How Much is the Bond Debt of the Owner of the Vinh Dam Complex Project?

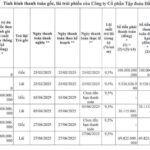

TTC Phu Quoc JSC (TTC Phu Quoc) has recently submitted a document to the Hanoi Stock Exchange (HNX) disclosing information on bond principal and interest payments.

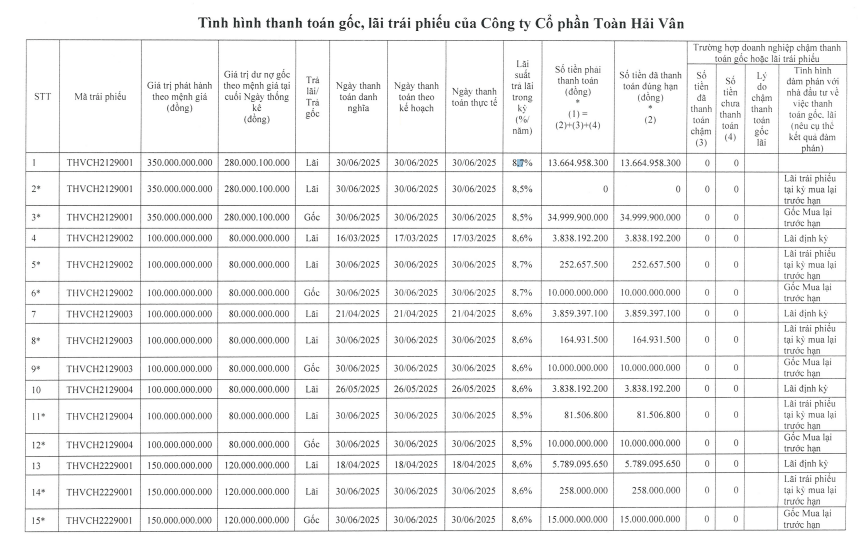

In the first half of 2025, Toan Hai Van repurchased a total of VND 80 billion in bond principal ahead of schedule, including nearly VND 35 billion in principal of THVCH2129001 bonds, VND 15 billion in principal of THVCH2229001 bonds, and VND 10 billion each in principal of THVCH2129002, THVCH2129003, and THVCH2129004 bonds.

During this period, the company also paid approximately VND 32 billion in interest on the above five bond lots.

As of June 30, 2025, the outstanding principal at par value of the THVCH2129001 bond lot was VND 280 billion, THVCH2229001 was VND 120 billion, and the remaining three lots had outstanding balances of VND 80 billion each.

Source: HNX

According to information on HNX, the above five bond lots were issued by TTC Phu Quoc in 2021 and 2022, with a total issuance value of VND 800 billion.

The bonds are expected to mature on June 30, 2029, with an interest rate of 9.5% per annum, and interest payable semi-annually.

These are non-convertible bonds, without warrants, guaranteed, and issued in the form of book-entry registration, and can be bought back or sold before maturity.

According to the issuance announcement on HNX, the source of repayment of principal and interest of the bonds when due will be guaranteed from project revenue

“Tourism and resort project of the Vinh Dam Complex project in Duong To commune, Phu Quoc city, Kien Giang province (now An Giang province). This project is invested by TTC Phu Quoc.”

The Vinh Dam Complex project has a total expected investment of VND 3,579 billion, and the products include a resort complex combining tourism, accommodation, and other services in Phu Quoc.

The Potential of the “Giant” Backing Toan Hai Van

Regarding TTC Phu Quoc, this enterprise was established on April 16, 2009, mainly operating in the field of real estate. Its head office address is located in Group 11, Suoi Lon Ward, Phu Quoc Special Zone, An Giang province.

According to a change registration in April 2025, the company’s owner’s equity was VND 2,265 billion.

Ms. Huynh Bich Ngoc (born in 1962) used to hold the position of Chairman of the Board of Directors and legal representative of TTC Phu Quoc. Later, this position was held by Mr. Nguyen Thanh Ngu (born in 1987)

TTC Phu Quoc is known to be a member of TTC Group, founded by businessman Dang Van Thanh. TTC Group was established in July 1979 and operates in multiple sectors through its member units, including Agriculture, Energy, Real Estate, Industrial Real Estate, Tourism, and Education.

Therefore, it is understandable that the Vinh Dam Complex project of TTC Phu Quoc bears a significant “imprint” of Saigon Thuong Tin Real Estate Joint Stock Company (TTC Land, ticker: SCR) – another enterprise in the TTC “ecosystem.”

Specifically, on December 24, 2024, TTC Land issued Resolution No. 32/2024/NQ-HĐQT on approving the policy of cooperating to invest in the A4-1 Resort and B1-9 Complex of the Vinh Dam Complex project with Toan Hai Van.

In detail, TTC Land issued VND 850 billion of private placement bonds with a term of 60 months to invest in these two sub-projects of the Vinh Dam Complex. These bonds are guaranteed, non-convertible, and without warrants. The interest rate for the first year is 8.5%, and the issuance term is 60 months.

In addition, TTC Land also approved the policy of signing an investment cooperation contract with Toan Hai Van, with a capital contribution value of VND 2,245 billion, a cooperation period of 5 years, and profit sharing based on the actual cooperation ratio of each party.

Selavia Project Perspective. Image: TTC Phu Quoc

Back to TTC Phu Quoc, in addition to the Vinh Dam Complex project, the enterprise is also the investor of the Selavia real estate resort complex project, with an area of about 290ha and a total project investment of about VND 30,000 billion, creating many subdivisions from resorts, shopping, entertainment…

“IPA Unveils a Whopping 209 Billion VND Payment for Bond Interest and Principal”

In the first half of 2025, IPA made principal and interest payments totaling over VND 209.4 billion for three bond lots.

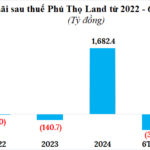

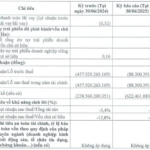

“Phú Thọ Land Plunges into $15 Million Loss in the First Half of 2025”

In a stark contrast to its remarkable performance in 2024, where it achieved a staggering profit of over VND 1,680 billion, Phu Tho Land JSC ended the first half of 2025 with a notable decline, posting a loss of nearly VND 394 billion in after-tax profit. This is a significant deviation from the previous year’s success, where the company recorded a profit of almost VND 60 billion in the same period.

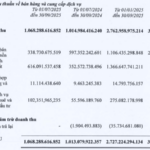

Home Credit Vietnam Records Over VND 1,160 Billion in Net Profit for H1 2025

As of the end of the first half of 2025, Home Credit Vietnam reported a net profit of over VND 1,166.6 billion, a significant surge of 146.1% compared to the same period last year. The company’s outstanding debt from bond issuances stood at VND 6,700 billion, marking an increase of 91.4%.