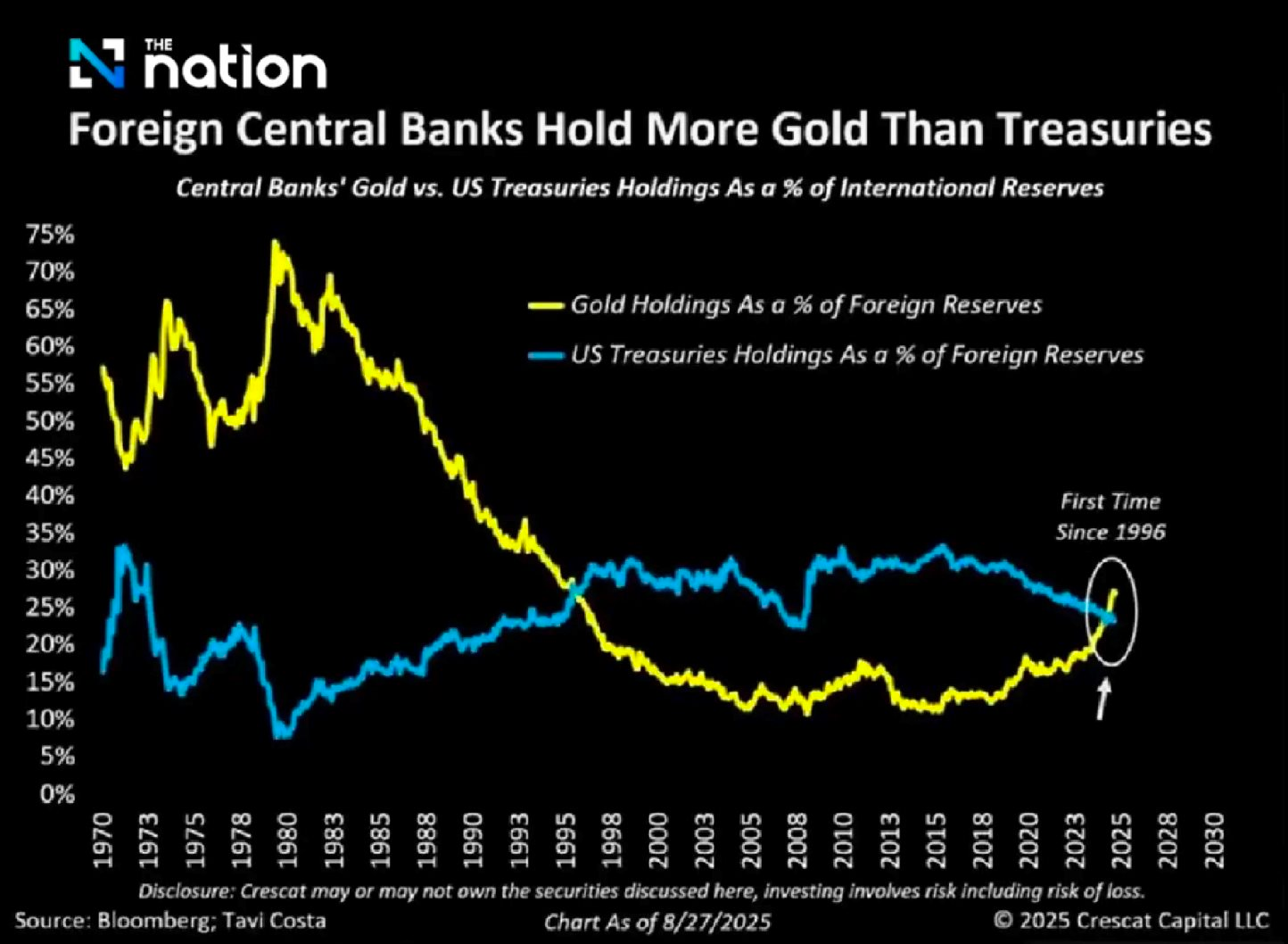

According to an analysis by Charles-Henry Monchau, Chief Investment Officer (CIO) at Swiss asset management firm Syz Group, global central banks are now holding more gold reserves than US Treasury bonds for the first time since 1996. This significant shift, described as a “global rebalancing,” occurs amidst rising geopolitical and trade tensions.

Figures from the World Gold Council (WGC) show that as of May 2025, global official gold reserves stood at 36,344 tons. Fueled by the surge in gold bar prices to over $3,500/ounce this year, the estimated value of these reserves is approximately $4.5 trillion.

In contrast, the US Treasury’s June 2024 survey estimated foreign holdings of US Treasury bonds at $3.8 trillion. This marks the first time since 1996 that gold has surpassed US Treasury bonds in central bank reserves.

After years of modest growth, central banks have accelerated their gold purchases significantly. According to the WGC, they bought 1,082 tons in 2022, 1,037 tons in 2023, and a record 1,180 tons in 2024, more than double the annual average of the previous decade.

In 2025, the pace of gold purchases slowed down but remained high, with 244 tons bought in Q1 and 166 tons in Q2. London-based consulting firm Metals Focus still expects net gold purchases to reach around 1,000 tons this year.

The WGC’s 2025 survey revealed that 43% of central banks plan to add more gold to their reserves in the coming year, and 95% anticipate a further increase in global gold holdings.

Analysts attribute this primarily to the weakening role of the US dollar as the primary reserve currency. Record-high US public debt, coupled with geopolitical instability and concerns about the global economic outlook, have driven countries to turn to gold as a “safe haven.”

The International Monetary Fund (IMF) acknowledges that while the US dollar maintains its dominance, its influence is waning over time. In this context, gold is increasingly viewed as a reliable alternative.

The Greenback Hits a New High: Official Exchange Rate Surpasses 26,500 VND

The US dollar is on a roll, with the exchange rate reaching new heights on August 20, 2025. The official exchange rate hit a record high, with the selling price reaching a staggering VND 26,500 per USD at banks across the country. This unprecedented surge has the market buzzing, as the Vietnamese currency feels the heat from the mighty dollar.

The Golden Opportunity: Unveiling the Latest Trends in the Precious Metal Market

The gold price remained stagnant this morning, following yesterday’s decline, while global prices continued to plummet.