Key Infrastructure Developments in Southern Ho Chi Minh City

After a vibrant trading period in the East, the real estate market is shifting towards the south of Ho Chi Minh City, offering more affordable prices and benefiting from several large-scale infrastructure projects.

First and foremost, the Ben Luc – Long Thanh Expressway, expected to be fully operational by 2026, will connect the Southwest region, Ho Chi Minh City, and Long Thanh Airport. With a length of 57km, this route will reduce travel time and boost real estate development along the corridor. Approximately 30km is already in use, including a 21km section connecting the Mekong Delta with the Hiep Phuoc port cluster, easing traffic congestion in the city center. Construction is currently underway to meet the deadline for full operation in Q3 2026.

Additionally, the Ho Chi Minh City Ring Road 4, with a total length of 207km and an investment of over VND 120,000 billion, is accelerating. The route passes through five provinces, with Long An (now Tay Ninh) accounting for 40% of its length and is expected to be completed by 2028.

Once operational, Ring Road 4 will reduce travel time from the Southwest to the center of Ho Chi Minh City by 30-40%, encouraging population and investment flow to satellite cities.

Other key projects, such as Ring Road 3, the expanded Ho Chi Minh City – Trung Luong Highway, National Highway 50, Nguyen Huu Tho Street, DT826D, and DT830, are also being implemented simultaneously.

This infrastructure network not only improves inter-regional connectivity but also provides long-term leverage for the real estate market in the south of Ho Chi Minh City.

The “Front-Running” Infrastructure Mindset

Since Q2 2025, investors have been seeking opportunities in potential neighboring markets. The “front-running” mindset, anticipating price increases due to upcoming infrastructure developments, has driven investment capital back into the real estate market in the south of Ho Chi Minh City.

In this area, prices are still relatively low. Land plots in Can Giuoc and Duc Hoa (Tay Ninh) are priced around VND 30-40 million per square meter. These areas offer clean legal titles, well-developed internal infrastructure, proximity to key infrastructure projects, and match the preferences of most investors.

For instance, The 826 EC, a red-book land plot project developed by Hai Thanh in Can Giuoc, has attracted strong market interest following recent sales launches. Strategically located just 15 minutes from Phu My Hung, the project sits on the front lines of two vital roads: the extended Le Van Luong and Long Hau (40m) streets. This area is envisioned to become a key industrial and urban hub in the southern gateway of Ho Chi Minh City, offering convenient connections to Hiep Phuoc Port, Metro 4, Ring Road 4, and Long Thanh International Airport via the Ben Luc – Long Thanh Expressway, along with several large urban areas.

A red-book land plot project at the intersection of the extended Le Van Luong and Long Hau streets.

In addition to its administrative advantages, the project offers flexible financial policies: a 20% down payment to sign the sale and purchase agreement, bank financing for 70% of the value over 30 years, interest rate sponsorship for 15 months, and a 24-month grace period for principal repayment. Quick-payment customers enjoy a discount of up to 5%, while wholesale buyers receive an additional 2% discount, optimizing profits from the start.

In the same region, projects like Saigon Village and Saigon RiverPark have also witnessed positive demand in the secondary market. Their prices have increased by 5-6 times compared to the initial launch, underscoring their potential for value appreciation.

A New Destination for Investment Capital

At a recent seminar, Ms. Duong Thuy Dung, Executive Director of CBRE Vietnam, shared that real estate 20-30km away from Ho Chi Minh City’s center is half the price, offering a competitive advantage. According to Ms. Dung, this price difference has encouraged a trend of capital shifting to neighboring areas that benefit from ongoing infrastructure and ring road developments while offering significant growth potential.

Analyzing market data, CBRE asserts that the demand for housing in Ho Chi Minh City remains robust, but limited supply and high prices have restrained buyers. Consequently, many investors and homebuyers are turning to satellite cities, which offer abundant land resources, improving connectivity, and more affordable options.

CBRE also highlights Long An, which is experiencing high immigration rates, ample land supply, reasonable costs, and proximity to Ho Chi Minh City. These factors, combined with the entry of prominent developers like Vingroup, EcoPark, and T&T Group, are creating a dual impetus for Long An’s long-term market growth. As infrastructure improves and housing demand increases, property prices in the area are expected to rise in line with supply and demand dynamics.

Sharing this view, Mr. Dinh Minh Tuan, Director of Batdongsan.com.vn, believes that Long An will become a new destination for investment capital due to its competitive prices and developing infrastructure. According to Mr. Tuan, Ho Chi Minh City’s real estate market has witnessed a noticeable shift from the city center to peripheral areas, with nearly 2,400 new projects expanding the urban space to Ring Road 4 during 2016-2025.

“Property prices will surge when key infrastructure projects are completed in 2025-2026, especially for well-located projects with excellent connectivity, thoughtful planning, and synchronized infrastructure along Ring Roads 3 and 4,” emphasized Mr. Tuan.

Unlocking New Opportunities for Investors: The Transformative Impact of Key Infrastructure Developments in Southern Ho Chi Minh City

According to Ms. Duong Thuy Dung, Executive Director of CBRE Vietnam, investors have recognized the irrationality of real estate prices in the center of Ho Chi Minh City and are strongly shifting their focus to the neighboring areas. These peripheral regions benefit directly from existing and upcoming infrastructure and belt roads, offering significant growth potential.

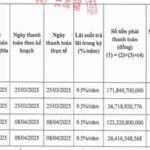

“A Hefty Payment of 360 Billion VND: How Much Debt Does Tien Phuoc Group Still Hold?”

In the first half of 2025, Tien Phuoc Group made significant strides in its financial endeavors by allocating approximately VND 360 billion towards settling principal and interest payments for two bond issuances from 2021. With this substantial repayment, the group has successfully eliminated its bond debt, marking a pivotal moment in their financial journey.

The Latest Directive: Establishing a Fund for Relocation Housing and Land

The Department of Construction has been tasked by the Ho Chi Minh City People’s Committee to establish a fund for housing and land to serve resettlement purposes. This task is based on the needs for resettlement arrangement and the proposal to invest in the construction of resettlement areas by various units. A report on the implementation results must be submitted before October 15th.

“Quảng Ninh Takes Off: Primed to Become Northern Vietnam’s Premier Investment Destination”

The province of Quang Ninh is entering a breakthrough phase, fueled by the convergence of three powerful drivers. First, it attracts high-quality FDI inflows, showcasing its appeal to foreign investors. Second, its strategic infrastructure is now complete, boasting highways, sea ports, and airports that seamlessly connect it to the rest of the country and the world. But it’s the third driver that truly sets Quang Ninh apart: the emergence of modern coastal urban complexes. These complexes are crafting a new “runway” for growth, transforming the province into a leading investment hub in Northern Vietnam.