On August 29, Vingroup Joint Stock Company (code: VIC), owned by billionaire Pham Nhat Vuong, made an important announcement to bondholders.

Specifically, regarding the periodic disclosure of bond information as prescribed in Circular No. 76/2024/TT-BTC dated November 6, 2024, of the Ministry of Finance, guiding the regime of information disclosure and reporting under the Government’s Decree No. 153/2020/ND-CP dated December 31, 2020, on the offering and trading of corporate bonds in the domestic market and offering corporate bonds in the international market, Vingroup announces to bondholders the following reports:

(1) Financial statements;

(2) Audited (or reviewed) financial statements for the first six months of 2025;

(3) Report on bond principal and interest payment status;

(4) Report on the use of proceeds from bond issuances;

(5) Report on the fulfillment of commitments to bondholders.

According to Vingroup, bondholders who wish to examine these documents are requested to bring their identification documents and proof of bond ownership (such as investment account statements or bond balance confirmations issued within one working day from the date of the request to view the documents):

(1) Bondholders provided by Techcom Securities Joint Stock Company (“TCBS”) can visit TCBS’s head office at 27th floor, C5 D’Capitale building, 119 Tran Duy Hung street, Yen Hoa ward, Hanoi city, and TCBS will facilitate the bondholders’ access to the above documents.

(2) Bondholders provided by HD Securities Joint Stock Company (“HDS”) can visit HDS at 5th floor, 32 Tran Hung Dao street, Cua Nam ward, Hanoi city, and HDS will facilitate the bondholders’ access to the above documents.

(3) Bondholders provided by BIDV Securities Joint Stock Company (“BSC”) can visit BSC at 8th and 9th floors, Thai Holdings building, 210 Tran Quang Khai street, Hoan Kiem ward, Hanoi city, and BSC will facilitate the bondholders’ access to the above documents.

(4) Bondholders with codes VICD2227001, VICD2227002, and VICD2328001 will contact the bank representing the bondholders to access the above documents.

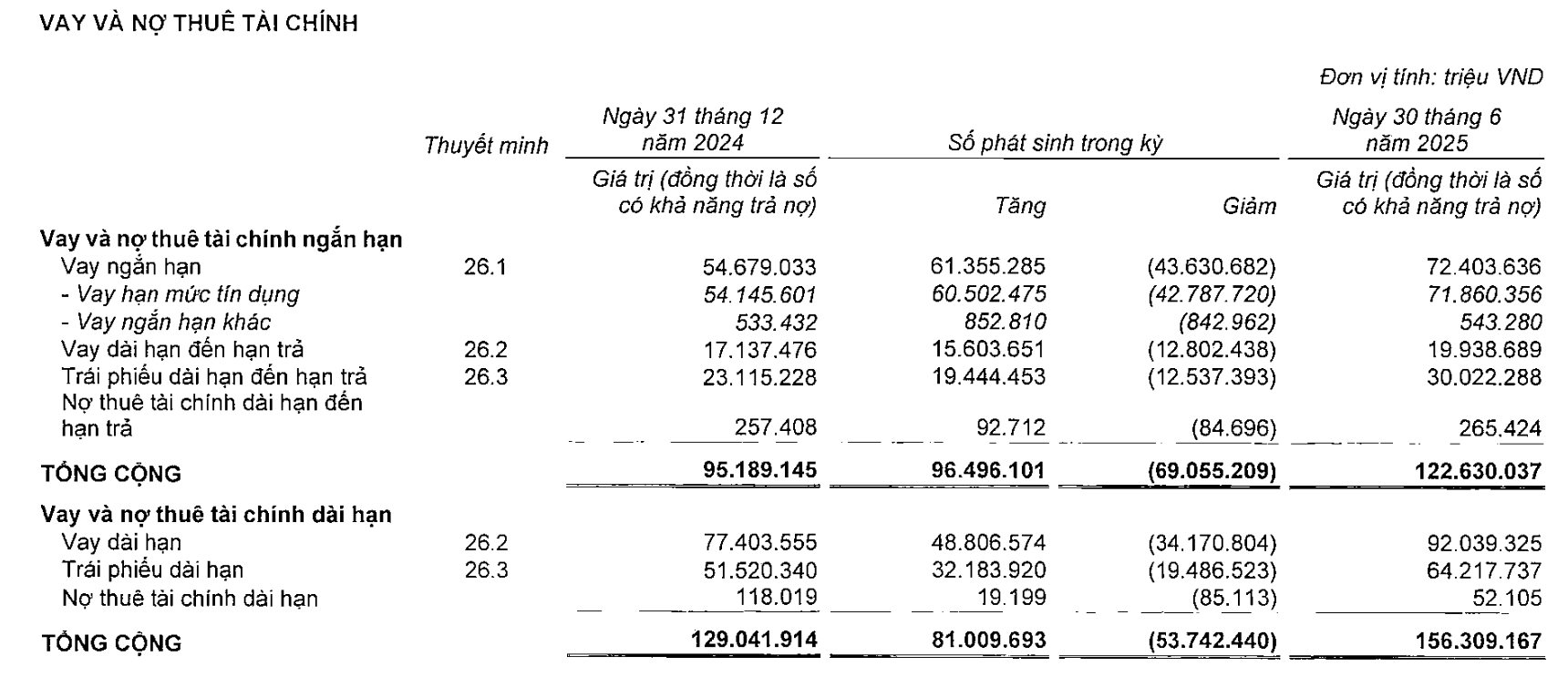

As recorded in the audited semi-annual financial statements for 2025, as of the end of the second quarter, Vingroup’s total financial borrowings amounted to approximately VND 280,000 billion, equivalent to 29% of total assets, and is considered a safe structure. Most of these loans are secured by assets, including inventory, tangible fixed assets, investment properties, and shares in some companies held by Vingroup. Among these, the bond debt stood at over VND 94,000 billion. This disclosure ensures transparency in the periodic disclosure of bond-related information.

In terms of business results, for the first six months of 2025, Vingroup recorded revenue of VND 130,476 billion, doubling that of the same period last year. After expenses, pre-tax profit reached VND 11,159 billion, up 69% year-on-year.

The Footsteps of Two ‘Armies’ Returning to Build Vietnam’s Economy: Forging the Foundation and Framework from the East, Completing the Vision from the West.

The power couple, Mr. and Mrs. Pham Nhat Vuong, alongside Nguyen Thi Phuong Thao, Ho Hung Anh, and Nguyen Dang Quang, are often hailed as the “heroes” of Eastern Europe. They returned to Vietnam, bringing with them a wealth of capital and an industrial operational mindset. These individuals have focused their efforts on the backbone industries of the economy, aiming to strengthen the country’s financial foundation.

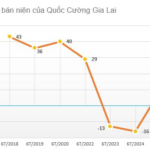

“Doubts Cast on Quoc Cuong Gia Lai’s Ability to Continue Operations by Auditors”

QCG’s short-term assets stand at VND 1,844 billion, while its short-term liabilities amount to a staggering VND 3,814 billion.