Post-Holiday Variables

In August, the stock market witnessed four consecutive weeks of gains, despite a strong divergence in the final week. The VN-Index ended the month at 1,682.2 points, an impressive 11.96% surge compared to July. This remarkable growth reflects robust capital inflows and buoyant investor sentiment.

Securities firms led the rally as market liquidity consistently broke records. Banks also stood out due to high credit growth, attractive valuations, and expectations of a market upgrade. Real estate, port services, insurance, retail, and steel sectors witnessed price increases as well.

On the flip side, certain sectors like textiles, industrial parks, and telecommunications experienced declines during the month. Market liquidity set new records, with trading volume on HoSE reaching 35 billion shares, up 12.4% from July, averaging 1.67 billion shares per session.

A significant drawback was the

sudden foreign net selling

, totaling VND 42,199 billion on HoSE – a record high in many years.

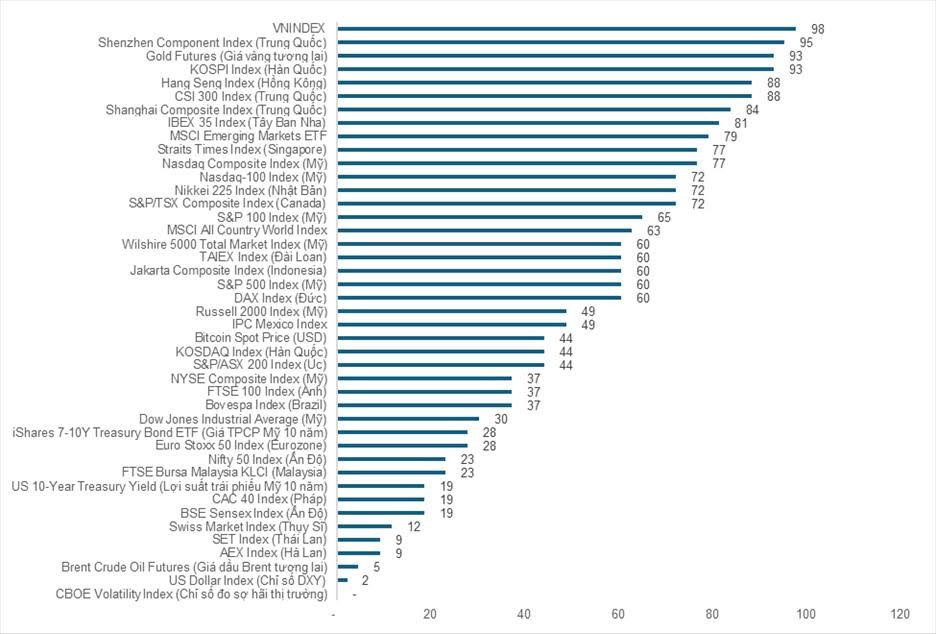

VN-Index continues to lead growth compared to global stock markets and other investment channels

As the National Day holiday concludes, the domestic stock market will resume trading on September 3rd. Mr. Nguyen The Minh, Director of Analysis at Yuanta Securities, forecasts several variables that could impact the market in September. Nonetheless, investors remain optimistic about the short-term prospects of the stock market. The VN-Index continues to spearhead growth compared to global stock markets and alternative investment avenues.

One of the primary drivers sustaining the stock market’s momentum is the expectation that the US Federal Reserve (Fed) will

cut interest rates

during its meeting on September 17, 2025, with an 87.6% probability. Recent statements indicate that the Fed prioritizes boosting growth and employment, bolstering market confidence.

Historically, Fed interest rate cuts have positively influenced the stock market over the long term, provided the US economy doesn’t slip into a recession. Additionally, as most central banks worldwide have already lowered interest rates, this fuels the upward trajectory of global stock markets, at least until inflation rears its head again in 2026.

However, it’s noteworthy that foreign investors offloaded a record high of over VND 42,000 billion in August 2025, with VIC accounting for more than 30%. Aside from real estate, foreign investors also sold financial stocks aggressively, notably VPB, SSI, CTG, and VCB.

The ownership ratio of foreign investors has dropped below 15% – the lowest level in five years. Since the beginning of the year, they have net sold VND 78,000 billion. In contrast, domestic institutions have net bought nearly VND 9,450 billion.

Market Upgrade Expectations

Mr. Dao Hong Duong, Director of Industry and Stock Analysis at VPBank Securities (VPBankS), believes that in the short term, the market will receive information that could influence investor sentiment. Firstly, the Fed’s decision during its meeting on September 17 and the exchange rate dynamics after the State Bank of Vietnam (SBV) announced the sale of 180-day term with cancellation at a ceiling price of VND 26,550/USD.

Mr. Duong suggests that if

the Fed cuts rates

, the market will react very positively. Conversely, if the Fed refrains from cutting rates, investor sentiment won’t suffer further negative impacts. These two factors are expected to exert either positive influences or avert new shocks.

Notably, at the end of September and the beginning of October, the Financial Times Stock Exchange Group (FTSE) is expected to announce the results of its review for a potential upgrade of the Vietnamese market.

FTSE is expected to announce the results of its review for a potential upgrade of the Vietnamese market soon.

Vietnam’s import and export turnover during the first seven months remained promising, with a trade surplus of over $10 billion, although signs of slowing down have emerged.

Regarding domestic policies, Mr. Duong assesses that the Fed’s rate cut trajectory this year will significantly influence Vietnam’s monetary policy flexibility. With an 8% GDP growth target, the State Bank of Vietnam has demonstrated agility in its management, reflected in the 9.9% credit growth in the first half of the year.

Nevertheless, challenges persist concerning

inflation and exchange rates

. While inflation is not yet a concern, the exchange rate surged in April and May. If the Fed officially lowers the rate by 0.25 percentage points, Vietnam could reap a dual benefit: the expectation of monetary easing in the last months of the year and exchange rate stability around the 26,550 VND/USD threshold.

Mr. Duong suggests keeping an eye on six sectors: banks, basic materials, industrial goods and services, financial services, information technology, and retail. Within these sectors, HPG stands out in basic materials, while the industrial sector focuses on electrical equipment, port services, and maritime transportation.

In the financial services sector, securities firms are highly regarded due to

the favorable business environment

. The retail sector is anticipated to accelerate in the last two quarters of the year. Information technology, with an 18-20% growth in post-tax profits compared to 2024 and attractive valuations, is also a priority, especially if Vietnam is upgraded by FTSE.