If you’re a new investor just stepping into the stock market, you may have come across terms like T+2 and T+0. Initially, these may seem confusing, but they are, in fact, basic concepts integral to daily trading activities.

Understanding T+2 and T+0 will not only help you grasp how the market operates but also prevent situations where you “have stocks but cannot sell them” or “have money in your account but cannot buy immediately.”

What is T+2?

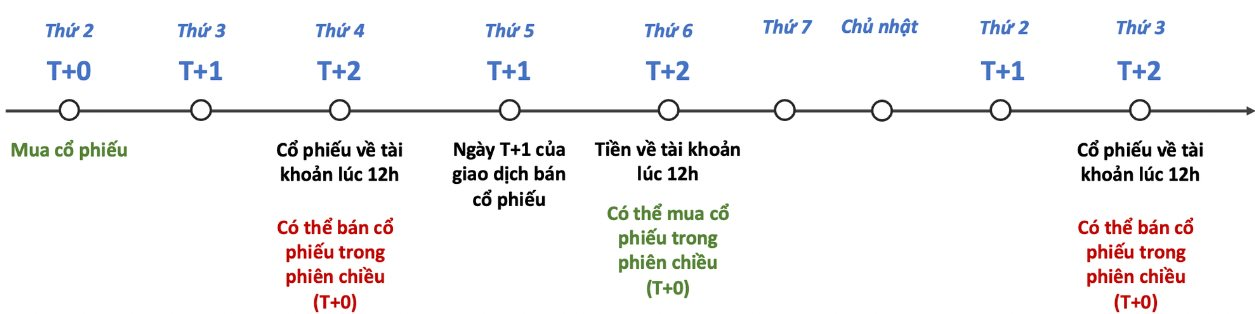

In Vietnam’s stock market, T+2 refers to the settlement time for trades. This means that after you place a buy or sell order and it gets executed, it takes two business days for the stocks or money to be credited to your account.

For instance, if you buy VNM stocks on Monday (T+0), even if the order is matched during the session, the stocks will only be officially transferred to your account by 12 PM on Wednesday (T+2), and you can sell them in the afternoon session of the same day. Conversely, if you sell stocks on Monday, the money will be credited to your account by Wednesday afternoon (T+2), and you can use it to buy more stocks or withdraw it.

The T+2 mechanism is in place to ensure the settlement and clearing process between securities companies and the Securities Depository Center. Simply put, it is the necessary time for “delivering goods and making payments” in a market with millions of transactions daily.

What is T+0?

Unlike T+2, the concept of T+0 is more often mentioned in the context of developing Vietnam’s stock market. T+0 means that investors can buy and sell the same stock on the same day. For example, if you buy HPG stocks in the morning and notice a price increase in the afternoon, you can sell them immediately.

In many developed stock markets, T+0 is standard, providing high flexibility and allowing investors to capitalize on short-term fluctuations. However, in Vietnam, T+0 is currently only applicable to derivative securities trading and not to the underlying stock market. The implementation of T+0 for underlying stocks is under research and gradual preparation.

How Does T+2 Affect Investors?

With the T+2 mechanism, Vietnamese investors must accept a delay in capital rotation. This directly affects the liquidity of their accounts. Many new investors are surprised to find that they cannot sell stocks immediately after purchasing them or use the proceeds from a sale to buy again on the same day.

The T+2 delay necessitates a more cautious trading strategy. For instance, if you anticipate a stock’s price to increase in a few days, T+2 may not significantly impact you. But if you’re a short-term trader, T+2 can be a hindrance. Moreover, during periods of high market volatility, having to wait until T+2 afternoon to rotate capital can make investors vulnerable, causing them to miss opportunities or face higher risks.

What Changes Would T+0 Bring if Implemented?

If the T+0 mechanism is introduced, investors will have more flexibility in buying and selling. If a stock’s price increases on the same day, you can immediately realize your profits without waiting for two days. This faster capital rotation enhances liquidity and attracts new investors.

However, T+0 also comes with risks. When buying and selling become too easy, it may fuel speculative trading, leading to increased market volatility. Inexperienced investors may get caught in a cycle of continuous buying and selling, resulting in quick losses. Therefore, implementing T+0 requires a robust trading infrastructure and a tight legal framework to manage risks.

In conclusion, while T+2 and T+0 may seem complicated, they are fundamental concepts that every investor should understand. Currently, the Vietnamese market operates on a T+2 settlement for underlying stocks, meaning you need to wait until the T+2 afternoon session for your money or stocks to be officially credited to your account. Meanwhile, T+0 is only applicable to derivatives, but if introduced for underlying stocks, it could bring about significant changes in both opportunities and risks.

For new investors, the most important thing is to understand the current rules, develop a trading strategy suited to the T+2 mechanism, and be prepared in terms of knowledge and mindset for a potential shift to T+0. Ultimately, whether it’s T+2 or T+0, success in the market relies on your discipline, clear strategy, and risk management skills.

“Why Are Many Investors Still Stranded Despite the Stock Market’s Consistent Rise?”

The VN-Index soared by almost 180 points in August, marking a remarkable rally. However, many investors are still licking their wounds, as they have not yet been able to recover from their losses.

Liquidity Dries Up Ahead of Holiday Season: Which Sectors Remain Attractive?

The week leading up to the long holiday witnessed a weakened cash flow. However, some sectors remained resilient and attracted cash inflows.