Introduction to the New Indexes: VN50 Growth and VNMITECH

On August 11, 2025, HOSE introduced the construction and management rules for two new indexes: the Vietnam Modern Industry and Technology Index (VNMITECH) and the Vietnam Growth 50 Index (VN50 Growth). These indexes will be reviewed periodically on the third Wednesday of January and July each year.

Performance of the projected VN50 Growth Index constituents as of August 22, 2025. Source: MBS Research

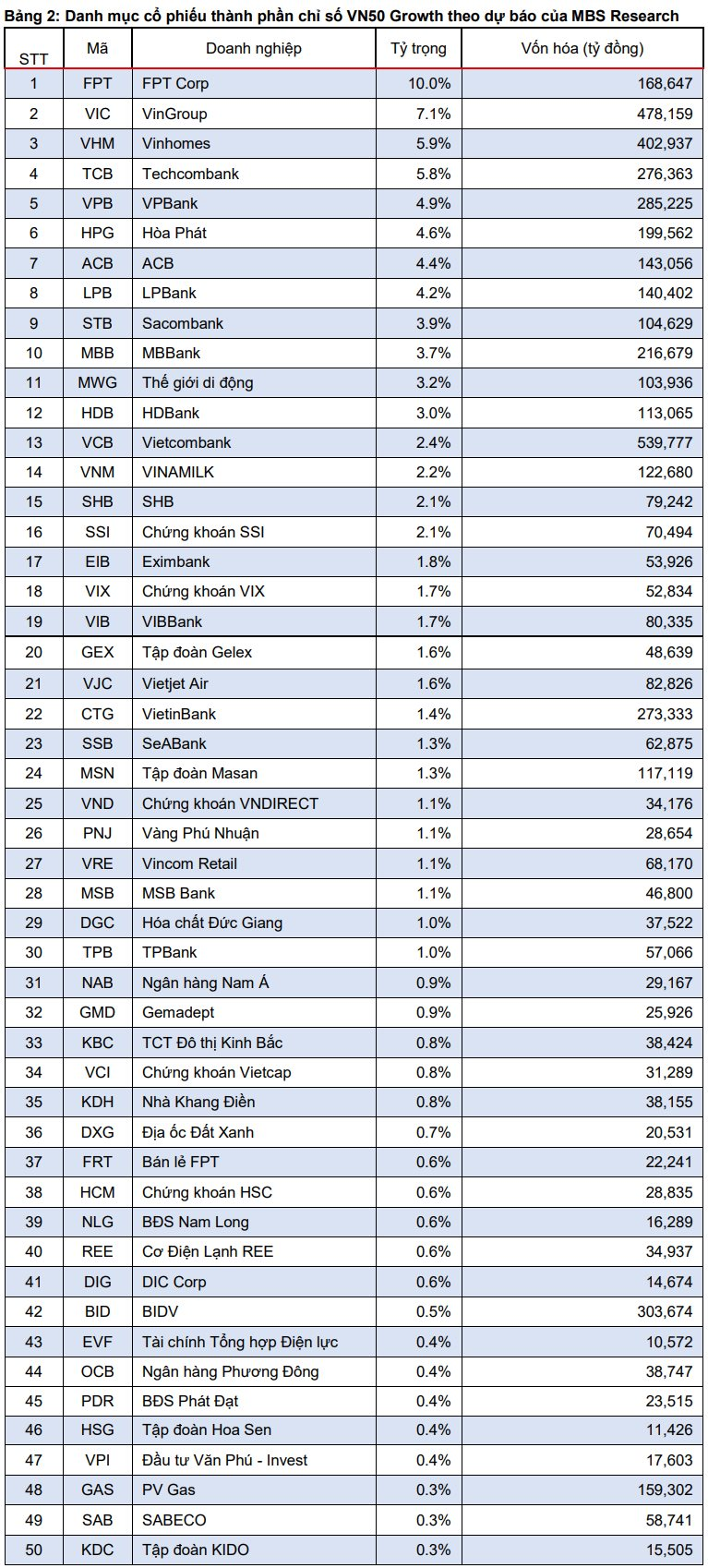

The VN50 Growth Index comprises 50 constituent stocks selected from the VNAllshare Index, meeting the following criteria: (1) a minimum free-float adjusted market capitalization of VND 2,000 billion, and (2) a minimum matching trading value of VND 20 billion/day. The 50 stocks with the largest market capitalization will be selected for the main basket, and the next 10 stocks will be on the reserve list. A capitalization limit of 10% is set for each stock and 40% for stocks in the same industry (GICS Level 1 sub-industry).

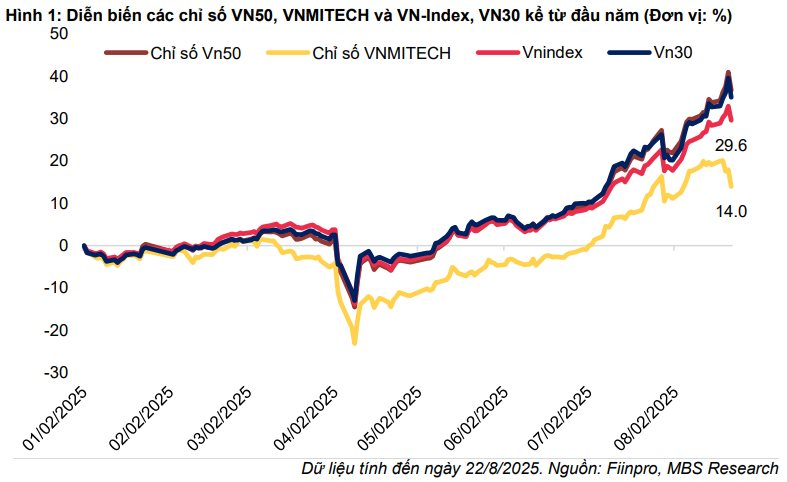

According to MBS’s latest report, based on estimates as of August 22, the top 5 stocks by market capitalization in the VN50 Growth Index are expected to be: FPT, VIC, VHM, TCB, and VPB, accounting for 33% of the index’s capitalization. The VN50 Growth Index has outperformed the VN-Index and VN30, rising nearly 37% since the beginning of the year compared to their respective gains of 29.6% and 31.1%.

Other stocks projected to be included in the VN50 Growth Index are HPG, ACB, LPB, MBB, MWG, STB, HDB, VCB, and VNM.

Data as of August 22, 2025. Source: MBS Research projections

The VNMITECH Index will include a minimum of 30 and a maximum of 50 constituent stocks selected from the VNAllshare Materials, VNAllshare Industrials, and VNAllshare Information Technology sector indexes, meeting specific screening criteria. Stocks must satisfy the following criteria in order of priority: a minimum free-float adjusted market capitalization of VND 1,500 billion and a minimum matching trading value of VND 20 billion/day. A capitalization limit of 15% is set for each stock and 25% for stocks selected from VNMAT, with no sector limits for stocks chosen from VNIND and VNIT.

MBS projects that the top 5 stocks by market capitalization in the VNMITECH Index will be: HPG, FPT, GEX, VJC, and GMD, accounting for 64% of the index’s capitalization. Other stocks expected to be included in the VNMITECH Index are REE, DIG, DGC, TCH, HSG, CII, DPM, and HDG.

The VNMITECH Index has grown by nearly 14% since the beginning of the year, outpacing the VN-Index and VN30, which rose by 29.6% and 31.1%, respectively.

Data as of August 22, 2025. Source: MBS Research projections

The Stock Exchange Reveals Attractive Investment Opportunities for the Year-End Rush.

Introducing our expert-crafted stock catalog, meticulously curated based on stringent criteria. We focus on capitalization and liquidity, ensuring smart investment choices. Moreover, the enterprises featured in our catalog exhibited positive revenue and profit growth in the first half of 2025, showcasing their resilience and potential.

Expert Insights: Market Rally Has Further to Run – Smart Stock Picks Needed for Investors to Stay Afloat.

“According to investment guru, Mr. Do Thanh Son, the investment narrative for the latter part of the year revolves around the fundamentals of individual businesses. With pricing no longer being the sole competitive advantage, the focus shifts to growth potential and intrinsic value.”

What’s in Store for the Stock Market Post the 2nd of September Holidays?

The stock market closed off an impressive August rally, with the VN-Index soaring past 1,680 points and consecutive record-breaking liquidity. Experts believe that several variables, such as expectations of a Federal Reserve rate cut in September, exchange rate dynamics, and the potential for an FTSE upgrade for the Vietnamese stock market, will keep investor sentiment buoyant post the September 2nd holiday.