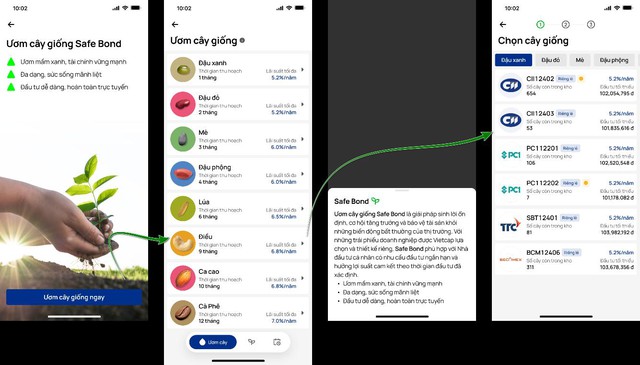

In today’s dynamic investment landscape, Vietcap introduces the SAFE Bond, a competitive fixed-income product for investors who are cautious about market volatility. With its range of offerings, Vietcap assures investors of the reliability and growth potential of its products. Let’s explore the unique features of the SAFE Bond.

SAFE Bond – Secure Investment, Sustainable Growth

The SAFE Bond offers a secure investment solution with stable returns, providing a safe haven for investors seeking to diversify their portfolios or optimize their cash flow while waiting for equity investment opportunities. Through the Vietcap app, investors can conveniently access investment packages offering attractive post-tax yields of up to 6% per annum, with a short investment period of just 3 months.

Key Features of SAFE Bond:

Diverse bond portfolio issued by reputable listed companies such as Thanh Thanh Cong – Bien Hoa (SBT), Dau Tu Nam Long (NLG), Ha Tang Ky Thuat TP.HCM (CII), Tap Doan PC1 (PC1), and Becamex IDC (BCM). More companies will soon be added to the Vietcap app.

Competitive interest rates ranging from 5.2% to 7.0% per annum, outperforming savings accounts with similar tenors, enabling you to optimize your profits and sustain growth.

Flexible tenor options catering to investors’ diverse liquidity needs.

Easy and fully digital investment process, conveniently accessible through your mobile phone.

To purchase the SAFE Bond, investors can open a securities account with Vietcap or consult with their investment advisors. For a quick guide, refer to the following video:.

https://www.youtube.com/watch?v=dwXFFhxZOpo&feature=youtu.be

Target Audience for SAFE Bond:

Domestic investors with securities accounts at Vietcap who meet the criteria for professional securities investors.

Investment Period and Interest Rates:

The SAFE Bond offers flexible investment periods ranging from 1 month to 12 months, with competitive market interest rates from 5.2% to 7.0% per annum.

For detailed investment instructions, please visit: https://www.vietcap.com.vn/huong-dan-chung/website-safe-bond

Vietcap is committed to empowering its clients’ financial growth, freedom, and opportunities. With the SAFE Bond, we assure our investors of our dedication to delivering valuable products that foster financial growth and security. It’s an opportunity within your reach.

Unlocking New Opportunities for Investors: The Transformative Impact of Key Infrastructure Developments in Southern Ho Chi Minh City

According to Ms. Duong Thuy Dung, Executive Director of CBRE Vietnam, investors have recognized the irrationality of real estate prices in the center of Ho Chi Minh City and are strongly shifting their focus to the neighboring areas. These peripheral zones benefit directly from existing and upcoming infrastructure and belt road projects, offering significant growth potential.

“Quảng Ninh Takes Off: Primed to Become Northern Vietnam’s Premier Investment Destination”

The province of Quang Ninh is entering a breakthrough phase, fueled by the convergence of three powerful drivers. First, it attracts high-quality FDI inflows, showcasing its appeal to foreign investors. Second, its strategic infrastructure is now complete, boasting highways, sea ports, and airports that seamlessly connect it to the rest of the country and the world. But it’s the third driver that truly sets Quang Ninh apart: the emergence of modern coastal urban complexes. These complexes are crafting a new “runway” for growth, transforming the province into a leading investment hub in Northern Vietnam.

The Resilient Vietnamese Economy: Global Institutions Forecast Bright Outlook for Vietnam’s Economic Growth

The Vietnamese economy is projected to flourish, with AMRO forecasting a 7% growth rate for 2025, followed by a slight dip to 6.5% in 2026. Standard Chartered’s predictions echo this positive outlook, estimating a healthy 6.1% GDP growth for the entire year of 2025. Moreover, UOB’s forecast for the period between 2026 and 2045 paints an even more promising picture, with an expected average annual GDP growth rate of 7% for Vietnam. These projections showcase the country’s robust economic trajectory, positioning it as a prominent player in the region’s economic landscape.