MSVN’s report highlights the continued attractiveness of banks to investors among listed companies on the stock market, especially in developing countries such as Vietnam in the current phase. As the government pushes for economic growth, banks are poised to benefit significantly from this policy direction. MSVN anticipates that several private Vietnamese banks will emerge in this decade to become the main pillars of the country’s financial sector.

The economy’s growth momentum stems from the Renewal 2.0 programs, with a plan to achieve a 10% annual GDP growth rate, approximately $1.4 trillion in total investment over five years ($280 billion per year), mainly directed towards infrastructure development. Additionally, there are aspirations to upgrade the country’s credit rating to Investment Grade by 2028–2030 and elevate the stock market to Emerging Market status to attract foreign capital. The development of International Financial Centers (IFCs) in Ho Chi Minh City and Da Nang aims to increase the proportion of financial services from 19% of Ho Chi Minh City’s GDP to 30–35%, on par with international financial centers.

The government has introduced a series of robust reform programs, including reducing the number of ministries, provinces, districts, and communes. Resolutions 66, 68, 57, and 59 have been enacted to boost the private sector as the primary driver of economic growth. A legal framework is also being established for fintech, AI, crypto, e-commerce, and proactive international integration with a strategic approach.

MSVN foresees a promising and profitable investment phase in the next 3–5 years.

Previously, SSI also released a report anticipating that a potential market upgrade could trigger significant new capital inflows (from both domestic and foreign investors) into bank stocks, potentially driving the banking sector’s valuation beyond its historical average. SSI has also raised the target P/B ratios for banks.

According to the MSVN report, promising positions within the banking sector include HDBank (HDB), Techcombank (TCB), MB (MBB), Vietcombank (VCB), and VietinBank (CTG). HDBank, as one of the largest private banks, is expected to become a financial pillar of the “Rising Nation” era, and it is also considered an “alpha stock” with long-term appeal to investors due to its liquidity momentum and clear growth strategy.

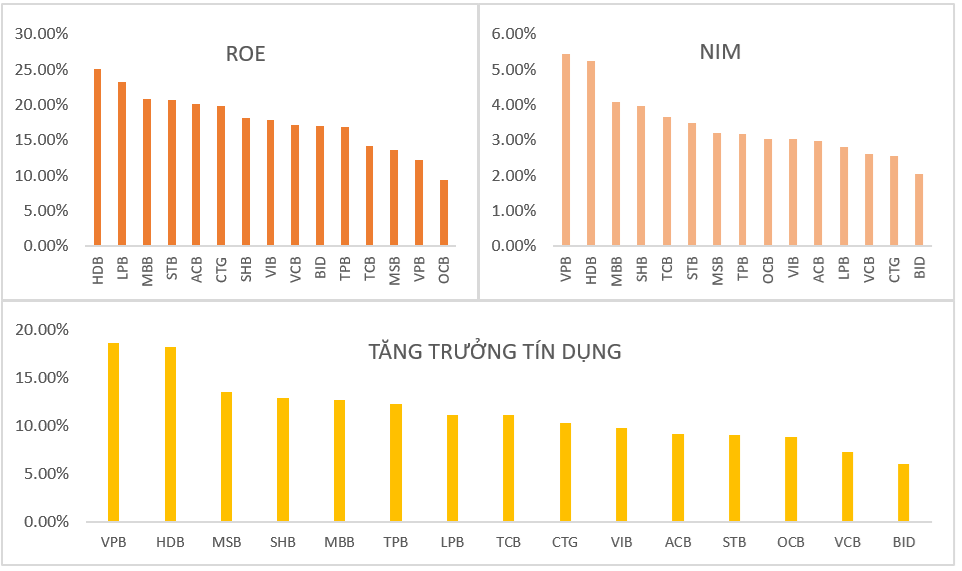

Chart: ROE, NIM, and credit growth of the Top 15 banks in Q2/2025, with HDBank achieving 26.5% ROE, 5.23% NIM, and 18.2% credit growth

In addition to the benefits enjoyed by the banking sector as a whole, HDBank’s value is further enhanced by its unique advantages. These include the upcoming presence of a large foreign strategic shareholder, the increase in foreign ownership limit (HDB has already reached the current limit of 17.5% and is expected to raise it to 27%, while the maximum foreign ownership limit for HDB can go up to 49% due to its participation in the mandatory transfer of DongA Bank). HDBank also boasts a leading position in credit growth within the industry, with an expected credit growth rate of over 32% for 2025. Moreover, HDBank consistently tops the industry in business efficiency, with a ROE of 26.5% and pre-tax profits of over VND 10,000 billion in the first half of 2025. Going forward, new revenue streams from the HD Financial Group ecosystem will enable HDBank to maintain sustainable growth and profitability.

Notably, HDBank possesses a robust financial ecosystem and significant potential for value addition through its capital mobilization and strategic partnerships, such as bancassurance (currently in negotiations with several prominent international insurance companies), and the upcoming IPOs of HD Saison (a leader in consumer lending) and HD Securities (a securities company within the HD Financial Group ecosystem).

Source: MSVN Report

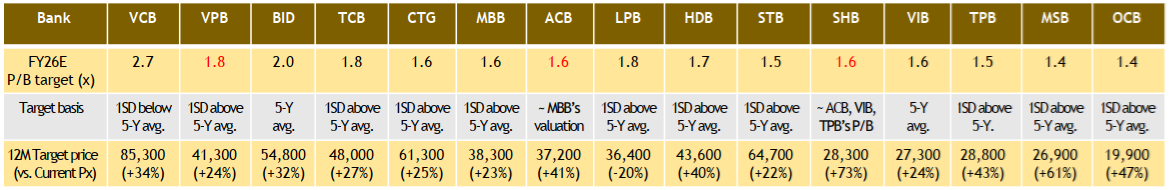

According to Maybank IBG (MSVN), HDBank’s target price is VND 43,600/share (a +40% increase) based on a 2026E P/B of 1.7x. Many analysts and investors believe that there could be even more positive breakthroughs as HDBank’s true potential is unveiled in the future. With a ROE consistently above 25%, the highest in the industry, along with its unique advantages and potential to be unlocked through upcoming value-added initiatives, HDBank’s reasonable P/B could approach 2.0x, similar to the levels of Vietcombank (2.7x), BIDV (2.0x), VPB (1.8x), and Techcombank (1.8x). In that case, HDB’s target price could surpass VND 50,000/share.

The Launch of Vietcap’s New Exciting Bond Offering

The Vietnamese stock market witnessed a robust recovery in the trading sessions leading up to the holiday break, rebounding from initial tremors. Despite a significant decline in liquidity, the trading floors remained vibrant and captivating, with green hues dominating various industry groups as buying force returned.

Latest HDBank Interest Rates for September 2025: Which Term Deposit Offers the Best Returns?

As of September 2025, HDBank offers a maximum interest rate of 6.1% p.a. on regular deposits. This competitive rate positions HDBank as a leading player in the Vietnamese banking industry, providing customers with an attractive option for their savings and investment needs.

Unlocking New Opportunities for Investors: The Transformative Impact of Key Infrastructure Developments in Southern Ho Chi Minh City

According to Ms. Duong Thuy Dung, Executive Director of CBRE Vietnam, investors have recognized the irrationality of real estate prices in the center of Ho Chi Minh City and are strongly shifting their focus to the neighboring areas. These peripheral zones benefit directly from existing and upcoming infrastructure and belt road projects, offering significant growth potential.