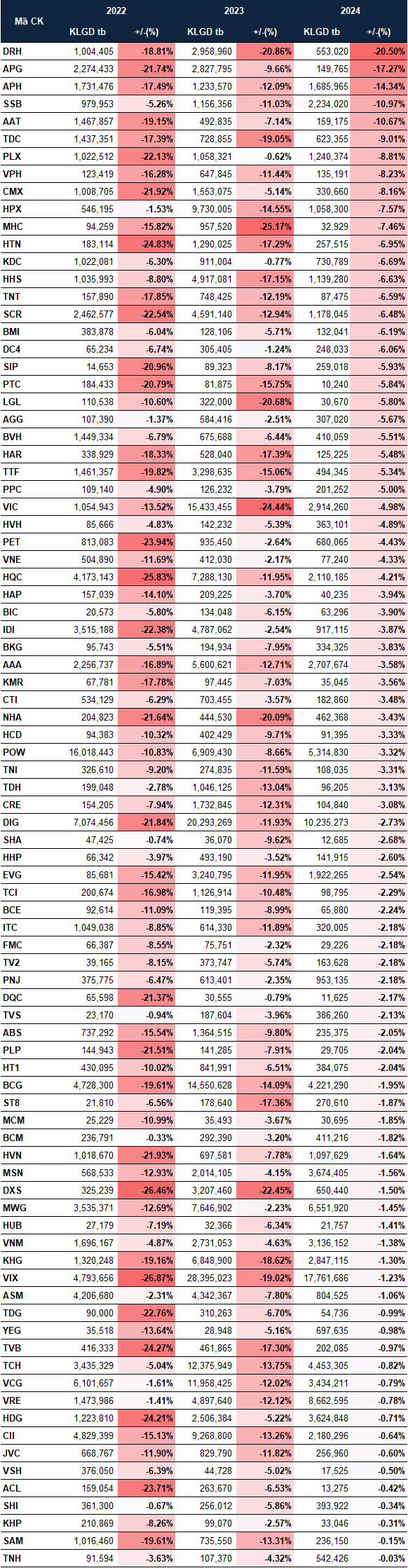

Specifically, according to VietstockFinance statistics, only one stock on the HOSE exchange has consistently increased in September over the past three years (2022-2024): BSI. In contrast, a staggering 87 stocks have consistently declined, including notable names such as PLX from the oil and gas group; SCR, AGG, HQC, DIG, and TCH from the residential real estate group; SIP and BCM from the industrial real estate group; VNM from the food group; and VCG and CII from the construction group.

|

Stocks on the HOSE exchange that increased in price during September from 2022-2024

Source: VietstockFinance

|

|

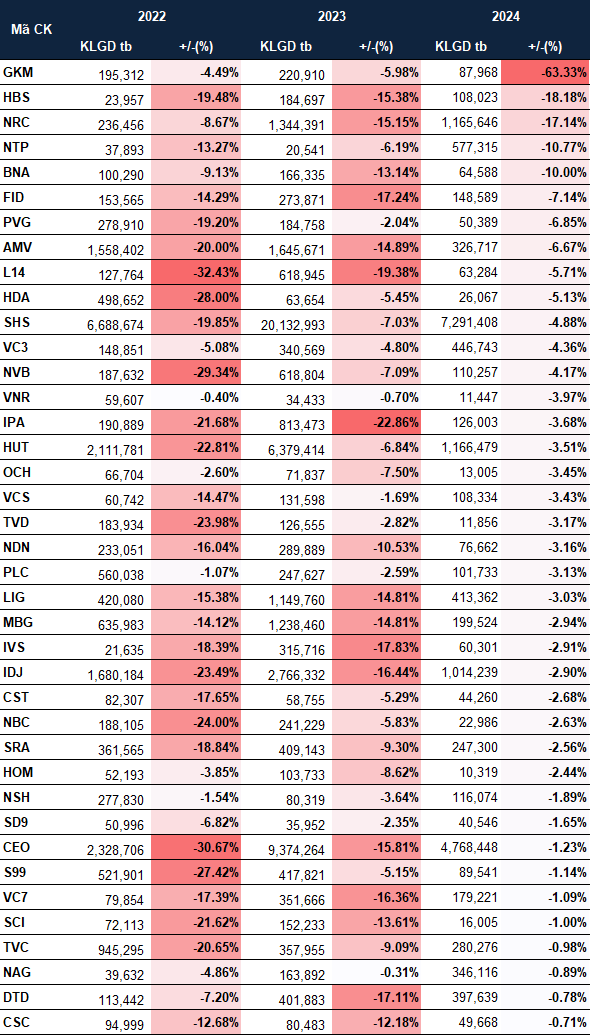

Stocks on the HOSE exchange that decreased in price during September from 2022-2024

Source: VietstockFinance

|

On the HNX exchange, the data did not record any stocks that consistently increased during this period, but there were 39 stocks that consistently declined, including NRC, GKM, L14, SHS, VNR, OCH, VCS, NDN, PLC, CEO, and VC7, among others.

|

Stock price movements on the HNX exchange during September from 2022-2024

Source: VietstockFinance

|

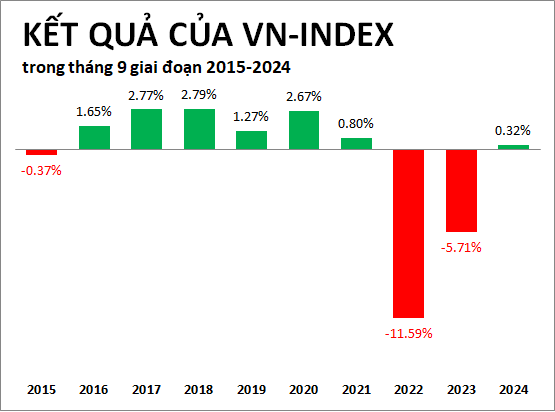

The overwhelming number of declining stocks in the above statistics is mainly due to the lackluster performance of the VN-Index in September 2022 and 2023. However, when considering a broader timeframe, September has been a favorable month for the VN-Index, as it increased for six consecutive years from 2016 to 2021.

Source: VietstockFinance

|

– 08:02 04/09/2025

Market Beat: The Triumphant Trio Revives, VN-Index Rallies in the Afternoon

The Vietnamese stock market indices witnessed a remarkable turnaround on Thursday, September 4th. After a challenging morning session, the VN-Index surged in the afternoon, closing at 1,696.29, a gain of nearly 15 points. The HNX-Index and UPCoM-Index mirrored this positive sentiment, with the former climbing 1.29 points to 283.99 and the latter rising 0.8 points to finish at 111.85. This unexpected rally has injected a dose of optimism into the market, setting the stage for a potential upward trajectory in the coming sessions.

The Stock Exchange Reveals Attractive Investment Opportunities for the Year-End Rush.

Introducing our expert-crafted stock catalog, meticulously curated based on stringent criteria. We focus on capitalization and liquidity, ensuring smart investment choices. Moreover, the enterprises featured in our catalog exhibited positive revenue and profit growth in the first half of 2025, showcasing their resilience and potential.

“VN-Index to Surpass 1,800 Points in 2025: Another Institution Joins the Bullish Forecast”

MSVN highlights that improved systemic liquidity following July’s pressures facilitated a boost in bank credit and supported market liquidity.