In its recently published report, foreign fund PYN Elite Fund noted an impressive investment performance in August, reaching 12.3% – slightly higher than the VN-Index’s gain, despite a 2.6% appreciation of the EUR against the VND. This result was driven by strong performances in banking (+20%) and securities (+19%) stocks, the two sectors comprising a large portion of the fund’s portfolio.

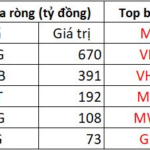

PYN Elite Fund is currently one of the largest foreign funds in the Vietnamese stock market, managing a portfolio of over EUR 1 billion (more than VND 30,000 billion) as of the end of August. The fund has a preference for financial stocks, with 4 banking codes (STB, MBB, VIB, OCB) and 3 securities codes (VIX, SHS, VCI) in its top 10 holdings.

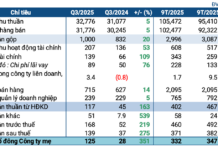

According to PYN Eilte Fund, August witnessed robust growth for banks. Investors turned optimistic as Q2 results indicated improved asset quality and robust lending processes, signaling the beginning of a multi-year credit expansion cycle alongside strong GDP growth.

Regarding STB, the largest holding in the portfolio, the fund noted that the bank started the year as one of the top three best-performing banks, driven by expectations surrounding the VAMC auction and potential ownership changes. However, in the past two months, the performance gap relative to its peers has narrowed as investors await the actual restructuring process.

PYN Eilte Fund highlighted two recent developments regarding STB: (1) The bank received the entire VND 6,300 billion from the sale of mortgaged assets of the Phong Phu Industrial Park in August, much earlier than initially planned; and (2) The State Bank is expected to soon approve the sale of stakes. While the bank’s current P/B is in line with peers, the anticipated equity increase is expected to make its 2027E valuation very attractive.

In addition to banks, PYN Eilte Fund also benefited from the retailer MWG, which announced solid Q2 results and plans for an MW IPO for its ICT & CE retail business. The fund brought MWG back into its top 10 holdings in March and has since increased its ownership. As of the end of August, MWG was the fund’s fourth-largest investment, accounting for 7.4% of its portfolio.

On the macroeconomic front, the government has launched a large-scale infrastructure and housing development plan to upgrade strategic infrastructure and reduce dependence on exports. This plan encompasses 250 projects with a total investment of USD 48 billion, equivalent to 10% of GDP. The government will contribute 37% of the capital, while private and foreign investors will finance the remaining 63%.

The Stock Market Race: VN-Index Breaks Barriers, Shaping the Future

Will the VN-Index continue its record-breaking streak for the rest of the year? Could the prospect of an upgrade be the main catalyst for the market’s breakthrough in the coming period? Find out as our panel of experts discuss these topics and more on Vietstock LIVE #20, broadcasting online at 3 PM on Friday, September 5th, 2025.