Liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 1.24 billion shares, equivalent to a value of over 35.5 trillion dong; HNX-Index reached over 117 million shares, equivalent to a value of over 2.88 trillion dong.

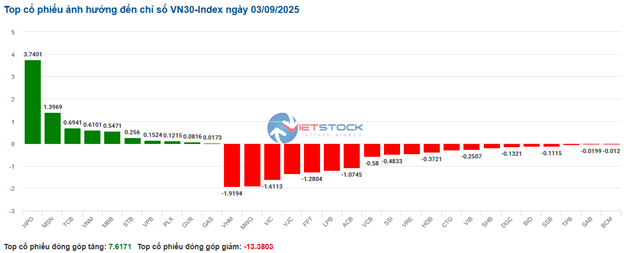

VN-Index opened the afternoon session on an unfavorable note as selling pressure continued to mount, despite multiple attempts from the buying side to pull the index back to the reference level. However, the selling side maintained its dominance, resulting in the VN-Index closing in the red. In terms of impact, VCB, VIC, VHM, and VPB were the most negative influences on the VN-Index, contributing to a loss of over 8.5 points. On the other hand, HPG, BID, MBB, and BSR remained in the green, adding over 4 points to the overall index.

| Top 10 stocks with the highest impact on the VN-Index on 09/03/2025 (in points) |

In contrast, the HNX-Index exhibited a rather optimistic performance, influenced positively by stocks such as CEO (+6.5%), HUT (+4.52%), PVS (+3.54%), and KSV (+1.83%)…

|

Source: VietstockFinance

|

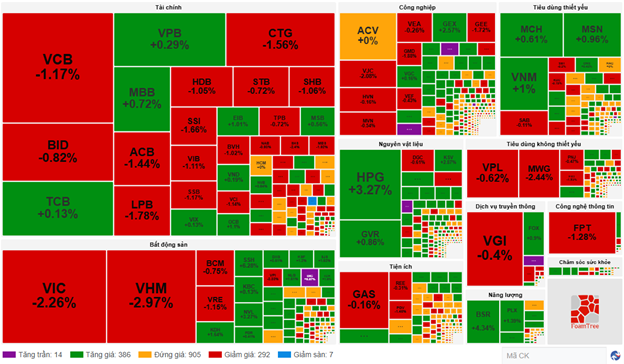

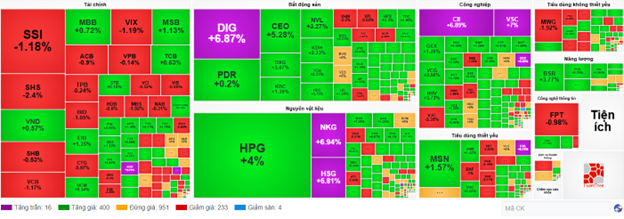

At the close, green dominated most industry groups. The energy sector led the market with a gain of 2.61%, mainly driven by BSR (+3.96%), PLX (+1.25%), PVD (+3.29%), and PVS (+3.54%). This was followed by the materials and information technology sectors, which rose by 1.8% and 1.68%, respectively. On the other hand, the real estate sector remained in the red, declining by 0.62%, mainly due to VIC (-2.57%), VHM (-1.72%), VRE (-0.82%), and KBC (-0.13%).

In terms of foreign trading, they continued to be net sellers on the HOSE exchange, offloading over 2,873 billion dong, focusing on HPG (944.37 billion), VPB (203.78 billion), FPT (200.02 billion), and MSN (198.85 billion). On the HNX exchange, foreign investors net sold over 51 billion dong, mainly offloading SHS (70.07 billion), CEO (18.73 billion), IDC (8.22 billion), and VFS (8.12 billion).

| Foreign Trading Net Buy/Sell Activity |

Morning Session: Large Caps Pressure the Market as Foreigners Continue to Offload

Pressure from large-cap stocks continued to challenge the market in the latter half of the morning session. The VN-Index temporarily paused at 1,675.57 points, down 0.39%. Meanwhile, the HNX-Index performed more positively, rising by 0.49% to 281.34 points. The market breadth witnessed 400 advancing stocks, 299 declining stocks, and 905 stagnant stocks.

The VN30 group exerted significant pressure, as the top 10 stocks with the most negative impact on the VN-Index belonged to this group. VHM, VIC, and VCB were the main hindrances, causing the index to lose more than 7 points. On the brighter side, only HPG and BSR made notable positive contributions, adding approximately 1.7 and 0.9 points, respectively.

Industry groups exhibited clear differentiation. On the declining side, the financial sector weakened across the board, with numerous stocks falling by over 1% alongside high liquidity, including SSI, SHS, SHB, VCB, ACB, CTG, HDB, and VCI…

Source: VietstockFinance

|

Although the real estate and information technology sectors recorded the most significant declines, this was mainly due to the influence of large-cap stocks within these industries, such as VIC (-2.26%), VHM (-2.97%), VRE (-1.15%), and FPT (-1.28%). Many stocks within these sectors still traded positively, including DIG, which hit the ceiling price, CEO (+4.88%), DXG (+3.51%), NVL (+3.27%), HDC (+3.37%), KDH (+1.64%), NLG (+1.51%), CMG (+1.61%), and DLG (+4.29%).

Conversely, the energy sector maintained its leading position, recording a gain of nearly 3%. Additionally, positive buying momentum in steel stocks, such as NKG hitting the ceiling price, HPG (+3.27%), HSG (+6.27%), VGS (+4%), TVN (+4.88%), and TLH (+3.68%), contributed to the materials sector becoming a notable bright spot.

Foreigners net sold nearly 1,584 billion dong on all three exchanges during the morning session alone. Their trading tendency remained a significant obstacle for the market, especially as the selling pressure concentrated on large-cap stocks. HPG, FPT, and MWG topped the net selling list with values of 485, 164, and 139 billion dong, respectively. Meanwhile, CII and NKG were the most net bought stocks, but their values were relatively modest, totaling over 60 billion dong, insufficient to provide substantial support to the market.

| Top 10 stocks with the highest foreign net buy/sell value during the morning session of 09/03/2025 |

10:35 am: Large Caps Pressure VN-Index at the 1,680-point Level

Investors displayed hesitation as trading volume remained subdued, and the main indices fluctuated around the reference level. As of 10:30 am, the VN-Index had lost 1.73 points, hovering around 1,680 points, while the HNX-Index had gained 2 points, trading around 281 points.

The breadth of the VN30 constituents was mixed, but the selling pressure slightly outweighed the buying momentum. Specifically, VHM, MWG, VJC, and FPT subtracted approximately 1.91 points, 1.89 points, 1.61 points, and 1.33 points from the index, respectively. Conversely, HPG, MSN, TCB, and VNM were among the few stocks that maintained their positive performance, contributing over 6.4 points to the VN30-Index.

Source: VietstockFinance

|

The majority of industry groups were painted green, with the energy, materials, and consumer staples sectors providing the most substantial support to the market recovery. These sectors rose by 2.94%, 1.66%, and 0.61%, respectively. Conversely, the financial and real estate sectors exhibited contrasting performances, exerting pressure on the overall market.

Within the energy sector, most stocks witnessed positive momentum. Notably, BSR climbed by 4.34%, PLX advanced by 1.94%, PVS increased by 3.54%, and PVD rose by 3.99%. Conversely, only a handful of stocks, such as TD6, VTV, NBC, and PVP…, experienced selling pressure, but their declines were insignificant.

Following closely, the materials sector also demonstrated resilience despite some mild differentiation in stock performances. Buying interest primarily focused on large-cap stocks, including HPG, which surged by 5.09%, while NKG and HSG hit the ceiling price, and GVR and MSR rose by 1.2% and 7.28%, respectively. Conversely, a few stocks, such as HT1, PTB, and DHC, declined slightly, but their losses were relatively minor.

On a less positive note, the real estate and financial sectors continued to be tinged with red, mainly due to the negative performances of large-cap stocks within these industries. Selling pressure was observed in stocks such as VHM, which fell by 2.11%, VIC decreased by 1.01%, VRE dropped by 1.32%, VCB declined by 1.17%, BID lost 0.93%, CTG fell by 1.17%, and ACB slipped by 0.9%…

Compared to the opening, the buying side still held a significant advantage. There were 400 advancing stocks, while 233 stocks declined.

Source: VietstockFinance

|

Opening: A Cautious Start

The stock market opened after the National Day holiday in a cautious mood. The main indices fluctuated around the reference level as money flow remained tentative. By 9:30 am, the VN-Index had lost about 6 points, falling to 1,676 points, while the HNX-Index traded around 280 points.

The energy and media sectors temporarily led the market higher, thanks to positive buying momentum in large-cap stocks such as BSR (+2.26%), PVS (+2.65%), PVD (+2.35%), PLX (+0.97%); VGI (+0.27%), FOX (+0.6%), and VNZ, which hit the ceiling price.

On the other hand, the real estate sector had a less favorable start, facing pressure from the Vingroup trio: VHM (-1.24%), VIC (-0.47%), and VRE (-0.99). However, the majority of stocks within the sector remained in positive territory, with notable gainers including NVL (+2.98%), DIG (+5.58%), CEO (+2.85%), SJS (+3.03%), DXG (+2.63%), and KDH (+1.51%).

According to newly released data from S&P Global, Vietnam’s Manufacturing Purchasing Managers’ Index (PMI) for August 2025 stood at 50.4 points, down from 52.4 points in July. While remaining above the 50-point threshold, indicating a continued improvement in the health of the manufacturing sector for the second consecutive month, the

Stock Market Week Sept 03-05, 2025: The Unexpected Drop After Hitting 1,700 Points

The VN-Index took a surprising tumble during the week’s final session, bringing an end to four consecutive weeks of gains. This sudden shift highlights the intense profit-taking pressures at play in the higher price ranges, with persistent foreign sell-offs further exacerbating the situation and significantly impacting investor sentiment.

The Bank Stock Surprise: A Proprietary Trading Boost

The proprietary trading arms of securities companies returned to net buying with a value of VND435 billion on the HoSE.