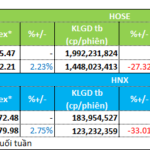

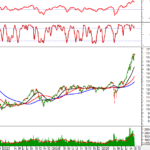

The Vietnamese stock market experienced a volatile last week of August. After a turbulent start to the week, the VN-Index staged an impressive recovery on Tuesday before returning to its previous peak. The index closed the last session of the month at around 1,682.2 points, a 2.23% increase from the previous Friday, thus marking the fourth consecutive week of gains in August.

According to Asean Securities, the market’s liquidity declined, indicating investors’ cautious sentiment ahead of the holiday period. Asean Securities maintains its view that the VN-Index will continue to experience short-term volatility, with near-term support at 1,650 – 1,665 and resistance at 1,690, as the market faces profit-taking pressure, especially from foreign investors.

For short-term traders, it is recommended to prioritize a holding strategy to optimize profit. This holding approach should focus on stocks that are attracting strong cash flow, maintaining a short-term upward trend, and belonging to leading sectors (such as Banking, Securities, and Real Estate, etc.).

For long-term buy-and-hold investors, Asean Securities suggests maintaining current positions, especially for stocks with low capital. Increasing allocation should be considered during the next dip for leading stocks with promising profit growth prospects in the 2025 – 2026 period.

Meanwhile, Mr. Do Thanh Son, Head of Investment Advisory at Mirae Asset Securities Vietnam, noted that while the VN-Index has risen over 50% from its bottom, a typical bull cycle usually lasts around 500 sessions, and the market has only completed half of its journey. Additionally, with corporate earnings for 2025 expected to increase by 15.6%, this rally appears to be underpinned by solid fundamentals rather than solely short-term speculative money.

As valuations are no longer extremely cheap but growth potential remains, Mirae Asset experts believe that the investment narrative for the latter part of the year will revolve around the fundamentals of individual companies. With the market only halfway through its typical bull cycle, lessons from 2021, coupled with 2025 year-end financial results and compelling individual stories, suggest that sector selection and investment strategies should be based on macroeconomic factors and unique company narratives.

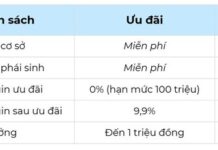

Experts highlight several sectors that could attract cash flow. Firstly, real estate stocks are expected to benefit from relaxed credit policies and improving legal frameworks.

Securities companies will also directly benefit from the market’s booming liquidity and potential for an upgrade in Vietnam’s status, presenting a positive outlook.

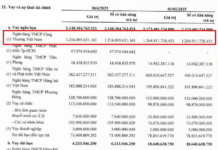

Mirae Asset analysts also favor the banking sector, particularly banks with high-quality assets and strong credit growth. Additionally, consumer and retail businesses are viewed positively as the economy recovers and consumer spending rebounds.

Notably, infrastructure investment companies have significant growth potential, given the government’s push to disburse nearly VND 1 quadrillion this year.

Market Beat: Ending the Tug-of-War with a Shocking Drop

The VN-Index took a sharp turn in the latter half of the morning session, plunging 13 points to break free from the tug-of-war stalemate that characterized the early trading hours.

Should Investors Be Concerned About the Record Outflow from the Block?

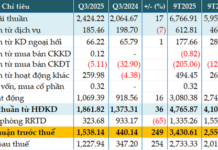

The VN-Index continued its upward trajectory in August, closing at 1,682.21 points and instilling a sense of optimism in the market. However, domestic investors are now questioning the motives of foreign investors, as they witnessed the largest net-selling month since the beginning of the year, with cumulative outflows surpassing VND 58.9 trillion.