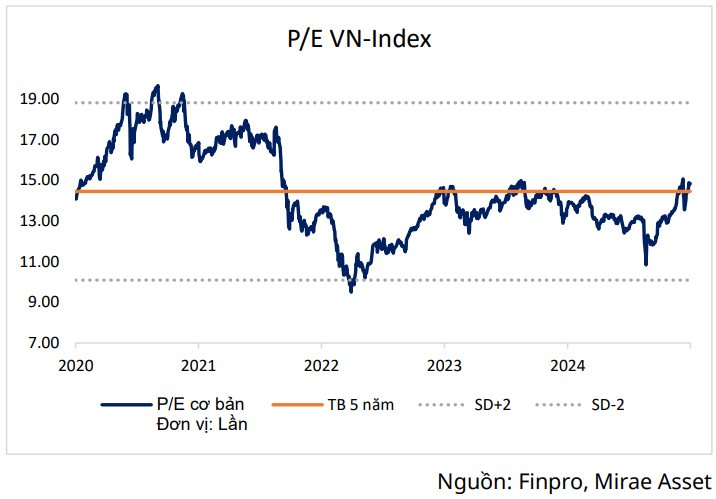

In a recent report, Mirae Asset Securities indicated that the P/E VN-Index is currently at 14.8 times, equivalent to the five-year average. Meanwhile, the business performance of many enterprises has started to improve, especially in sectors benefiting from economic growth and public investment.

“The combination of reasonable valuation levels and positive profit prospects in 2025 indicates that the VN-Index still has an attractive valuation range, thereby facilitating the attraction of additional investment capital in the context of improving macro environment and liquidity,” MASVN stated.

According to Mirae Asset, a key investment metric that assesses risk-adjusted performance is the Sharpe Ratio. This ratio calculates the difference between the expected return of a portfolio and the risk-free interest rate, divided by the standard deviation of returns. A positive Sharpe Ratio (>0) is desirable, indicating efficient performance, while a negative ratio may suggest excessive risk.

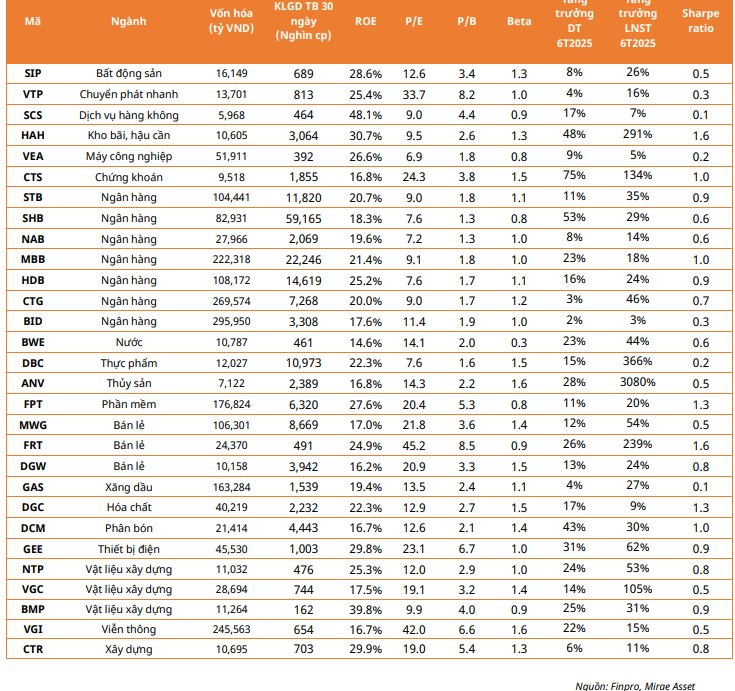

The following investment portfolio by MASVN is based on the Sharpe Ratio filter, a critical criterion for measuring the efficiency of returns relative to risk. Additionally, the portfolio incorporates the 2025 six-month business results, focusing on enterprises with solid financial foundations and sustainable growth prospects.

The selected stocks meet criteria such as a market capitalization of over VND 5,000 billion and an average trading volume higher than 100,000 shares, ensuring liquidity.

In terms of risk management, the portfolio’s Sharpe Ratio must be positive, reflecting a favorable profit generation ability relative to the risk undertaken. The Return on Equity (ROE) of the stocks in the portfolio surpasses that of the VN-Index, demonstrating superior profitability and efficient business operations.

Simultaneously, the revenue and profits of the enterprises in the first six months of 2025 must exhibit positive growth, ensuring stability and robust financial health.

Below is a list of the 29 stocks included in the MASVN portfolio:

Through this screening process, Mirae Asset’s analysis team observed that the banking sector continues to play a pivotal role in the portfolio due to its ability to maintain stable price growth. With their large capitalization and high liquidity, this sector is expected to directly benefit from accommodative monetary policies and economic stimulus packages, thus reinforcing their market-leading position in the second half of 2025.

The portfolio also focuses on sectors that benefit from domestic stimulus measures, including retail, software, utilities, chemicals, food, construction, and building materials. These sectors are supported by the recovery of domestic consumption, digitalization trends, and large-scale public investment projects promoted by the government.

Notably, the construction and building materials sector is anticipated to accelerate in the latter half of the year, driven by expedited progress in project deliveries and disbursements, providing a growth impetus for the industry. In parallel, the securities sector also stands out due to the prospects of market upgrade, which the government is vigorously pursuing, creating an incentive to attract domestic and foreign capital.

What’s in Store for the Stock Market Post the 2nd of September Holidays?

The stock market closed off an impressive August rally, with the VN-Index soaring past 1,680 points and consecutive record-breaking liquidity. Experts believe that several variables, such as expectations of a Federal Reserve rate cut in September, exchange rate dynamics, and the potential for an FTSE upgrade for the Vietnamese stock market, will keep investor sentiment buoyant post the September 2nd holiday.