|

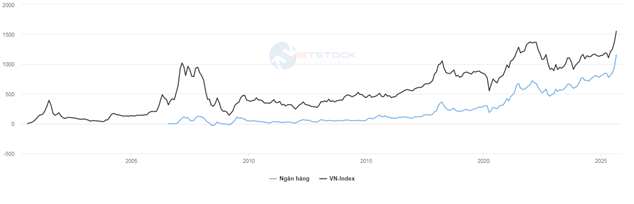

The VN-Index and Banking Sector Index Performance

Source: VietstockFinance

|

At the end of August, the VN-Index reached 1,682.21 points, an increase of 11.96% compared to the end of July. Meanwhile, the banking sector index surged by 18.75%, hitting a new peak of 1,086.41 points, according to VietstockFinance data.

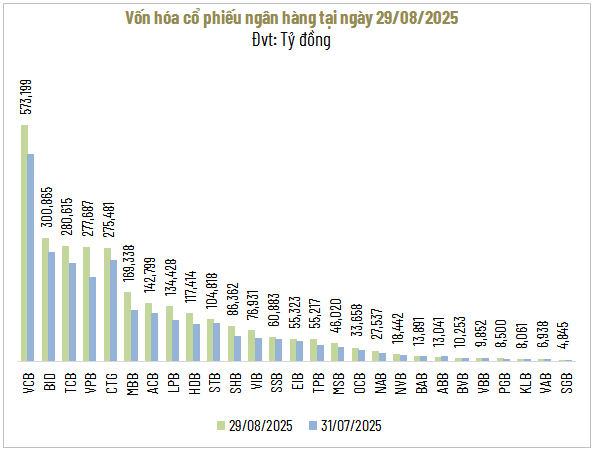

Market Capitalization Surge

Source: VietstockFinance

|

By the end of the session on August 29, the total market capitalization of the banking sector exceeded 2.9 million VND trillion, an increase of 475,512 VND billion (nearly 20%) compared to the previous month. The sector currently accounts for approximately 46% of the total market capitalization, maintaining its leading role.

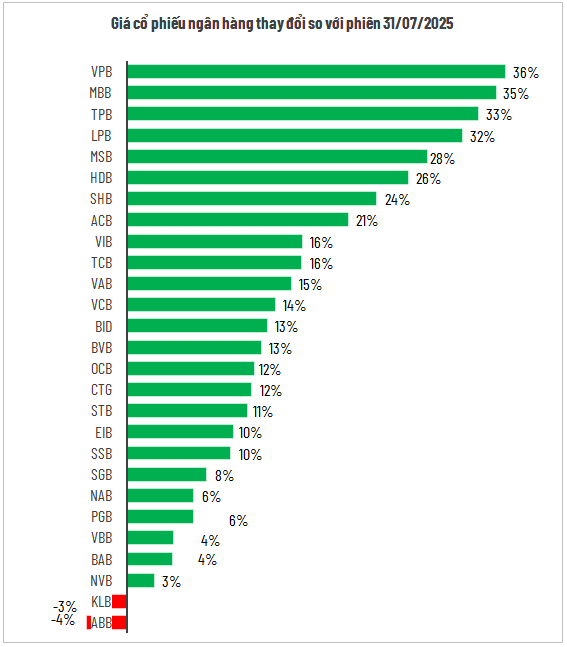

This surge in market capitalization can be attributed to a rise in share prices across the board, with only ABB and KLB experiencing minor declines of less than 5%. Notably, private banks outperformed their state-owned counterparts, with significant gains in VPB (+36%), MBB (+35%), TPB (+33%), and LPB (+32%).

Source: VietstockFinance

|

Record-Breaking Liquidity

Source: VietstockFinance

|

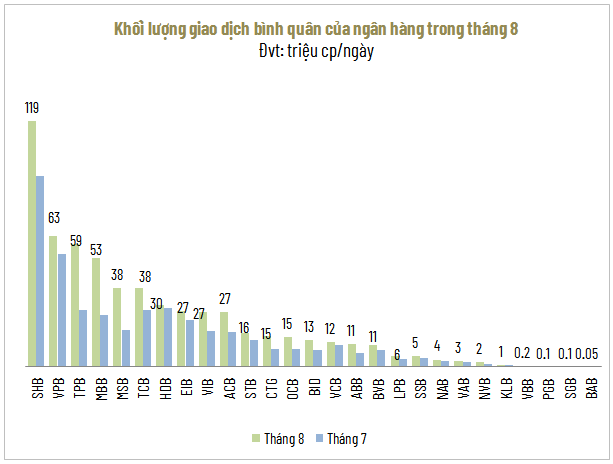

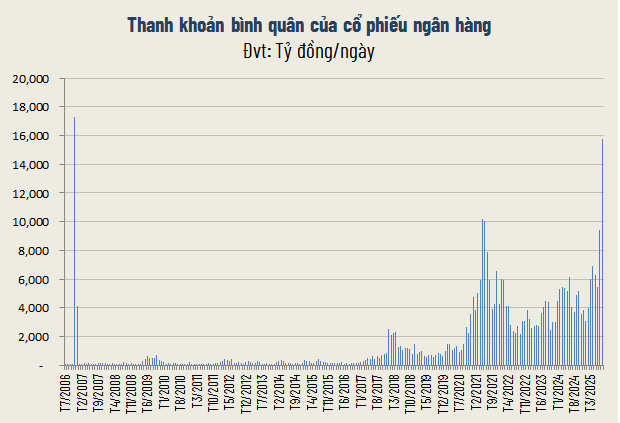

Liquidity in the banking group soared in August, with an average of over 593 million shares traded per session, a 45% increase compared to July. The value of transactions also hit a record high in over 18 years (since February 2007), averaging nearly 15,776 VND billion per session, a 67% increase from the previous month.

Source: VietstockFinance

|

With the exception of BAB (-63%) and KLB (-13%), most banking stocks witnessed heightened activity. Notably, SGB (tripling in volume), TPB and MSB (more than doubling), and MBB (increasing by more than two-fold) stood out.

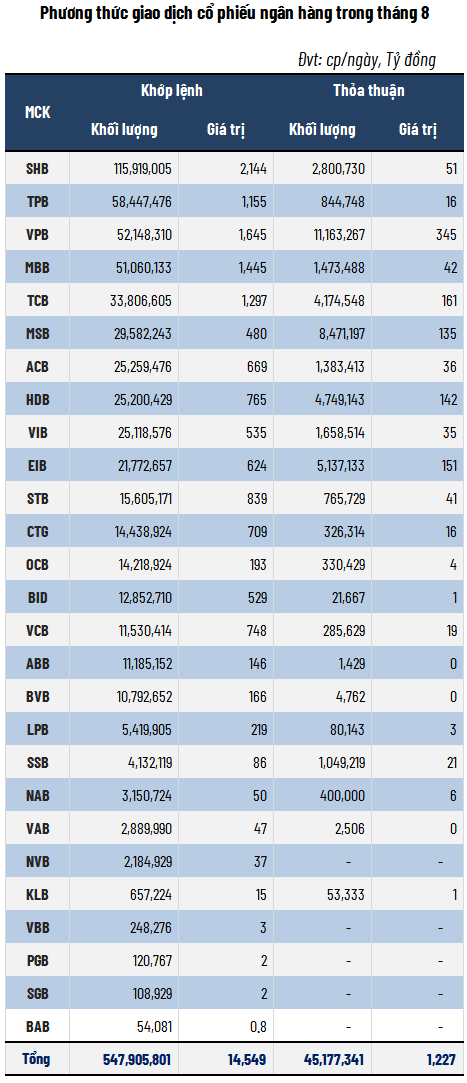

SHB maintained its top position in terms of liquidity, with an average of nearly 119 million shares traded per session (including matched and negotiated deals), a 29% increase from the previous month. On the other hand, BAB was the least liquid stock, with only 54,081 shares traded per session, amounting to less than 800 million VND in value.

Source: VietstockFinance

|

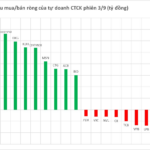

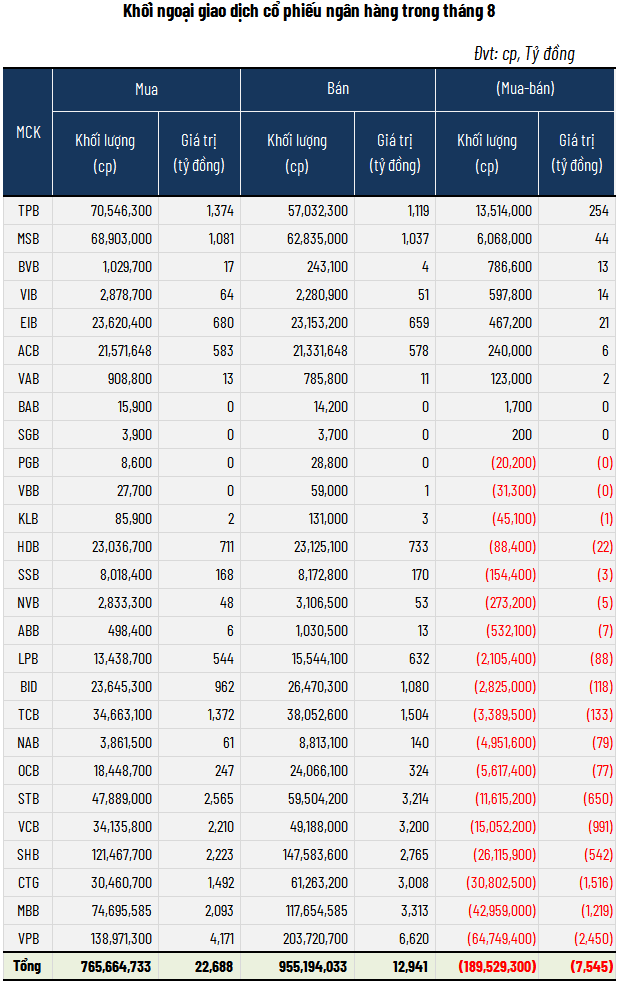

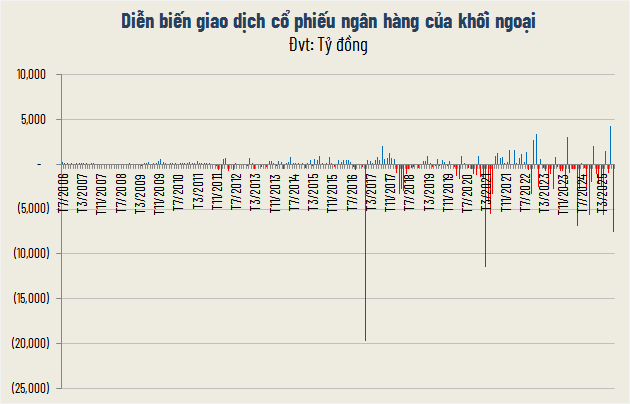

Foreign Investors Take Profits

The sharp rise in stock prices prompted foreign investors to take profits, resulting in a net sell-off of nearly 190 million banking shares, totaling 7,545 VND billion – the highest level since April 2021.

Source: VietstockFinance

|

VPB, the stock with the highest increase in August (+36%), was also the most sold-off, with a net sell value of 2,450 VND billion. Notably, VPB was the most bought stock in July, indicating that foreign investors took advantage of the opportunity to realize their profits.

Source: VietstockFinance

|

On the contrary, TPB and MSB were the two stocks that foreign investors net bought the most, with values of 254 VND billion and 44 VND billion, respectively.

– 19:00 03/09/2025

Stock Market Week Sept 03-05, 2025: The Unexpected Drop After Hitting 1,700 Points

The VN-Index took a surprising tumble during the week’s final session, bringing an end to four consecutive weeks of gains. This sudden shift highlights the intense profit-taking pressures at play in the higher price ranges, with persistent foreign sell-offs further exacerbating the situation and significantly impacting investor sentiment.

The Bank Stock Surprise: A Proprietary Trading Boost

The proprietary trading arms of securities companies returned to net buying with a value of VND435 billion on the HoSE.