Deputy Governor of the SBV Pham Thanh Ha provides information on monetary and credit policy orientations to achieve the goal of controlling inflation and stabilizing the macro-economy from now until the end of the year – Photo: VGP

At the regular Government press conference for August held on the afternoon of September 6, Deputy Governor of the State Bank of Vietnam (SBV) Pham Thanh Ha answered the press about monetary and credit policy orientations to achieve the goal of controlling inflation, stabilizing the macro-economy, and achieving growth of 8.3-8.5% in 2025, as well as achieving double-digit growth in the following years.

According to the Deputy Governor, in the coming time, the global economic outlook is forecast to continue facing many difficulties, challenges, and increasing risks, requiring policy management to closely follow the situation and implement proactively, flexibly, and effectively. Accordingly, based on the socio-economic development orientations of the Party, National Assembly, and Government, the State Bank will focus on the following key solutions:

First, flexibly and synchronously manage monetary policy tools and solutions with appropriate timing and intensity, balancing exchange rates and interest rates, thereby facilitating production and business activities, promoting growth, and ensuring macroeconomic stability and inflation control in line with set targets.

Second, continue to manage the exchange rate flexibly, closely following market developments, and be ready to intervene in the market when necessary to ensure the stability of the foreign exchange market.

Third, instruct credit institutions to continue efforts to reduce operating costs and promote digital transformation, thereby striving to reduce lending interest rates to support businesses and people.

Fourth, manage credit in line with macroeconomic developments and capital absorption capacity to timely provide capital for the economy.

Fifth, continue to coordinate closely with ministries and sectors to promptly remove difficulties in implementing credit policies, thereby creating favorable conditions for businesses and people to access bank credit.

“In the process of management, the SBV will closely monitor domestic and international economic developments to flexibly manage monetary policy in a practical manner,” emphasized the Deputy Governor.

According to the Deputy Governor, since the beginning of 2025, the global economy has been facing many risks and uncertainties arising from tariff policies, geopolitical tensions, and unpredictable monetary policy paths of major central banks. Domestically, production and business activities of enterprises continue to face difficulties, and consumption and exports are affected by complex and unpredictable developments in the global economy and international financial markets.

In this context, the Government sets a target of economic growth of 8.3-8.5% in 2025 as a foundation for double-digit growth in the following years. The State Bank of Vietnam fully understands that this is an extremely important political task that requires strong and resolute actions.

Accordingly, the SBV has proactively and timely implemented synchronous management solutions to promote economic growth in association with maintaining macroeconomic stability, controlling inflation, and ensuring the major balances of the economy.

Up to now, the liquidity of the credit institution system has been ensured, the money market has been stable, and the exchange rate has fluctuated flexibly in line with market conditions.

Specifically: The lending interest rate continues the downward trend, by the end of August 2025, the average lending interest rate decreased by about 0.6% compared to the end of 2024. The foreign exchange market has ensured smooth liquidity, and all legitimate foreign currency demands have been met fully and promptly. By the end of August 2025, the interbank exchange rate increased by 3.45% compared to the end of the previous year. Credit has grown positively compared to recent years, as of August 29, 2025, total outstanding credit of the economy reached VND 17,460 trillion, up 11.82% compared to the end of 2024.

“Credit programs and policies under the direction of the Government and the Prime Minister continue to be implemented drastically and effectively by credit institutions, thereby providing timely capital for the economy. The results achieved in monetary policy management have made important contributions to controlling inflation in line with the set targets,” said the Deputy Governor.

The Vietnamese Economy in the First Eight Months of 2025: A Snapshot Through Numbers

The Vietnamese economy witnessed a stellar performance in the first eight months of 2025, with impressive trade figures. According to statistics from the General Statistics Office, the country’s trade turnover reached nearly USD 600 billion, with a trade surplus of almost USD 14 billion. The country also attracted nearly 14 million international visitors and witnessed an increase in FDI inflows, showcasing a robust and vibrant economy.

An Ambitious Province: Targeting Record-Breaking Economic Growth Without Mergers

The province of Quang Ninh has set an ambitious target for its economic growth this year, aiming for a 14% increase in GRDP – the highest goal in its history and 2% higher than the government’s target. This bold aspiration presents both a challenge and an opportunity to solidify its position as a leading growth hub in Northern Vietnam. To turn this record-breaking vision into reality, Quang Ninh is implementing a comprehensive range of strategic solutions across vital sectors.

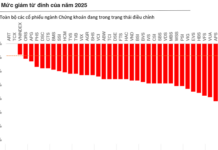

The Big Two Catalysts Boosting Vietnam’s Banking Sector Valuations: Spotlight on Vietcombank, VietinBank, HDBank, Techcombank, and MB

“The banking sector is poised for a valuation uplift, according to Quan Trong Thanh, Director of Analytics at Maybank Investment Bank (MSVN). He asserts that the industry’s prospects are closely tied to the nation’s economic growth trajectory. With Vietnam’s imminent upgrade to Emerging Market status, the country’s stock market is expected to witness a significant influx of foreign investment. A substantial portion of this inflow is likely to be directed towards the banking sector, further bolstering its valuation.”