Gold Prices Reach New Heights

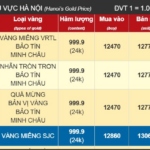

Gold bar and ring prices have been on a steady rise since the beginning of August, with a significant surge in the past two weeks. Gold prices are reaching new peaks daily.

After the 2nd of September holiday, Ms. Khanh Chi from Tu Liem, Hanoi, wanted to buy five gold rings as a longevity gift for her relatives. However, despite visiting a gold shop on Tran Nhan Tong street, she was unable to purchase any rings. “Some shops said they were sold out, while others said I would have to wait for 10-15 days to receive the gold,” Ms. Chi said.

At Bao Tin Minh Chau jewelry store, staff announced they had run out of gold since 10:30 am and were unsure when new stock would arrive. Similarly, Saigon Jewelry Company and several other gold shops on Tran Nhan Tong street also reported a shortage of gold bars and rings.

Gold shops run out of stock as selling prices continue to peak. Illustrative image: Nam Giang.

Bao Tin Manh Hai, another gold shop on Tran Nhan Tong street, was also sold out. However, they offered customers the option to place orders at the current price and receive the gold after ten days. With this arrangement, customers would need to make full payment for the gold in advance, and the shop would provide a receipt for them to collect the gold later.

Gold Price Movement is Unpredictable

In a conversation with Tien Phong newspaper, Lawyer Truong Thanh Duc, Director of ANVI Law Firm and VIAC Arbitrator, shared that gold prices are a variable and challenging to predict. Apart from being influenced by government policies, gold prices are highly internationalized and closely linked to global political and economic fluctuations. Therefore, while there may be downward pressure, the extent of the gold price gap with the world market needs to be carefully monitored and assessed over time.

The lawyer also suggested that, given the current context, gold investors should make flexible decisions based on their goals, whether it be asset accumulation or profit-oriented investment, rather than adhering to perspectives formed in the previous period.

The out-of-stock situation is prevalent across most gold businesses. Illustrative image: Nam Giang.

Regarding Decree 232, which will take effect on October 10th, abolishing the monopoly on gold bars, Lawyer Duc stated that this does not mean a complete liberalization of the market but rather a cautious opening. The reason is that the State Bank still tightly controls gold bar production and bullion import. Specifically, companies intending to produce gold bars must have a minimum charter capital of VND 1,000 billion, no unrectified administrative violations, and established internal production and quality control processes.

Commercial banks interested in producing gold bars must have a minimum charter capital of VND 50,000 billion, along with similar conditions. More importantly, these are necessary conditions, and sufficient conditions include obtaining a license for trading gold bars.

Similarly, for the import of gold materials and the export and import of gold bars, the State Bank will grant annual quotas and licenses for each transaction to enterprises and commercial banks. Thus, the scale of the “open door” policy is quite limited. This does not consider the annual quotas and individual transaction licenses, which imply a “measured” approach to the amount of gold allowed in the market.

“Previously, the State Bank decided on the exact number of gold bars to be produced, but now a few companies will make that decision themselves. However, the State Bank remains in control of the total gold bar output by managing the import of raw materials and the final production and stamping of gold bars,” Lawyer Duc said, adding that many banks meet the conditions but have no interest in trading gold.

Evidently, the government’s controlled relaxation of the gold market in Decree 232/2025 is a reasonable step, given the strong preference for gold among Vietnamese people.

With cheap money, if gold production, import, export, and trading were unrestricted, it could lead to a rush among individuals and businesses to buy and sell gold, potentially destabilizing the economy.

“Decree 24 is crucial for maintaining macroeconomic stability. Therefore, Decree 232, while amending certain points of the previous decree, still inherits the spirit of strict management of the gold market in general and gold bars in particular. This approach is necessary, and we cannot immediately liberalize the market just because the context has changed. In the future, when the macroeconomic foundation is solid, the value of the domestic currency is strong, and people no longer favor gold, there is no reason not to liberalize the market gradually,” Lawyer Duc concluded.

The Golden Monopoly is Over: Will Prices Ever Drop?

According to experts, the elimination of the gold bullion monopoly will not lead to an immediate decrease in gold prices in the short term. There will be a certain lag time before any significant changes are observed.

The Golden Opportunity: From Gold to the New Investment Craze

The long queues outside gold shops in Ho Chi Minh City have led to a creative shift in investment strategies. With only a limited amount of gold being purchased, often just a fraction of what people desire, the focus has now turned to silver. This new investment avenue offers a distinct advantage with its affordable pricing and abundant supply.

Today, September 2, Gold Ring Prices Soar by VND 2 Million, While Gold Bars Remain Unchanged.

The precious metal witnessed a significant surge this morning, with gold jewelry prices at various businesses skyrocketing by up to 2 million VND per tael.