Mr. Dinh Quang Hinh, Head of Macroeconomics and Market Strategy at VNDirect Securities Corporation, analyzed: “Currently, the stock market is very vibrant, so companies are taking advantage of issuing shares to raise capital, supporting activities such as margin lending and investing in deposit certificates…”

“Increasing charter capital through share issuance aims to supplement capital for business and liquidity purposes. The fact that securities companies are raising capital shows that they have spotted good opportunities to expand their business operations,” Mr. Hinh added.

“It is forecasted that this move will have positive impacts on the market. However, it is necessary to be cautious as the market might not be able to absorb all the new shares, leading to potential adjustment pressure. But for now, the pressure to absorb capital is not a significant concern,” he further elaborated.

Numerous securities companies are rushing to increase their charter capital. (Illustrative image: Government Portal)

Similarly, Mr. Nguyen The Minh, Director of Analysis at Yuanta Securities Vietnam, shared that the stock market is currently quite vibrant, with liquidity and capitalization increasing rapidly in the past period.

“Enterprises have shown agility and more experience. In the past, companies used to wait for a while after the market became vibrant before initiating capital increase plans,” Mr. Minh said.

“However, this could be a missed opportunity as the most successful capital raising and mobilization occur when the market is performing well, with increased liquidity and capitalization, attracting more investor participation. Hence, now is the opportune moment to easily raise and mobilize capital,” he added.

Securities companies rush to issue shares

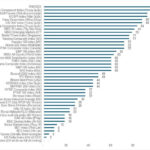

Against the backdrop of the stock market’s recovery and robust growth, numerous securities companies have swiftly implemented plans to issue shares to increase their charter capital and mobilize capital for their businesses.

Specifically, SSI Securities Corporation (Stock Code: SSI, trading on HoSE) has just published documents for an upcoming Extraordinary General Meeting of Shareholders in 2025, scheduled for September 25. The main agenda item is the offering of shares to existing shareholders.

Accordingly, SSI Securities plans to seek shareholder approval for the offering of up to nearly 415.6 million shares to its existing shareholders at a price of VND 15,000 per share. The offered shares will not be restricted from transfer.

SSI Securities expects to raise over VND 6,233.7 billion, which will be used to supplement capital for investment and margin lending activities.

The offering is expected to take place in 2025-2026 or another time decided by the Board of Directors and after obtaining approval from the State Securities Commission (SSC).

SSI Securities has also completed the offering of more than 104 million shares to professional securities investors on August 29, accounting for 5.28% of the total number of circulating shares of the company.

With an offering price of VND 31,300 per share, SSI is expected to raise over VND 3,256.5 billion from this issuance.

Following this issuance, the number of circulating shares of SSI Securities will increase from over 1.97 billion shares to nearly 2.08 billion shares, equivalent to a charter capital increase from over VND 19,738.6 billion to nearly VND 20,799.1 billion.

Thus, if SSI Securities’ shareholders approve the plan to issue nearly 415.6 million shares to existing shareholders, the company’s charter capital is expected to increase to nearly VND 24,934.9 billion.

Tien Phong Securities Joint Stock Company (TPS, Stock Code: ORS, trading on HoSE) also published a resolution on passing documents to collect shareholder opinions in writing.

Accordingly, TPS plans to seek shareholder approval for a private placement offering in 2025. Specifically, the company intends to offer more than 287.9 million shares, equivalent to 85.69% of the total number of circulating shares.

The purpose of the offering is to increase the company’s charter capital and supplement capital for its business activities.

TPS expects to offer all shares in this issuance to Tien Phong Commercial Joint Stock Bank (TPBank) at a price of VND 12,500 per share, estimating to raise over VND 3,599.1 billion. The offering is expected to take place in 2025-2026.

If the issuance is approved, TPS’s charter capital will increase from nearly VND 3,360 billion to over VND 6,239 billion.

Meanwhile, Ho Chi Minh City Securities Corporation (HSC, Stock Code: HCM, trading on HoSE) is in the process of implementing a plan to offer 359.98 million shares at a price of VND 10,000 per share through an exercise of subscription rights. The ratio of exercising subscription rights is 2:1, meaning that for every 2 shares held, shareholders will be entitled to buy 1 new share.

The transfer of subscription rights will take place from July 14, 2025, to September 9, 2025, and the registration and payment for the purchase of shares will be from July 14, 2025, to September 12, 2025.

Upon completion of the offering, HSC expects to raise nearly VND 3,599.8 billion. Of this amount, the company plans to allocate nearly VND 2,520 billion (70%) to supplement capital for margin lending activities and nearly VND 1,080 billion (30%) to supplement capital for proprietary trading activities.

At the same time, HSC will increase its charter capital from VND 7,208 billion to VND 10,808 billion. This capital increase plan was approved at the 2024 Extraordinary General Meeting of Shareholders.

What’s in Store for the Stock Market Post the 2nd of September Holidays?

The stock market closed off an impressive August rally, with the VN-Index soaring past 1,680 points and consecutive record-breaking liquidity. Experts believe that several variables, such as expectations of a Federal Reserve rate cut in September, exchange rate dynamics, and the potential for an FTSE upgrade for the Vietnamese stock market, will keep investor sentiment buoyant post the September 2nd holiday.

“Why Are Many Investors Still Stranded Despite the Stock Market’s Consistent Rise?”

The VN-Index soared by almost 180 points in August, marking a remarkable rally. However, many investors are still licking their wounds, as they have not yet been able to recover from their losses.