Counting

This locality was formed through the merger of two previous municipalities. The history of this place is a fascinating tale of two communities coming together, blending their unique cultures and identities to create a vibrant and diverse locale. It is a testament to the power of unity and a shining example of how, when we join forces, we can forge a stronger, more resilient future.