The Ministry of Finance has submitted a draft of the Personal Income Tax Law (amended) to the Ministry of Justice for appraisal. The draft law proposes revisions to the provisions on personal allowances for taxpayers and their dependents.

The drafting agency states that there are also opinions suggesting that the personal allowance should be based on the regional minimum wage. Specifically, the personal allowance in large cities and urban areas should be higher than that in rural and mountainous areas due to the higher cost of living.

However, the Ministry of Finance argues that according to the current Personal Income Tax Law, the personal allowance for taxpayers and their dependents is determined by a specific amount, applied uniformly across the country, regardless of income level, varying consumption needs, or geographical location.

Opinions suggest that personal allowances should be based on regional minimum wages.

For individuals working in difficult areas, the Personal Income Tax Law already exempts certain allowances, such as area allowances, attraction allowances, and relocation allowances, from taxable income to support workers and encourage individuals to work in these areas. Additionally, the law provides tax reductions for individuals facing difficulties due to natural disasters, fires, accidents, or serious illnesses.

The draft law proposes that the Government should determine the personal allowance to ensure flexibility and adaptability to the country’s socio-economic development in each period.

According to the current Personal Income Tax Law, individuals can deduct social insurance, health insurance, unemployment insurance, and occupational liability insurance for certain mandatory insurance sectors. They can also deduct personal allowances, charitable contributions, and allowances as stipulated by law… The remaining amount is then used as the basis for tax calculation.

In this latest draft, the Ministry of Finance proposes to include other specific deductions in the income from salaries and wages before tax calculation. There have been opinions suggesting that taxpayers should be allowed to deduct certain expenses incurred during the year, such as medical and educational expenses, at appropriate levels before tax calculation.

The drafting agency also proposes that the Government should issue detailed regulations to ensure flexibility and compatibility with socio-economic conditions. “The scope and level of deductible expenses must be carefully considered and calculated to achieve the desired goals while maintaining the role of personal income tax policy as a tool for income regulation and redistribution in the economy,” emphasizes the Ministry of Finance.

The Ministry of Finance presented the draft Personal Income Tax Law (amended) to the Government for submission to the 15th National Assembly at its 10th session (October 2025). The law is expected to take effect from July 1, 2026.

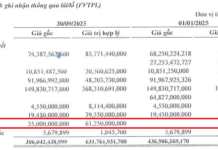

Currently, the personal allowance for taxpayers is VND 11 million/month, and VND 4.4 million/month for each dependent. Recently, the Ministry of Finance submitted a draft resolution of the Standing Committee of the National Assembly on adjusting personal allowances for income tax calculation, applicable from the 2026 tax period.

The highest proposed personal allowance is VND 15.5 million/month for taxpayers and VND 6.2 million/month for each dependent. In the lower option, the personal allowance for taxpayers is VND 13.3 million/month, and VND 5.3 million/month for each dependent.

The Power of Deductions: Why a Flat Rate and Unified System Benefits All

“There has been a debate on whether the personal income tax exemption amount should be based on regional minimum wages. However, this proposal has not gained support from the Ministry of Finance. The Ministry argues that the legal exemption amount must be uniform across the country, regardless of an individual’s income level, consumption needs, or place of residence.”

Proposed Regional Minimum Wage Increase for 2026

The Ministry of Home Affairs is seeking feedback on a draft decree that proposes to set a minimum wage for employees working under labor contracts.