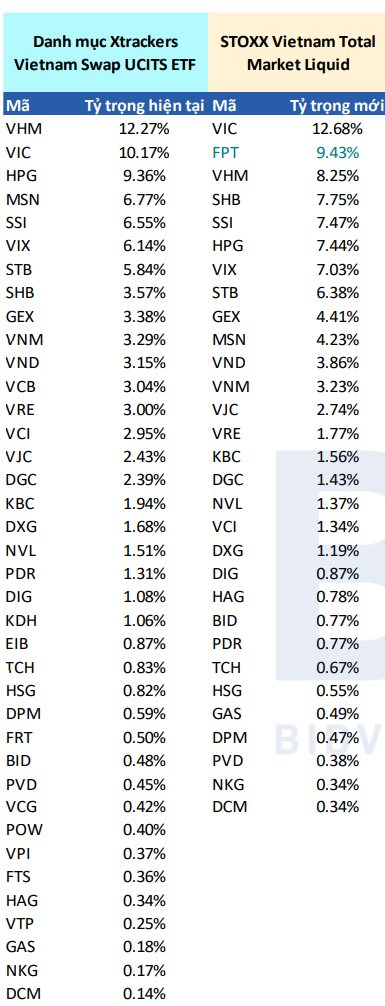

The upcoming quarterly restructuring of foreign ETFs in Q3 2025, taking place in September, features a notable change: the FTSE Vietnam ETF will be renamed from Xtrackers FTSE Vietnam Swap UCITS ETF to Xtrackers Vietnam Swap UCITS ETF, and its base index will change from FTSE Vietnam to STOXX Vietnam Total Market Liquid.

As announced by DWS, this change aims to improve liquidity compared to the previous index. The transition phase, starting from July 17, 2025, to October 16, 2025, is important to note. During this period, the fund’s investment portfolio may undergo a partial transition with swap transactions on both the current and new indexes.

The STOXX Vietnam Total Market Liquid is a stock index designed to measure the performance of highly liquid stocks in the Vietnamese stock market. Developed and managed by STOXX Ltd., this index is reviewed biannually in March and September.

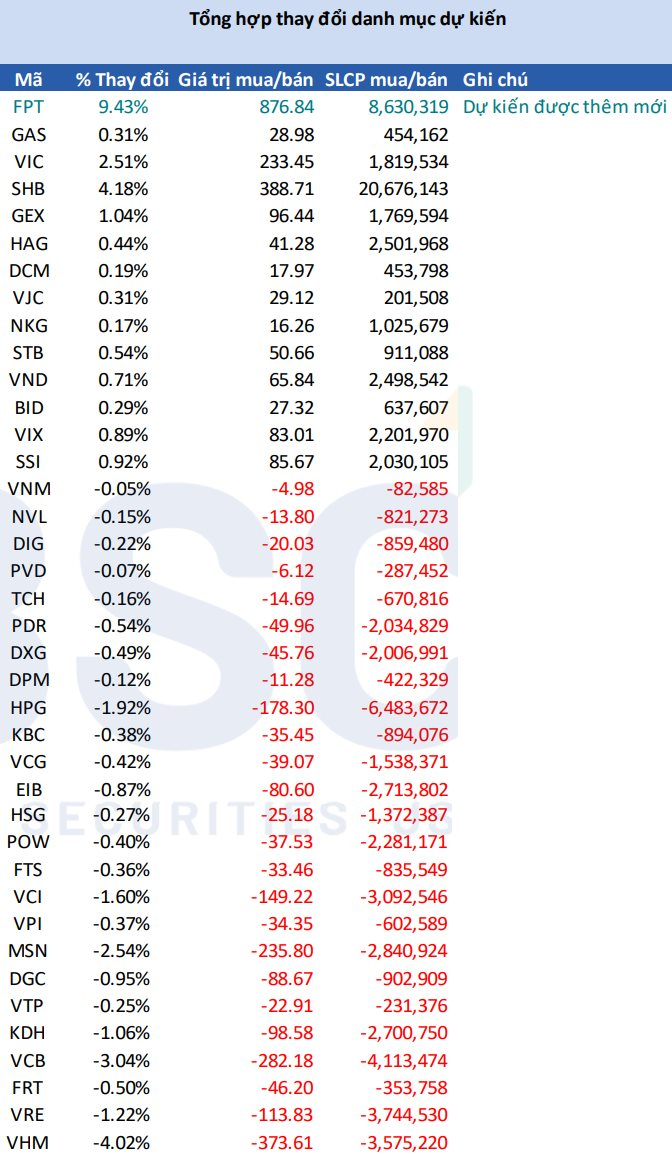

As of September 2, the scale of this ETF reached approximately VND 7,300 billion. Based on data from August 29, 2025, BSC Securities, in its latest report, predicted changes in the portfolio of the Xtrackers Vietnam Swap UCITS ETF for the upcoming restructuring period. Specifically, FPT technology stocks are expected to be added to the STOXX Vietnam Total Market Liquid with a weight of 9.43%. This translates to over 8.6 million FPT shares that the foreign ETF may purchase.

Other codes that may see significant accumulation include SHB (20 million units), HAG (2.5 million units), and VND (2.4 million units). In contrast, the Xtrackers Vietnam Swap UCITS ETF may sell HPG (6.4 million units), VCB (4.1 million units), and VRE (3.7 million units), among others.

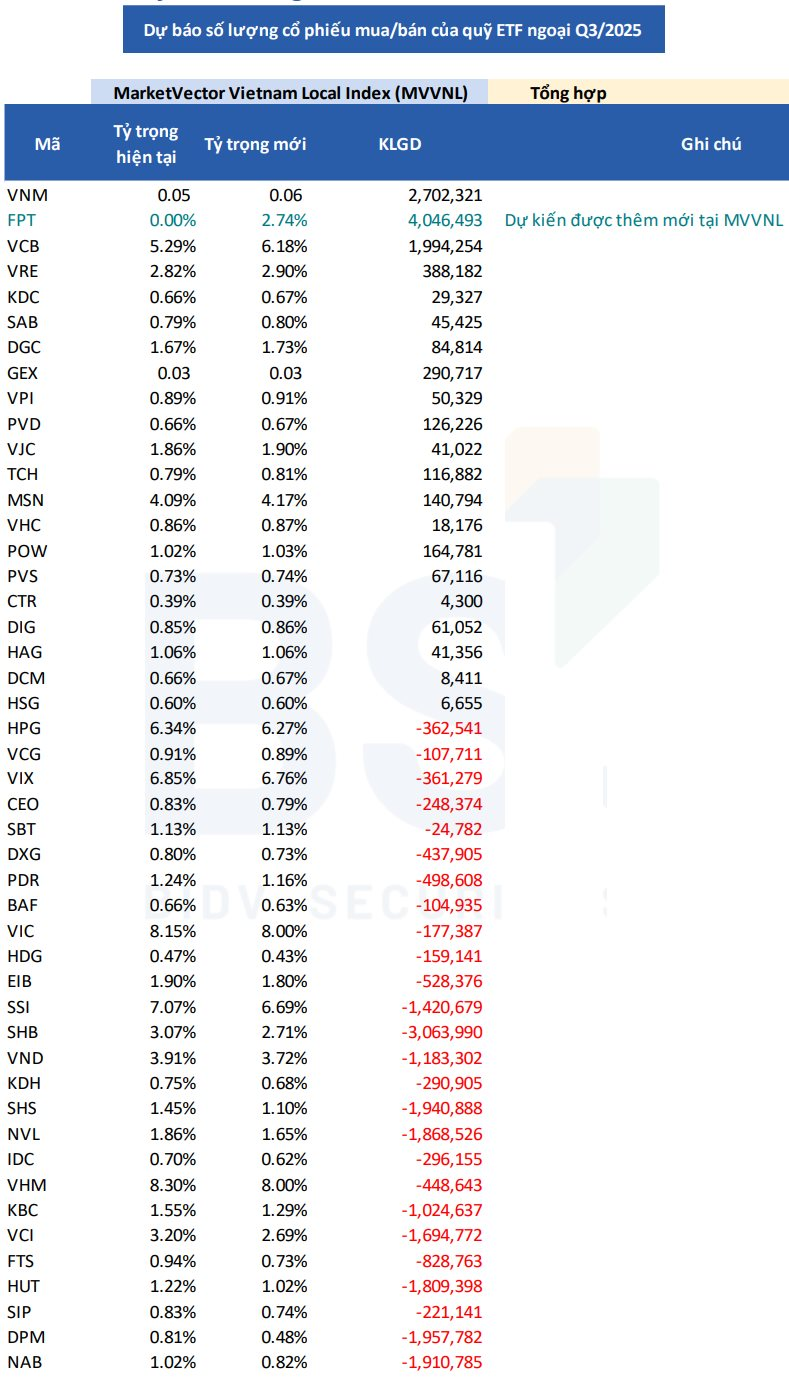

On September 12, 2025, MarketVector will announce the MarketVector Vietnam Local Index, the reference basket for the VanEck Vectors Vietnam ETF (VNM ETF). September 19 is expected to be the day for the completion of the full restructuring of the ETF portfolio referencing this index. BSC predicts that FPT stocks will be added, while no codes will be removed.

As of September 2, this ETF’s scale reached approximately VND 15,600 billion. The fund may purchase an additional 4 million FPT shares to add to its portfolio, along with potentially increasing the weight of codes such as VNM, VCB, and VRE.

In reality, FPT shares have been in an “overseas room” for the longest period in many years. As of September 3, 2025, FPT had an overseas room of 196 million units, equivalent to over 11%. This is seen as an opportunity for foreign ETFs to include FPT in their portfolios, which was previously impossible due to foreign ownership regulations.

The Master Wordsmith: Crafting Captivating Copy that Elevates Your Web Presence

Unveiling the Art of Asset Recovery: How Mr. Truong Gia Binh Retrieved a Whopping $700 Million

FPT’s stock has plummeted by over 31% since the start of the year. This sharp decline has investors concerned about the future prospects of this once-promising company. With such a significant drop, it’s clear that FPT is facing challenges that are impacting its performance and worrying shareholders. The question now is: what steps will FPT take to address this downward trend and reassure its investors?

Vietstock Daily: Summit Showdown

The VN-Index pared its gains towards the end of the trading session on August 27th, forming a Long Upper Shadow candle. This indicates that profit-taking pressures remain robust at the previous peak of 1,680-1,693 points. Additionally, with the Stochastic Oscillator indicator continuing to weaken after issuing a sell signal, it suggests that the index is likely to encounter further volatility in the upcoming sessions.

What Stocks Will the Two Foreign ETFs Sell Off in the Q3 Review?

According to forecasts by Yuanta Securities Vietnam (YSVN), the FTSE and VNM ETFs are expected to actively purchase FPT and SHB stocks while offloading HPG, SSI, and VND stocks during their third-quarter 2025 review.