Market liquidity increased compared to the previous trading session, with the VN-Index matching volume reaching over 1.65 billion shares, equivalent to a value of more than 47.4 trillion VND; HNX-Index reached over 172 million shares, equivalent to a value of more than 4.2 trillion VND.

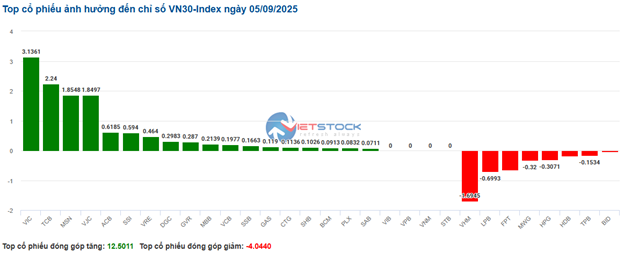

VN-Index opened the afternoon session with continuously increasing selling pressure, causing the index to plunge and close in the red. In terms of impact, VCB, VPB, BID, and VHM were the codes with the most negative impact on the VN-Index, with a decrease of more than 9.8 points. On the other hand, SJS, GVR, VJC, and REE remained in the green and contributed more than 1.1 points to the overall index.

| Top 10 stocks with the strongest impact on the VN-Index on 09/05/2025 (in points) |

Similarly, the HNX-Index also had a rather pessimistic performance, with the index negatively impacted by codes SHS (-7.22%), MBS (-4.47%), IDC (-2.22%), and NTP (-2.47%)…

|

Source: VietstockFinance

|

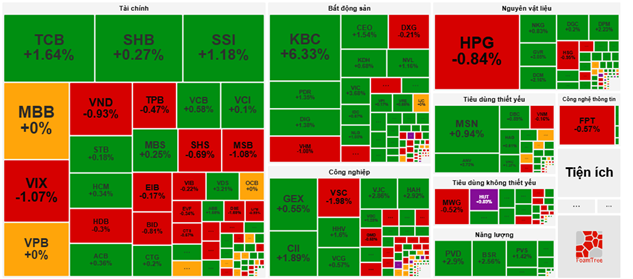

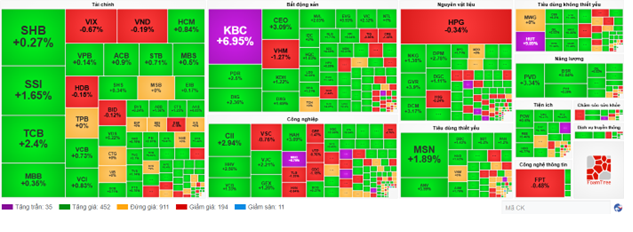

At the close, red dominated most sectors. The financial sector was the group with the largest decrease in the market, falling by 2.58%, mainly due to codes VCB (-2.03%), BID (-3.34%), TCB (-0.25%), and VPB (-4.01%). This was followed by the information technology and materials sectors, which fell by 1.53% and 1.41%, respectively. On the other hand, the healthcare sector was the only group to remain in the green, with a slight increase of 0.16%, mainly contributed by codes DHG (+0.49%), DBD (+0.19%), DCL (+6.19%), and OPC (+0.22%).

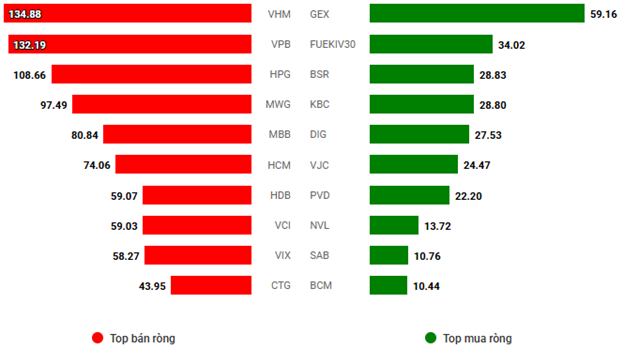

In terms of foreign trading, foreigners continued to sell a net of more than 1,383 billion VND on the HOSE exchange, focusing on codes VPB (270.03 billion), VHM (204.3 billion), MBB (155.76 billion), and HDB (130.57 billion). On the HNX exchange, foreigners sold a net of more than 69 billion VND, focusing on SHS (88.39 billion), PVS (12.64 billion), PVI (5.33 billion), and VFS (3.44 billion).

| Foreign Trading Buy – Sell Net |

Morning Session: Maintaining Green

The green color continued to dominate until the end of the morning session, although the upward momentum eased slightly. At the midday break, the VN-Index increased by 9.01 points (+0.53%), to 1,705.3 points; HNX-Index also increased by 0.88%, reaching 286.49 points. The market breadth was tilted towards buying pressure with 470 gainers and 274 losers.

In the top 10 stocks influencing the VN-Index, VIC was the code with the most positive impact, contributing 4.3 points to the VN-Index. In addition, TCB, GVR, and VCB also added a total of 2.7 points to the overall index. On the other hand, VHM had the most negative impact this morning, taking away more than 1 point from the index.

In terms of sector performance, the green color dominated most sectors. The energy group temporarily led the market with a positive increase of 1.74%, mainly contributed by stocks such as BSR (+2.56%), PVS (+1.42%), PLX (+0.68%), OIL (+0.82%), PVD (+2.9%), PVT (+1.63%), PVC (+3.33%), and PVB (+2.39%).

In addition, the real estate and non-essential consumer goods sectors also saw active trading as buying interest focused on stocks such as KBC (+6.33%), PDR (+1.35%), DIG (+1.38%), CEO (+1.54%), VIC (+3.68%); HHS (+1.42%), FRT (+2.7%), DGW (+1.02%), VGT (+2.42%), and HUT rose to the maximum daily limit.

On the opposite side, only the information technology sector failed to recover as selling pressure concentrated on the industry leader, FPT, which fell by 0.57%. Meanwhile, in the healthcare sector, although the sector index managed to stay slightly in the green thanks to the positive performance of stocks such as DBD (+0.38%), DCL (+4.2%), PMC (+1.17%), VDP (+2.79%), and JVC (+4.24%), several stocks also witnessed corrections towards the end of the morning session, including IMP (-0.91%), DHT (-1.62%), TNH (-0.62%), and DTP (-2.49%).

Source: VietstockFinance

|

Foreigners continued to sell a net of 1.1 trillion VND on all three exchanges, with the selling pressure mainly focused on VHM and VPB, with net selling values of 134.88 billion and 132.19 billion, respectively. In contrast, GEX led the net buying list with a value of 59.16 billion VND.

Source: VietstockFinance

|

10:30 am: Optimism Prevails, VN-Index Breaks 1,700 Points

VN-Index rose more than 11 points, trading around 1,707 points. HNX-Index increased by more than 3.7 points, trading around 287 points.

The breadth among the VN30 stocks was positive, with the majority of stocks trading in the green. Specifically, on the positive side, VIC contributed 3.13 points, TCB added 2.24 points, MSN contributed 1.85 points, and VJC added 1.84 points. Conversely, VHM, LPB, FPT, and MWG were among the few stocks facing selling pressure, taking away more than 3.1 points from the overall index.

Source: VietstockFinance

|

Stocks in the financial sector continued to be dominated by green colors and played a leading role in driving the market’s upward momentum. Notably, SHB rose by 0.27%, SSI increased by 1.65%, TCB climbed by 2.4%, and MBB gained 0.71%… Conversely, only a few stocks recorded slight declines, including VIX, which fell by 0.67%, HDB decreased by 0.3%, and TPB dropped by 0.23%.

The real estate sector remained in focus as most of the leading stocks in this industry witnessed upward movements. Notable gainers included KBC, which hit the daily limit, DIG rose by 2.36%, PDR climbed by 2.5%, CEO increased by 3.09%, and KDH gained 1.22%…

Compared to the beginning of the trading session, buying pressure prevailed. There were 452 gainers and 194 losers.

9:30 am: Positive Start to the Session, VN-Index Surpasses 1,700 Points

In the morning session of September 5, as of 9:30 am, the VN-Index rose more than 7 points, reaching 1,703 points. Similarly, the HNX-Index also edged higher by 2.62 points, reaching 286.61 points.

The market witnessed a predominance of green colors, with essential consumer goods stocks such as MSN rising by 2.12%, ANV climbing by 4.72%, and VHC increasing by 1.89%.

Large-cap stocks, including GVR, TCB, and VIC, were among the main drivers of the indices, contributing more than 2 points to the overall performance. Conversely, VHM, HPG, and FPT faced selling pressure, taking away nearly 1.8 points from the indices.

Financial stocks continued their stable growth, with most codes trading in positive territory. Notable gainers included SSI, which rose by 1.89%, VND increased by 1.12%, and ACB climbed by 1.27%…

– 15:25 09/05/2025

Market Pulse, September 3rd: Foreigners’ Robust Selling of Blue-chips, VN-Index Hanging at 1,680 Points

The trading session concluded with the VN-Index dipping 0.91 points (-0.05%) to 1,681.3. In contrast, the HNX-Index climbed 2.72 points (+0.97%), finishing at 282.7. The market breadth tilted towards gainers, as 468 stocks advanced against 268 decliners. However, the large-cap VN30 index painted a different picture, with 15 stocks falling, 12 rising, and 3 unchanged, resulting in a sea of red.

The Rising Tide of Bank Stock Frenzy

In August, bank stocks continued to be the market’s powerhouse, surging ahead and outperforming the VN-Index with impressive growth rates.

Stock Market Week Sept 03-05, 2025: The Unexpected Drop After Hitting 1,700 Points

The VN-Index took a surprising tumble during the week’s final session, bringing an end to four consecutive weeks of gains. This sudden shift highlights the intense profit-taking pressures at play in the higher price ranges, with persistent foreign sell-offs further exacerbating the situation and significantly impacting investor sentiment.