CPI Rises by 3.25% Year-on-Year for the First Eight Months

|

According to the Statistics Office, eight groups of goods and services saw price index increases, while three groups witnessed decreases, contributing to the 0.05% CPI increase in August compared to the previous month.

The eight groups of goods and services that experienced price index increases include:

– Housing, electricity, water, fuel, and building materials rose by 0.21%, mainly due to the following reasons: Rental prices increased by 0.28% as demand for rentals rose in some localities with the upcoming new school year, as students returned to major cities for their studies; electricity prices for household use increased by 1.01% due to hot weather increasing electricity consumption; and prices of housing maintenance materials rose by 0.49% as prices of bricks, sand, and stones surged amidst scarce supply, higher production and transportation costs, and elevated construction demand.

On the contrary, some items saw price decreases compared to the previous month: Gas prices dropped by 3.86%, as domestic gas prices were adjusted downwards following international gas price reductions from August 1, 2025; and kerosene prices fell by 0.86%, influenced by price adjustments during the month.

– Education witnessed a 0.21% increase, with educational services rising by the same percentage as some private universities, secondary schools, and kindergartens in certain localities hiked their tuition fees for the 2025-2026 academic year. Additionally, prices of paper products increased by 0.9%, writing instruments by 0.71%, and other stationery and educational supplies by 0.52%.

– Clothing, headwear, and footwear rose by 0.17% due to heightened back-to-school shopping demand. Specifically, fabric prices increased by 0.28%, clothing services by 0.27%, shoes by 0.18%, ready-made garments and shoe services both by 0.16%, and headwear by 0.07%.

– Beverages and tobacco increased by 0.17% due to heightened summer consumption and rising production costs. Carbonated drink prices rose by 0.41%, mineral water by 0.3%, liquor by 0.2%, bottled/canned/boxed energy drinks by 0.17%, beer by 0.12%, and tobacco by 0.11%.

– Household appliances and utensils rose by 0.11% due to higher production and labor costs. Electric fan prices increased by 0.3%, plastic and rubber products by 0.25%, gas stoves by 0.24%, soap, detergents, and air conditioner repair services both by 0.23%, TV repair services and household item rentals both by 0.21%, bathroom water heaters by 0.16%, lighting fixtures and furniture (beds, cabinets, tables, and chairs) all by 0.11%, and wall mirrors by 0.02%.

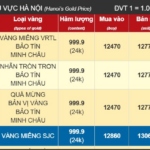

– Other goods and services rose by 0.11%, with notable increases in certain items: Jewelry prices increased by 1.46% following gold price trends; watch and jewelry repair services rose by 0.36%; funeral and wedding services by 0.18%; personal care services by 0.05%; haircutting and shampooing services by 0.04%; and environmental sanitation services by 0.01%. Conversely, prices of personal care electrical appliances decreased by 0.38%, and handbags, suitcases, and wallets fell by 0.15%.

– Culture, entertainment, and tourism rose by 0.08%, mainly driven by increases in hotel and guesthouse prices by 1.79%, sports facility rental fees by 0.19%, overseas tourism services by 0.09%, and movie and music event tickets by 0.04%. Conversely, domestic tourism decreased by 0.15% as travel companies introduced promotional discounts to stimulate consumption.

– Medicine and healthcare services witnessed a slight increase of 0.03% due to exchange rate fluctuations impacting the import costs of pharmaceuticals and raw materials. Specifically, cardiovascular drugs rose by 0.23%, anti-infective and antiparasitic drugs by 0.16%, non-steroidal anti-inflammatory drugs for pain relief, fever reduction, and anti-gout drugs, along with bone medications, by 0.15%, vitamins and minerals by 0.14%, and medical devices by 0.11%.

The three groups of goods and services that experienced price index decreases include:

– Post and telecommunications fell by 0.04%, with smart mobile phones and tablets decreasing by 0.63%, fixed-line phones by 0.23%, and regular mobile phones by 0.12%. Conversely, phone repair services rose by 0.6%, and accessories for smart mobile phones and tablets increased by 0.55%.

– Food and catering services decreased by 0.06%, with food products falling by 0.18%, while dining out increased by 0.2%, and cereals rose slightly by 0.01%.

– Transport decreased by 0.11%, with diesel prices falling by 2.06% and gasoline prices by 0.2% due to domestic fuel price adjustments. Additionally, used car prices dropped by 0.58%, and motorcycle prices by 0.18% as enterprises offered promotional programs and consumer support. Conversely, some groups saw price index increases compared to the previous month: Air passenger transport rose by 0.21%, water passenger transport by 0.08%, and road passenger transport by 0.06% due to heightened summer travel demand. Spare parts prices increased by 0.17% due to higher import costs, and vehicle maintenance service prices rose by 0.36% due to elevated labor costs.

Core inflation in August rose by 0.19% compared to the previous month and by 3.25% compared to the same period last year. For the first eight months of 2025, core inflation increased by 3.19% year-on-year, slightly lower than the 3.25% rise in the average CPI. This was mainly due to the inclusion of food, electricity, healthcare services, and educational services in the CPI calculation, which are excluded from the core inflation index.

– 09:05 06/09/2025

The Time to Adjust: Mastering the Art of Bank Interest Rate Changes

The central bank stated that when inflation rises, it increases interest rates to curb inflation. Conversely, when inflation is under control and aligns with the set targets, the central bank reduces interest rates to stimulate economic growth.

A Minimum Wage Increase of 7.2%: Strategies to Prevent a Price ‘Hike’

The minimum wage is set to increase by 7.2% from the beginning of 2026, a move aimed at counteracting the effects of inflation and ensuring workers can afford the rising cost of living. Historically, such wage increases have been followed by a rise in the price of goods. To prevent this, authorities must take action to stop businesses from simply passing on these increased labor costs to consumers, ensuring that this wage increase truly benefits workers.

What is the Impact of Large-Scale Capital Injection on Economic Growth?

Hundreds of projects have just been launched with an investment capital of approximately VND 1.28 quadrillion. This injection of funds into the economy is expected to boost economic growth in the coming years.