VN-Index Targets 1,838 Points by Year-End

In its latest strategic report for the remaining months of the year, Vietcombank Securities (VCBS) assesses that with the upward momentum of VN-Index in July and August, the overall index is now trading at a P/E of 14.9x.

The current P/E is attractive compared to the regional average (~15.3x) and the five-year average (~14.4x). Additionally, the low-interest rate environment and strong credit growth in the final quarter are expected to further boost market liquidity and elevate sector P/E valuations.

The VN-Index has reached a new high of 1,688 points on August 26, 2025, and is now approaching all-time highs.

With market upgrade expectations, aggressive growth policies, and flexible diplomatic strategies, VCBS anticipates the VN-Index to continue its upward trajectory towards the positive scenario of 1,838 points (with an updated market-wide EPS of 18%) in the last months of 2025.

However, VCBS acknowledges that the market will likely experience significant volatility during this upward journey, and there are notable risks, including the emergence of high inflation and potential changes in monetary policies, that could lead to a reversal in market trends.

Investment Strategy by Capitalization: Focusing on 5 Domestic-Oriented Sectors

Based on the aforementioned analysis, VCBS suggests that an investment strategy focused on large-cap stocks, particularly in domestically-oriented sectors such as Banking, Securities, Real Estate, Consumer Retail, and Construction, is suitable for the last quarter of 2025.

In the banking sector, analysts expect credit growth to accelerate, potentially surpassing the State Bank of Vietnam’s annual target, with estimates ranging from 18% to 20%. NIM is also projected to bottom out in Q2 and gradually recover in the second half, while non-performing loan ratios decline and bad debt recovery efforts improve.

For the securities industry, VCBS forecasts improved performance across all service segments, including robust brokerage revenue due to competitive transaction fees, increased margin lending, and a vibrant IB division fueled by an active IPO market within a positive stock market environment.

VCBS analysts also offer insights into the real estate sector, anticipating improved supply dynamics thanks to decisive legal solutions. Housing demand is expected to remain robust, supported by low-interest rates and various policy interventions.

Additionally, the consumer-retail sector, including food and beverage companies, is poised to benefit from preferential policies and a continued recovery in consumer demand. Notably, livestock companies are expected to maintain high pork prices.

In the construction sector, analysts view 2025 as the final year of the public investment cycle, which is considered one of the key drivers of high economic growth this year. The government is closely monitoring disbursement progress and enhancing accountability among relevant agencies.

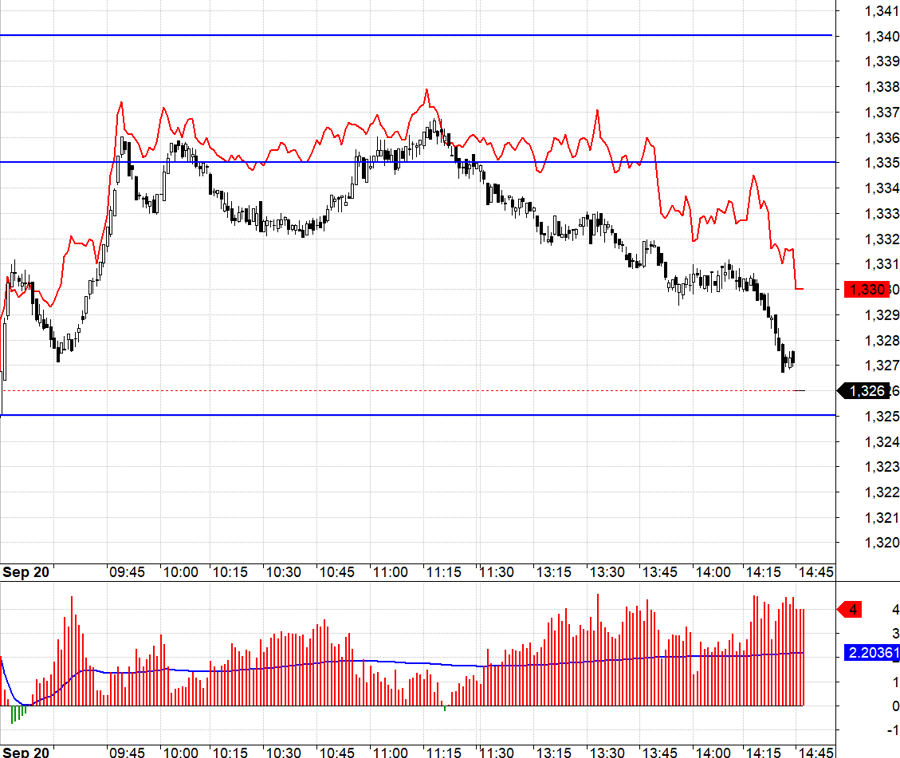

Market Beat: Ending the Tug-of-War with a Shocking Drop

The VN-Index took a sharp turn in the latter half of the morning session, plunging 13 points to break free from the tug-of-war stalemate that characterized the early trading hours.

Should Investors Be Concerned About the Record Outflow from the Block?

The VN-Index continued its upward trajectory in August, closing at 1,682.21 points and instilling a sense of optimism in the market. However, domestic investors are now questioning the motives of foreign investors, as they witnessed the largest net-selling month since the beginning of the year, with cumulative outflows surpassing VND 58.9 trillion.

“Market Winds of Change: Anticipating the Big Shift”

The VN-Index recovered towards the end of the trading session, forming a long lower shadow candle. This indicates that buyers stepped in during a period of correction, suggesting underlying strength in the index. However, to surpass the previous peak of 1,680-1,693 points achieved in August 2025, an improvement in trading volume is necessary in the upcoming sessions.