The Vietnamese stock market unexpectedly accelerated during the afternoon session on September 4th. The strong momentum from the VN30 group of stocks propelled the VN-Index to yet another record high. At the close, the VN-Index gained nearly 15 points to reach the 1,696.29 mark. The matching value on HoSE reached approximately VND 37,500 billion.

In this context, foreign investors also slowed down their net selling. Today, foreign investors net sold about VND 819 billion in the entire market, as follows:

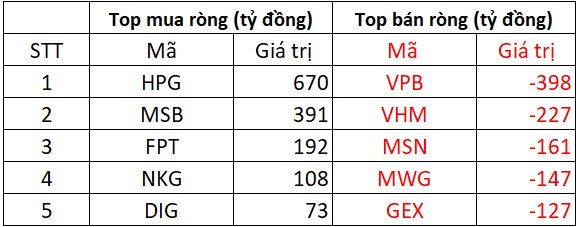

On HoSE, foreign investors net sold about VND 752 billion

In the buying side, HPG shares were net bought by foreign investors again with a value of up to VND 670 billion. MSB shares also received strong net buying of VND 391 billion today. In addition, FPT, NKG, and DIG were also net bought from VND 73 billion to VND 192 billion.

In contrast, VPB shares witnessed the strongest net selling by foreign investors with a value of VND 398 billion. Other blue-chip stocks that were also net sold in the range of VND 100-200 billion include VHM, MSN, MWG, and GEX.

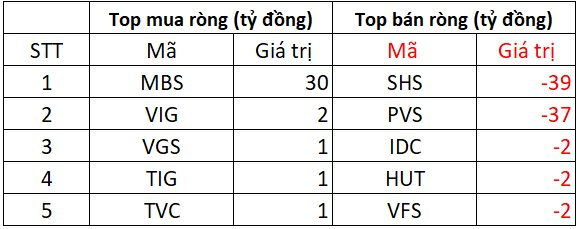

On HNX, foreign investors net sold about VND 40 billion

MBS shares were the most net bought with a value of VND 40 billion; VIG, VGS, TIG, and TVC followed suit with a net buying value of about VND 1 billion each.

On the opposite side, SHS and PVS shares were net sold for VND 39 billion and VND 37 billion, respectively. Foreign investors also net sold VND 2 billion in IDC, HUT, and VFS shares.

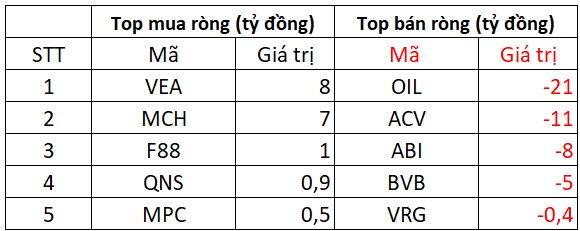

On UPCOM, foreign investors net sold nearly VND 28 billion

In terms of net buying, VEA and MCH were the two most net bought stocks with values ranging from VND 7-8 billion. Following them, F88, QNS, and MPC were net bought in the range of a few hundred million to VND 1 billion.

Conversely, OIL shares experienced net selling of VND 21 billion, while ACV, ABI, and BVB were also net sold with values ranging from VND 5-11 billion.

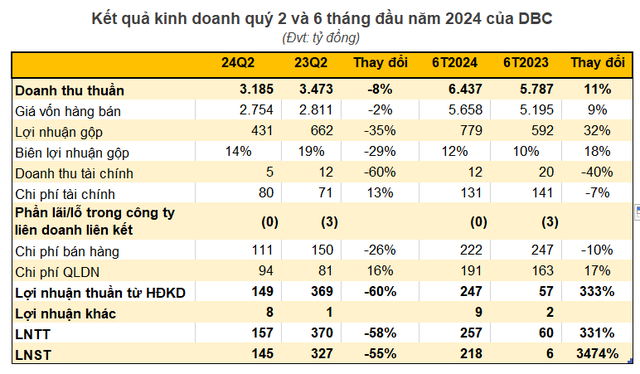

A Company at Risk of Delisting from HoSE Despite an Eightfold Increase in Profit for the First Half of 2025

The Ho Chi Minh Stock Exchange (HoSE) has issued a warning to the Company regarding the potential risk of delisting its stock (SRF) if the audited financial statements for 2025 receive a qualified audit opinion. This cautionary note highlights the importance of timely and accurate financial reporting to maintain the confidence of investors and comply with the exchange’s listing requirements.

The Stock Market Race: VN-Index Breaks Barriers, Shaping the Future

Will the VN-Index continue its record-breaking streak for the rest of the year? Could the prospect of an upgrade be the main catalyst for the market’s breakthrough in the coming period? Find out as our panel of experts discuss these topics and more on Vietstock LIVE #20, broadcasting online at 3 PM on Friday, September 5th, 2025.