From August 13 to 29, SmartMind Securities sold 2,250 SSH shares out of the registered amount of over 2.5 million shares, completing less than 0.01%. The reason for the unfinished transaction was that market conditions were not favorable. After the transaction, SmartMind still holds 2.5 million shares, equivalent to 0.673% of the total outstanding shares.

After the unsuccessful sale, the company continues to register to sell the above amount of shares in the period of September 9 to 17. If successful, SmartMind will no longer hold SSH shares in its proprietary trading portfolio.

SmartMind Securities and SSH are both companies in the Sunshine ecosystem. Mr. Do Anh Tuan – Chairman of the Board of Directors and major shareholder at Sunshine Group Joint Stock Company (HNX: KSF) – the parent company of SmartMind – also holds 243.75 million SSH shares, equivalent to 65% of capital.

SSH shares are currently trading at VND 97,000/share (September 3, 2025). Since April, the market price of SSH has increased by about 20%, from the range of VND 80,000/share to the current price range.

| Price movement of SSH shares since the beginning of 2025 |

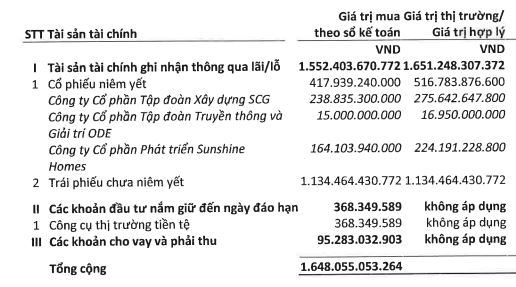

According to the semi-annual 2025 financial statement, the original investment cost of SSH of SmartMind’s proprietary trading block is VND 164 billion. At the market price at the time of reporting was VND 224 billion, the company is temporarily making a profit of 36%. From the end of June to now, the price of SSH shares has been on an upward trend. Therefore, it is highly likely that this securities company will realize profits from SSH with a higher profit margin than the above figure.

In addition to SSH, SmartMind’s proprietary trading portfolio also holds a large proportion in some stocks such as Construction Group Joint Stock Company SCG, Communications and Entertainment Group Joint Stock Company ODE. The company also holds more than VND 1,100 billion of unlisted bonds.

|

SmartMind’s FVTPL asset portfolio as of June 30, 2025

Source: SmartMind Securities Financial Statements

|

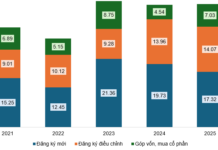

In the first 6 months of 2025, SmartMind’s operating revenue was over VND 143 billion, up 65% over the same period, mainly thanks to profits from financial assets recorded through profit/loss (FVTPL) increased strongly. This revenue reached VND 109 billion, double that of the same period. As a result, the securities company made a profit of over VND 93 billion, more than 2.3 times higher than the same period.

Regarding the business results of SSH, in the second quarter of 2025, the company recorded net revenue of VND 138 billion. However, the loss from the associated company has dragged down profits. As a result, the company made a net loss of over VND 250 billion (profit of VND 217 billion in the same period last year).

The negative second quarter caused the company to lose VND 231.5 billion in the first half of the year.

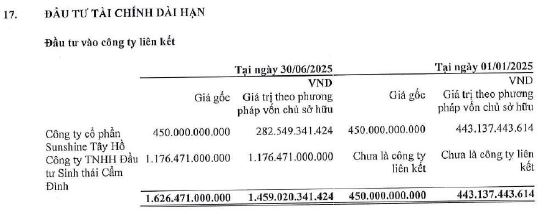

|

SSH‘s long-term financial investment portfolio

Source: SSH Financial Statements

|

| Net income of SSH by quarter in recent years |

– 09:36 09/04/2025

“VNDirect Seeks to Raise $10.6 Million Through Bond Issuance to Restructure Bank Debt”

“VNDirect is set to issue bonds with the code VND32501, amounting to a maximum of VND 250 billion, to restructure a bank loan that is due for maturity in September 2025. “

![[Infographic] Unraveling the Balance Sheets of Securities Companies: A Deep Dive into Their Financial Assets, Loan Portfolios, and Cash Positions](https://xe.today/wp-content/uploads/2024/08/info-co-cau-tai-san-ctck-cover-150x150.jpg)