This marks a significant step forward in Hanwha Life Vietnam’s product development strategy, underscoring its commitment to accompany customers on a journey toward a prosperous and sustainable future.

Long-term Protection, Efficient Investment

In the context of evolving customer needs for life insurance, Hanwha Life Vietnam introduces a new unit-linked insurance product named “Confident Living, Quality Life.” This product harmoniously combines long-term protection goals with efficient investment opportunities for customers.

The core philosophy of “Confident Living, Quality Life” revolves around empowering individuals to confidently pursue their personal goals, embrace their unique qualities, and build a prosperous future. To this end, the product is designed to offer peace of mind and financial security, featuring prominent insurance benefits such as Companion Protection and Companion Sharing, along with sustainable accumulation bonuses and efficient investment avenues for wealth accumulation.

The protection benefit of this product automatically increases over time, reaching up to 150% of the sum assured. This dynamic feature ensures customers have a robust financial solution that adapts to their life stages. Additionally, within the same insurance contract, the product extends comprehensive protection to the policyholder’s family members against the risk of accidental death, without the need for underwriting.

Hanwha Life Vietnam is committed not only to serving its customers but also to caring for their families as its own. This dedication is evident in the Companion Sharing benefit integrated into the product. Specifically, upon receiving a death benefit claim, the company will advance 10% of the sum assured (up to VND 50 million) to help the bereaved family with initial funeral expenses before completing the formal death benefit claim process. This demonstrates the company’s unwavering support during their customers’ most challenging moments.

Notably, “Confident Living, Quality Life” presents efficient investment opportunities—a distinctive feature. With Hanwha Life Vietnam’s guidance, customers will have access to a proactive investment plan through four unit-linked funds. These funds are specially designed to cater to diverse investment preferences and are managed by two reputable fund management companies, VinaCapital and KIM Vietnam. As a result, customers can diversify their investment portfolios even without a substantial initial capital. As their investment needs grow or change over time, customers can invest more, adjust their investment ratios, or switch funds according to their preferences.

Throughout the policy term, customers are also entitled to contract maintenance bonuses and special bonuses, bolstering their long-term wealth accumulation and providing added peace of mind to enjoy life according to their unique “quality.”

Accompanying and Elevating Customer Protection

From June onwards, Hanwha Life Vietnam has consistently launched a diverse range of products, including the unit-linked insurance “Steady Step Companion,” “100 Critical Illness Insurance,” and “Accident Risk Companion.” These offerings provide a comprehensive portfolio of products with reasonable premiums, ensuring customers are safeguarded against unforeseen life risks.

For Hanwha Life Vietnam, protection is a responsibility, and companionship is a mission.

Hanwha Life’s new products are meticulously tailored to meet the genuine needs of Vietnamese individuals, as evidenced by thoughtful touches. For instance, the unit-linked insurance “Confident Living, Quality Life,” the unit-linked insurance “Steady Step Companion,” and “Accident Risk Companion” all include extended protection benefits for family members. This not only provides added peace of mind for customers but also fulfills the profound aspirations of Vietnamese individuals to love and protect their families.

Hanwha Life Vietnam also places a strong emphasis on mental well-being. Similar to the Companion Sharing benefit in “Confident Living, Quality Life,” the “100 Critical Illness Insurance” offers a 2% sum assured (up to VND 10 million) as initial support upon diagnosis of a critical illness. This acts as an emotional anchor, empowering customers on their journey to combat critical illnesses.

“As a multinational group with a presence in multiple countries, Hanwha Life takes pride in our deep understanding of local cultures in each market. In Vietnam, our 17 years of serving customers have enabled us to grasp the cultural values, especially the strong emphasis Vietnamese individuals place on family. This understanding allows us to craft products that genuinely align with their needs and financial capabilities,” shared a company representative. “On our sustainable development journey, Hanwha Life aspires not only to protect our customers but also to elevate protection for their families, enabling them to confidently build a prosperous and happy future.”

Moving forward, Hanwha Life Vietnam will continue to introduce exceptional and specialized insurance solutions to comprehensively serve the health and financial protection needs of the Vietnamese population across various target segments.

Affordable Housing Permits Continue to Lead Sales in August

According to data from local construction departments, there were 18 projects with a total of 6,659 units eligible for future home sales across 11 provinces and cities in August 2025. Social housing continues to dominate, accounting for 5,020 units.

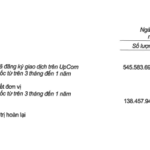

The Stock Market Race: VN-Index Breaks Barriers, Shaping the Future

Will the VN-Index continue its record-breaking streak for the rest of the year? Could the prospect of an upgrade be the main catalyst for the market’s breakthrough in the coming period? Find out as our panel of experts discuss these topics and more on Vietstock LIVE #20, broadcasting online at 3 PM on Friday, September 5th, 2025.

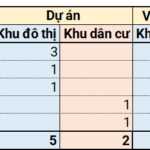

Investment Opportunity: August 2025 – Five Urban Developments with a Capital Investment of Nearly 30.2 Trillion VND

In August 2025, five provinces attracted investment with seven projects, totaling nearly VND 31.3 trillion. Notably, Quang Ngai province sought investment for three urban areas, with a total investment of approximately USD 1 billion.