HoSE-listed Quoc Cuong Gia Lai JSC (QCG) has recently published its reviewed consolidated financial statement for the first half of 2025.

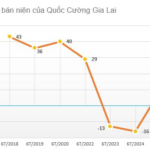

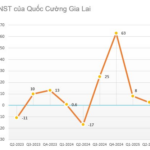

For the six months ended June 30, 2025, the company reported a consolidated net revenue of VND 242.6 billion, a significant increase of 272.1% compared to the same period in 2024.

The real estate segment contributed the lion’s share of this revenue with VND 177.5 billion, a remarkable 20.4 times increase year-over-year. Electricity trading brought in VND 47.1 billion, a 26.3% increase, while rubber revenue reached over VND 17.7 billion, a slight decrease of 5.9%.

After deductions for taxes and expenses, the company posted a net profit of over VND 10 billion, turning around from a net loss of VND 16.6 billion in the previous year.

Illustrative image

The auditing firm that reviewed the financial statement highlighted two critical issues regarding Quoc Cuong Gia Lai’s business situation.

First, under “Other Receivables,” VND 74.3 billion is part of the payment related to the Tan Phong riverside apartment and commercial complex project. According to the appellate judgment No. 184/2023/HS-PT dated April 3, 2023, the Ho Chi Minh City People’s Court ruled that the case be handed over to the Ho Chi Minh City People’s Committee for resolution according to legal regulations, taking into account the interests of residents, businesses, and related organizations.

As of the release of this report, the Ho Chi Minh City People’s Committee has not made a final decision on whether the company can continue with the project. Quoc Cuong Gia Lai is currently in discussions with the committee to reach a resolution.

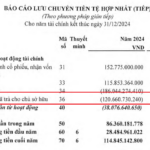

Second, as of June 30, 2025, the company’s short-term total assets were VND 1,844.1 billion, while short-term liabilities stood at VND 3,814.9 billion. A significant portion of this debt, VND 2,782.8 billion, stems from the company’s obligation to refund the full amount received under the Promise of Sale and Purchase Agreement for the Bac Phuoc Kien Urban Area Project in Ho Chi Minh City. This refund is part of the defendant Truong My Lan’s obligation to fulfill the judgment in the appellate judgment No. 1125/2024/HS-PT of the Ho Chi Minh City High-Level People’s Court.

This situation raises substantial doubt about the company’s ability to continue as a going concern. However, the auditing firm also noted that the company’s management has recognized this issue and has developed business and cash flow plans for 2025 and beyond. They are confident in their ability to meet debt obligations and maintain the company’s going concern status in the future.

As a result, the consolidated mid-year financial statement for the period from January 1, 2025, to June 30, 2025, has been prepared under the assumption of continuity of operations.

Regarding the VND 2,782.8 billion debt, it is worth mentioning that this amount is owed to Sunny Island Investment Joint Stock Company, pertaining to the Phuoc Kien project. At the beginning of the year, this debt stood at VND 2,882.8 billion, but on June 5, 2025, the company made a payment of VND 100 billion towards this obligation.

Meanwhile, in the long-term assets under construction category, the cost of the Phuoc Kien project increased from VND 5,360.8 billion to VND 5,426.5 billion in the first half of 2025.

“QCG’s 2024 Financial Report: Unraveling the Mystery Behind the $120 Million Dividend Payout”

The audited financial report for 2024 of QCG Joint Stock Company (HOSE: QCG) has raised questions among shareholders regarding a dividend expense of over VND 120 billion. The expenditure has sparked inquiries about the recipients and the potential impact on shareholders’ interests.

“QCG Makes a $100 Million Payment to Sunny Island, Profits in Second Quarter from Condo Handovers.”

The consolidated financial statements for the second quarter of 2025 of Quoc Cuong Gia Lai Joint Stock Company (HOSE: QCG) revealed a decrease in debt obligations to Sunny Island Investment Joint Stock Company by VND 100 billion, resulting in a remaining debt of VND 2.78 trillion. This financial liability stems from a dispute over the North Phuoc Kien residential project in Nha Be, dating back to 2016-2017.

“Quang Anh Group Settles 2.882 Trillion VND Debt with a 100 Billion Payment”

With a remarkable turnaround, the company has reported a post-tax profit of over VND 10.7 billion for the first half of the year, compared to a loss of VND 16.6 billion in the same period last year.